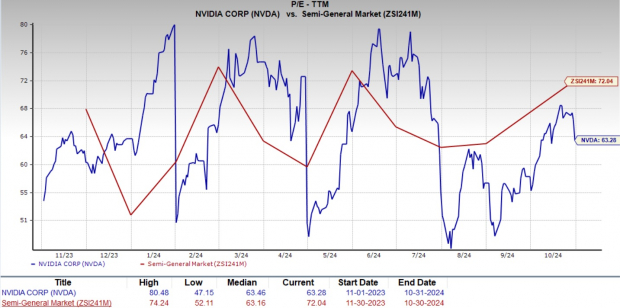

NVIDIA Corporation’s NVDA current valuation suggests that the stock is available at a discounted price compared with the industry average. NVDA stock currently trades at a trailing 12-month price-to-earnings (P/E) ratio of 63.28, which is significantly lower than the Zacks Semiconductor – General industry average of 72.04.

Image Source: Zacks Investment Research

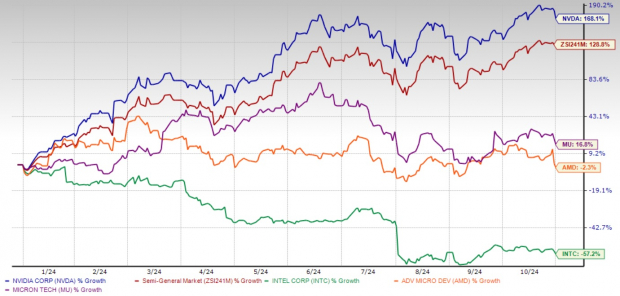

What makes the stock a more lucrative bargain at the moment is its fabulous year-to-date (YTD) performance. NVIDIA shares have skyrocketed 168.1% YTD, outperforming the industry’s surge of 128.8%. This impressive rally has placed NVIDIA among the top performers in the semiconductor space, with Intel Corporation INTC, Advanced Micro Devices, Inc. AMD and Micron Technology, Inc. MU lagging way behind.

While shares of Micron have risen 16.8% YTD, Intel and Advanced Devices Micro have declined 57.2% and 2.3%, respectively. Given this outperformance and attractive valuation, investors might be wondering if there is still an opportunity to buy NVDA stock.

YTD Price Return Performance

Image Source: Zacks Investment Research

Why NVIDIA Stock Has Room to Run

NVIDIA’s rapid rise is largely attributed to its pivotal role in the booming field of artificial intelligence (AI), especially in generative AI. The demand for generative AI applications, which enhance productivity across industries, is anticipated to skyrocket. According to Fortune Business Insights, the global generative AI market is expected to reach $967.6 billion by 2032, reflecting a compound annual growth rate (CAGR) of 39.6% from 2024 to 2032. This exponential market growth is expected to drive demand for NVIDIA’s high-performance graphic processing units (GPUs), which are fundamental to AI advancements.

NVIDIA’s cutting-edge GPUs deliver exceptional computational power, enabling AI models to scale effectively. These next-generation chips are fast becoming indispensable for businesses investing in AI. NVIDIA’s superior technology offers unmatched processing capabilities vital for the complex computations AI requires. As businesses increasingly invest in AI infrastructure, NVIDIA stands to benefit as the dominant provider of the technology underpinning these applications.

Growth Beyond AI: Diverse Applications Fuel NVIDIA’s Future

NVIDIA’s influence extends well beyond AI. The company’s GPUs are integral to advancements in sectors like automotive, healthcare and manufacturing. In automotive, NVIDIA’s solutions contribute to the development of autonomous vehicles, a market expected to experience rapid growth over the next decade. In healthcare, NVIDIA’s GPUs are revolutionizing medical diagnostics, enhancing imaging processes and improving patient care. This broad, multi-industry applicability positions NVIDIA as a resilient and diverse growth engine in the tech landscape.

Moreover, NVIDIA’s robust data center solutions are gaining traction. As companies invest in cloud and edge computing, demand for powerful data center infrastructure rises, making NVIDIA’s data center business a critical growth driver. This sector alone is projected to significantly boost the company’s revenues as businesses accelerate their digital transformation efforts, solidifying NVIDIA’s long-term growth potential.

NVIDIA’s Financial Strength and Impressive Outlook

NVIDIA’s financial performance has been outstanding. In its second-quarter fiscal 2025 report, the company posted a massive 122% year-over-year revenue increase, accompanied by a 152% jump in non-GAAP earnings per share (EPS). This financial strength highlights NVIDIA’s ability to capitalize on strong demand while navigating market competition effectively.

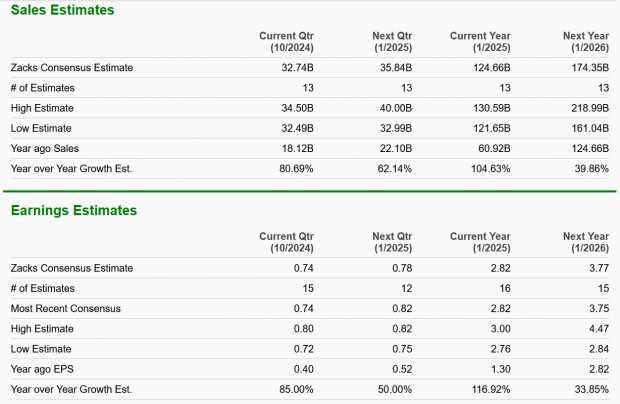

For the upcoming third quarter, NVIDIA’s revenues are expected to surge to $32.5 billion, up from $18.12 billion in the same quarter last year, underscoring its growth trajectory and position as a critical player in semiconductor technology for AI. Looking forward, the Zacks Consensus Estimate for NVIDIA’s fiscal 2025 and 2026 revenues and earnings points to sustained growth, reflecting confidence in the company’s market leadership across multiple sectors, including gaming, automotive and professional visualization.

Image Source: Zacks Investment Research

NVIDIA’s financial stability is a significant advantage. The company ended July 2024 with a cash reserve of $34.8 billion, up from $31.44 billion in April. This solid balance sheet enables NVIDIA to weather potential market fluctuations and supports continued investments in its growth initiatives. In a rapidly evolving tech landscape, this financial strength provides NVIDIA with a strategic advantage, positioning it to capitalize on future growth opportunities.

Conclusion: Buy NVIDIA Stock Now

NVIDIA’s dominant position in AI, coupled with its financial strength, broad market applications and attractive valuation, makes it a compelling buy. The company’s strong financial results, impressive outlook and extensive cash reserves create a solid foundation for continued growth.

Given the surging demand for AI and the expanding applications of NVIDIA’s technology across various industries, NVDA stock presents a strong opportunity for investors looking to benefit from the next wave of technological advancements. Now is the time to buy NVIDIA stock and capture its promising long-term potential.

NVIDIA currently carries a Zacks Rank #2 (Buy) and has a Growth Score of A. Our research shows that stocks with a Growth Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or #2, offer the best investment opportunities for investors. NVDA stock appears to be a compelling investment proposition at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report