Investors often consider Wall Street analysts’ recommendations when deciding on stock trades. But before relying on such advice regarding Nvidia (NVDA), it’s crucial to understand the implications behind the ratings.

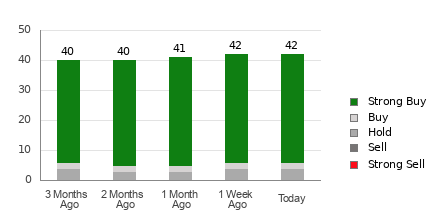

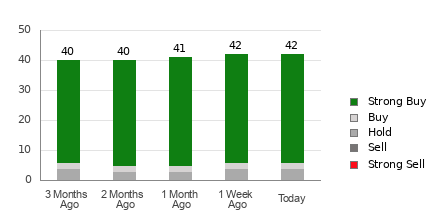

Nvidia currently boasts an Average Brokerage Recommendation (ABR) of 1.24 out of 5, which signifies a stance between Strong Buy and Buy as per 42 brokerage firms’ recommendations. The breakdown reveals 36 Strong Buy and 2 Buy ratings, constituting 85.7% and 4.8% of all suggestions, respectively.

Understanding Brokerage Recommendation Patterns for NVDA

Although the current ABR urges buying Nvidia, it isn’t advisable to base investment decisions solely on this metric. Studies indicate limited success for brokerage recommendations in identifying stocks with substantial price upward potential.

Brokerage firms often exhibit a positive bias toward stocks they cover due to vested interests. This bias results in a prevalence of ‘Strong Buy’ ratings over ‘Strong Sell,’ demonstrating a misalignment between institutional goals and retail investors’ interests. Hence, it’s wise to corroborate such information with reliable analytical tools or personal assessments.

Zacks Rank, a widely acknowledged stock assessment tool with a validated performance record, categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering insights into potential price movements. Thus, validating the ABR with Zacks Rank may aid in making informed investment choices.

A Clear Distinction: ABR Vs. Zacks Rank

While ABR hinges on broker recommendations, displayed in decimals, Zacks Rank primarily focuses on earnings estimate revisions, represented in whole numbers. Brokerage analysts’ optimistic ratings, influenced by institutional interests, often misguide investors.

In contrast, Zacks Rank relies on earnings estimate trends, showcasing a strong correlation with short-term stock price fluctuations. The gradations within Zacks Rank maintain equity across all stocks, irrespective of brokerage analysts’ estimates concerning current-year earnings.

Moreover, Zacks Rank reflects current market trends promptly as analysts frequently adjust earnings estimates to align with business dynamics. This timeliness enhances the tool’s efficacy in predicting stock price movements.

Assessing the Investment Appeal of NVDA

Notably, Nvidia’s Zacks Consensus Estimate for the current year has risen by 0.5% to $2.81 over the past month. The positive sentiment among analysts, evidenced by concurring upward revisions in EPS estimates, hints at a favorable outlook for the stock.

Based on recent consensus estimate changes and other earnings-related factors, Nvidia currently holds a Zacks Rank #2 (Buy), indicating a promising investment opportunity. This Buy-equivalent ABR for Nvidia could serve as a valuable reference point for potential investors.