Nvidia (NASDAQ: NVDA) has reached many milestones this year, from soaring past $1,000 a share to being invited into the Dow Jones Industrial Average. The latest achievement for the top chipmaker is surpassing Apple to become the world’s most valuable company at $3.57 trillion. This already happened once earlier in the year — but it didn’t last.

Will Nvidia stay ahead this time? Demand for Nvidia’s artificial intelligence (AI) chips is strong, the general AI market is set to climb from $200 billion to $1 trillion this decade, and Nvidia has a big catalyst right around the corner — the launch of its new Blackwell architecture. All of that is positive and supports the idea of Nvidia staying on top. That said, Nvidia shares have climbed more than 190% so far this year and 2,700% over the past five years.

If the stock price stagnates at any point, taking a break after a long string of gains, Apple could easily pull ahead — especially since growth is far from over at the smartphone giant. Any potential snafu in Nvidia’s Blackwell launch also could hold the stock back. Let’s take a closer look at the details and consider what may happen next.

Image source: Getty Images.

Fueling key AI tasks

First, a little background on Nvidia’s path so far. The company once was most known for selling graphics processing units (GPUs) to power video games, but the ability of these high-performance chips to process many tasks at once made them ideal for other uses, too — such as driving key AI tasks, like the training and inferencing of models.

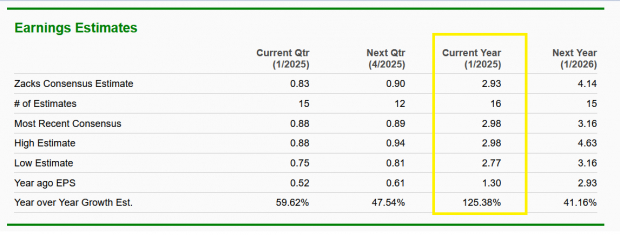

With the AI boom, Nvidia took off, selling not only GPUs but a full portfolio of other products and services to customers developing AI projects. Nvidia’s earnings surged, and in recent quarters, they’ve climbed in the triple digits. At the same time, gross margin has widened, passing 70% and showing Nvidia is highly profitable.

The general market has recognized Nvidia’s importance in today’s economy. The Dow Jones Industrial Average recently invited Nvidia to join, replacing chipmaker Intel in the benchmark index.

As mentioned, Nvidia stock has surged this year, rising so much that the company decided on a 10-for-1 stock split to make it easier for a broader range of investors to buy the stock. A split lowers the price of individual shares by issuing additional shares to current holders but doesn’t change the market value or anything fundamental about the company. Since the split in early June, Nvidia shares have continued to march higher, gaining about 20%.

Two major catalysts ahead

What’s next for Nvidia? Investors will keep a close eye on two major catalysts ahead — the company’s Nov. 20 earnings report and the launch of Blackwell. These events may set the tone for the coming months and could determine whether Nvidia will stay ahead of Apple when it comes to market value.

Nvidia expects to deliver double-digit revenue growth in the quarter, according to its most recent outlook. Though this is slower than the triple-digit growth we’ve seen, it shouldn’t be viewed as a slowdown. Here’s why.

Nvidia has increased its revenue to such high levels so quickly over the past couple of years that comparison quarters now are getting difficult. In the third quarter of last year, revenue already reached $18 billion. So it’s perfectly natural that the rate of growth eventually would pull back somewhat.

Investors also should be on the lookout for comments about the Blackwell launch during the upcoming earnings call. So far, Nvidia has said the production ramp-up is beginning in the fourth quarter and it will post billions of dollars in Blackwell revenue during that period. The company also said demand has surpassed supply, showing that customers continue to flock to the chipmaker for their AI needs.

Keep a long-term mindset

Finally, though it’s important to consider these near-term events, it’s crucial to do this with a long-term mindset. News that represents a short-term win or loss, for example, generally won’t impact the company’s earnings and share-performance picture over five or 10 years. Investors should consider this before buying or selling a stock on the latest news of the day.

Nvidia’s long-term prospects are bright, thanks to the company’s market leadership, innovation to stay ahead, and earnings strength. Whether the company remains the most valuable in the world or slips back behind Apple, the stock still makes an excellent one to buy and hold for the long haul.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $23,324!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,133!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $420,761!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 4, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Intel, and Nvidia. The Motley Fool recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.