Nvidia’s Position in the Market

Nvidia Corp.’s NVDA has been on a strategic growth trajectory, driven by robust free cash flow (FCF) and an evolving approach to recurring revenue. The company’s innovative approach has positioned it for substantial growth and a potential revaluation.

Analyst’s View on Nvidia

The Nvidia Analyst: According to BofA Securities analyst Vivek Arya, Nvidia is a compelling investment opportunity with a promising future. Arya has maintained a Buy rating on Nvidia stock with a price target of $700.

Nvidia’s Growth Strategies

The Nvidia Thesis: Arya’s forecast of $100 billion in FCF anticipated over CY24/CY25E positions Nvidia to drive innovative growth initiatives. One of the key strategies lies in transitioning towards a more recurring revenue-oriented profile. While Nvidia leads in AI, it aims to reduce reliance on hardware-centric operations for improved valuation. Arya emphasized the importance of acquisitions or partnerships to fortify recurring revenue sources, citing Nvidia’s previous bid for Arm Holdings as an example of its intent for software/IP assets.

Nvidia’s success with the Mellanox acquisition, which saw annualized revenue quintuple to $10 billion, exemplified its strategic investment acumen. The company is also considering expanding into storage to complement its compute and networking strengths, a move that could elevate its role as a comprehensive AI systems vendor.

Furthermore, while Nvidia may not delve into specialized AI cloud services due to intense competition, it remains committed to alternative GPU-focused CSP to broaden its reach. With only a modest percentage of revenue originating from software/subscriptions, strategic additions to its AI enterprise suite through mergers and acquisitions or enhanced partnerships have the potential to significantly augment recurring revenue in 2024.

Potential Catalysts and Market Outlook

Anticipated catalysts, such as the CES and GTC tradeshows, could potentially drive stock movement, potentially breaking Nvidia out of its recent trading range. Despite being among the largest U.S. stocks, Nvidia trades at a discount on various metrics compared to its peers, presenting an enticing investment opportunity.

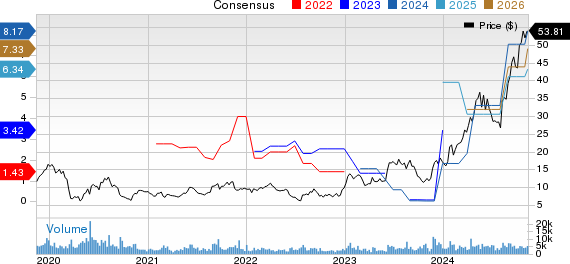

Current Stock Performance

NVDA Price Action: Nvidia stock was up 2.25% at $490.80 on Friday at the time of publication.

Now Read: Nvidia Enjoyed AI Hype, But Now It’s Approaching ‘Trough Of Disillusion’: Analyst

Photo: Shutterstock