Nvidia(NASDAQ: NVDA) stock made headlines Wednesday by becoming just the third U.S. public company to surpass a $3 trillion market cap. In the historical context, Apple was the first to achieve this milestone in January 2022, followed by Microsoft in January 2024. As Nvidia ascends, anticipation grows that it may eventually dethrone Microsoft to claim the market cap crown.

Let’s delve into the factors propelling Nvidia’s stock to these remarkable heights and what investors can anticipate from this leading chipmaker in the foreseeable future.

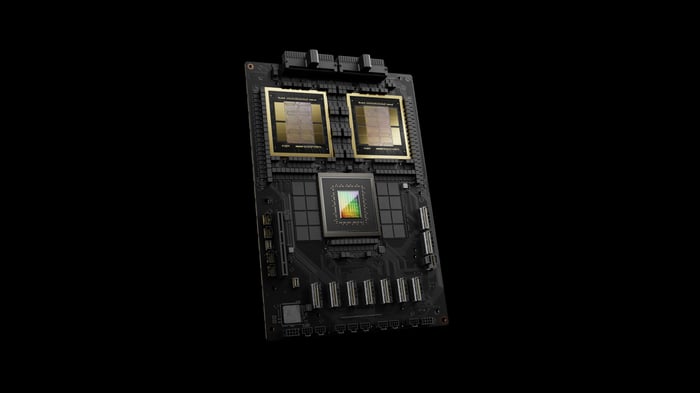

The Nvidia GB200 Grace Blackwell Superchip. Image source: Nvidia.

The Leading Light in Chipmaking

Nvidia has been on a winning streak lately, riding the AI wave that has swept across various industries. However, it’s crucial to look back at a time when Nvidia faced adversity. Between November 2021 and October 2022, the company’s stock plummeted over 66% due to macroeconomic challenges. Yet, the tide turned with the emergence of generative AI in early 2023, catalyzing a tech revolution where Nvidia’s data center chips played a pivotal role.

Generative AI introduced groundbreaking capabilities: from crafting poems and songs to generating digital artwork. These innovations caught the eye of tech experts who soon realized the vast potential for productivity enhancement in various sectors. Nvidia’s success stems from the parallel processing prowess ingrained in its graphics processing units (GPUs), enabling efficient handling of complex tasks even before the advent of generative AI.

These advanced AI models, with trillions of variable training data bits, necessitate thousands of GPUs to function effectively. For instance, training OpenAI’s GPT-4 entailed utilizing over 25,000 of Nvidia’s top-tier A100 AI processors, each costing around $10,000. This underscores the massive investment required to leverage AI capabilities, presenting a lucrative opportunity globally.

A Legacy of Triumph

Credit for Nvidia’s present success belongs to CEO Jensen Huang’s forward-thinking strategy. Back in 2013, when AI was not yet the buzzword it is today, Huang boldly pivoted Nvidia towards AI, leveraging parallel processing designed for gaming graphics to power AI applications. This strategic move laid the foundation for Nvidia’s current dominance in the AI arena.

Prior to the AI boom, Nvidia already boasted a strong track record, but AI now drives its financial engine. Over the last decade, Nvidia’s revenue surged by 2,260%, fueling an impressive 11,530% increase in net income and a soaring stock price gain of 27,900%, with projections hinting at continued growth.

Nvidia’s meteoric rise sets the stage for a 10-for-1 stock split scheduled post-market close on Friday. History suggests such splits often lead to a 25% increase in the year following, surpassing the S&P 500’s typical 12% gain. This reflects operational and financial strength, mirroring the upward trajectory witnessed in the stock price.

Examining Nvidia’s latest financials paints a compelling picture. For the fiscal 2025 first quarter ending April 28, Nvidia reported record revenue of $26 billion, a remarkable 262% year-over-year increase, along with an astounding 629% surge in earnings per share to $5.98. The robust performance was spearheaded by the data center segment, showcasing a 427% revenue spike driven by high demand for AI chips.

Implications for Nvidia’s Future

In light of recent uncertainties surrounding AI’s longevity, some investors adopt a cautious stance. However, underestimating AI’s potential could prove costly. Conservative estimates project the generative AI market to reach $1.3 trillion by 2032, while more bullish forecasts like those from Ark Invest CEO Cathie Wood depict a $13 trillion total addressable market by 2030.

Crucially, leading tech giants are striving to rival Nvidia’s GPU supremacy, yet advancements in this area have been limited. Nvidia remains devoted to substantial research and development investments to maintain its AI processor superiority, with last year’s R&D expenditure totaling nearly $8.7 billion.