- The solid uptrend of NFLX shows no signs of stopping, backed by robust growth exceeding forecasts.

- Improving business quality is fueling notable advancements in the balance sheet.

- Strong cash flow ensures ongoing share repurchases, contributing to positive momentum.

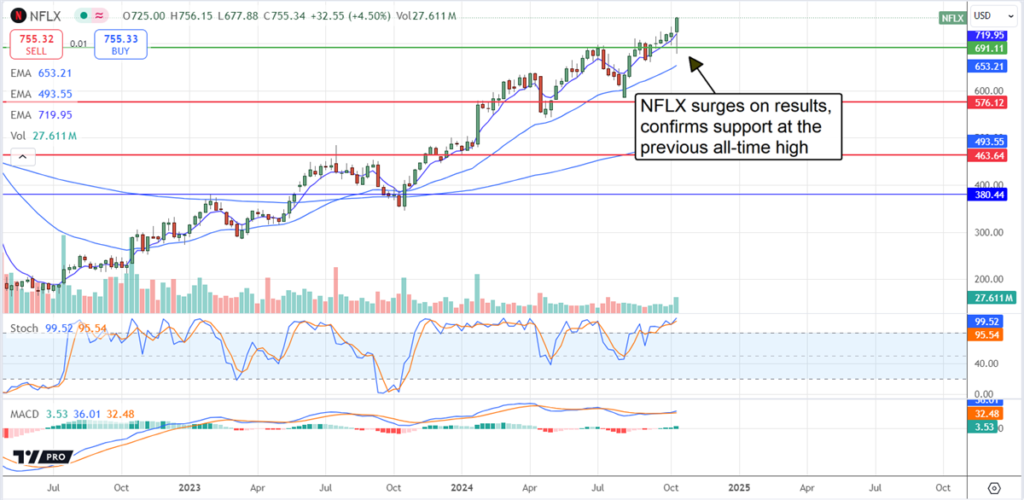

Netflix’s (NASDAQ:) upward trajectory remains steadfast due to the company’s continuous expansion that outpaces predictions consistently. Looking ahead to 2024 and 2025, growth will be propelled by increasing user numbers and heightened engagement, with further impetus expected in 2026 from ad sales.

An essential aspect highlighted in recent reports is the steady enhancement in business quality, fostering a sustainable boost in cash flow, margins, profits, and free cash flow accessible to investors. This positive trend supports significant share buybacks, effectively reducing share count while propelling the company forward. Based on growth projections, technical indicators, and analyst sentiment, Netflix stocks may see an additional 15% increase by year-end and potentially reach new record highs in 2025.

Netflix Performance Shines in Q3, Points to Earnings Upsurge

Netflix’s Q3 performance showcased considerable strength, offering fresh catalysts for the market. The recorded $9.825 billion in net revenue reflects a 15% year-over-year surge, surpassing MarketBeat.com’s consensus by 65 basis points. The growth was underpinned by a 14.4% rise in global paid memberships, an acceleration from the prior year’s 10%, driven by enhanced security measures such as password lockdown and diversified membership options.

The company’s advertising sector exhibits growth potential, attracting 50% of sign-ups from ad-supported regions. Netflix aims to reach a crucial subscriber scale for advertisements, a move expected to fuel growth in the coming years. While operating margin witnessed a 700 basis point improvement, slightly below consensus forecasts, the earnings-per-share (EPS) of $5.40, up 15% from the previous year, prompted management to revise upwards the yearly guidance.

The company’s outlook remains robust, anticipating a 15% revenue increase, positioning the margin at a higher-than-expected level. With the margin forecasted at 27% for the year, up by 100 basis points, Netflix enhances its financial standing. Notably, the company’s robust cash flow allows it to balance its content investments while engaging in share repurchases. The Q3 repurchases, reducing the share count by 2.7%, are expected to continue at a robust pace given the remaining authorization of $3.1 billion.

Analysts’ Optimism Drives Netflix Price Targets Up by 15% or More

Following Netflix’s impressive results, analysts responded enthusiastically, issuing over a dozen upward revisions within 24 hours of the announcement. These revisions come with elevated price targets, with the majority of analysts surpassing the consensus estimation by nearly 85%. The revised consensus hints at a minor dip in the share price from $742, despite its 65% surge over the past year, including a recent overnight 5% gain prompted by the revisions. The revised targets indicate potential prices above $800, reaching as high as $925, offering a range of growth potential between 7.5% to 25% achievable by year-end.

With the post-earnings report price action witnessing a nearly 10% surge, Netflix set a new all-time high, a clear validation of support at key levels including the 30-day moving average and the prior all-time peak. This movement signifies a continuing uptrend, setting sights on the $825 target. The derived target reflects the summer price pullback’s magnitude projected towards the pivotal support level now affirmed as a stronghold.