Netflix stock recently reached a remarkable peak following a staggering 150% surge in upfront ad sales. This surge, attributed to the company’s strategic focus on live sports and highly anticipated shows like Happy Gilmore 2 and Squid Game 2, showcases Netflix’s prowess in the advertising landscape. Upfront ad sales involve advertisers committing to purchasing ad spots in advance, a significant indicator of market confidence.

The surge in ad revenue can be traced back to Netflix’s robust pipeline of upcoming content and lucrative sports deals, including partnerships for NFL Christmas Day games and WWE Raw. Amy Reinhard, Netflix’s President of Advertising, highlighted the company’s collaborations with major brands like Amazon and Google and unveiled plans to launch a global, in-house ad tech platform by 2025.

Market analysts, notably Jefferies’ James Heaney, predict that Netflix may soon increase its subscription prices due to its foray into sports content. The company’s pivot towards sports strengthens its pricing power, evidenced by the phasing out of its most affordable ad-free option in favor of promoting the $15.49 Standard plan.

Assessing the Investment Potential of NFLX

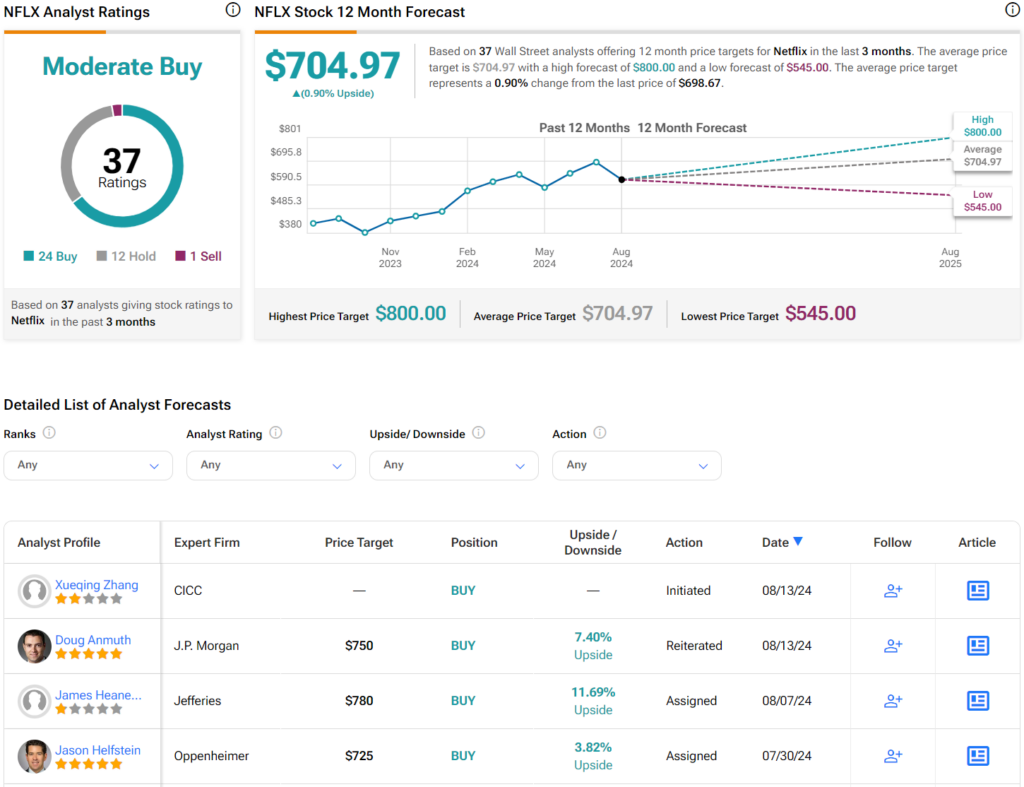

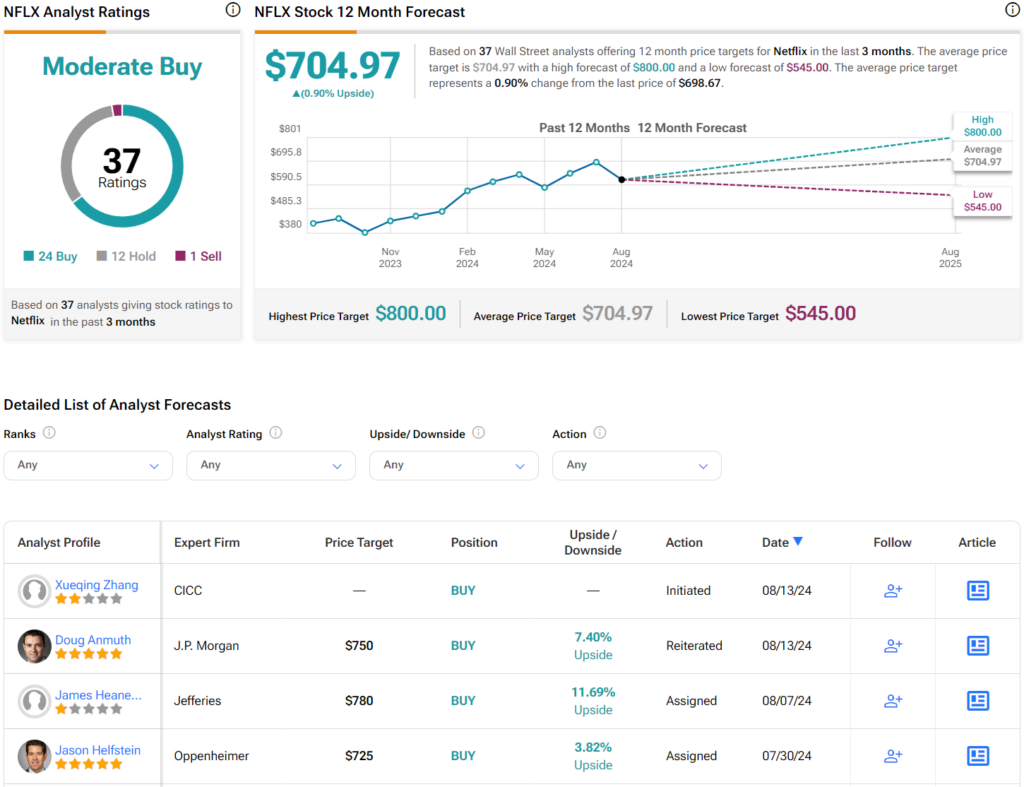

Wall Street analysts maintain a Moderate Buy consensus on NFLX stock, with 24 Buy ratings, 12 Holds, and one Sell recorded in the past quarter. Following a remarkable 71% surge in its share price over the last year, the current average NFLX price target of $704.97 per share hints at a modest 0.9% upside potential.