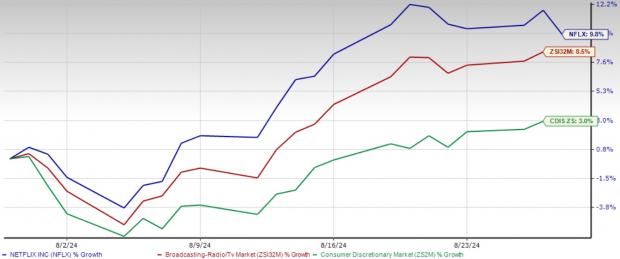

Investors in the entertainment industry are witness to a remarkable development this year—Netflix, the streaming behemoth, has soared an impressive 40.5% year-to-date, outpacing competitors and defying market expectations. This surge comes at a time when concerns loom large over slowing user growth, a crucial metric for investors in recent times.

Shifting Tides of Performance

For third-quarter 2024, Netflix anticipates a dip in paid net additions compared to the previous year due to early impact from paid sharing. The ability of the company to sustain this upward trajectory in the face of headwinds has cast a shadow of doubt on the sustainability of this remarkable rally.

Adaptation Amidst Challenges

Despite growing concerns over diminishing user growth, Netflix has orchestrated a multi-pronged strategy to reinforce its market dominance. By focusing on crafting original content that garners critical acclamation and viewer loyalty, Netflix has managed to stand out in a crowded market and justify price hikes to its loyal subscriber base.

The streaming giant’s expansion into advertising-supported tiers has not only attracted price-conscious consumers but also diversified its revenue channels, potentially ensuring more stable future earnings. Moreover, Netflix’s aggressive international expansion into untapped markets has paid dividends, with international subscribers now constituting a significant portion of its user base and driving substantial growth.

Embracing a diverse array of new narratives, Netflix is venturing into different genres across varied geographies, keeping its content offerings fresh and appealing. These strategic forays have been pivotal in sustaining user engagement and entrenching Netflix’s position as a global entertainment powerhouse.

Resilience Amidst Adversity

While competition intensifies with formidable rivals such as Disney+, HBO Max, and Apple TV+, Netflix’s robust financial performance has captured investor attention. A surge in the stock price has propelled Netflix’s valuation multiples to new heights, potentially capping future growth prospects. The company’s forward sales multiple eclipsing historical averages and industry benchmarks raises concerns about overvaluation and its impact on investor returns.

Charting a Course Forward

While concerns linger over Netflix’s stock valuation, the company’s proactive approach to content innovation, global expansion, and revenue diversification reaffirms its commitment to long-term growth. As Netflix continues to navigate the dynamic streaming landscape, its solid market positioning and strategic initiatives suggest a potential for sustained success, urging investors to keep a close eye on this entertainment juggernaut.