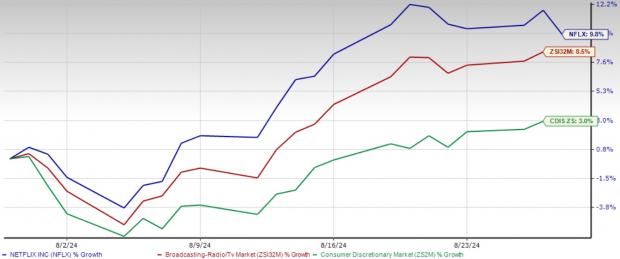

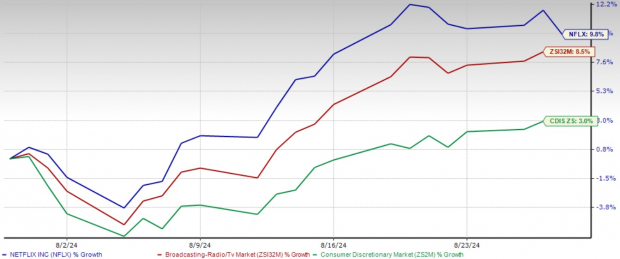

Netflix NFLX, the streaming giant, has witnessed an astounding 40.5% surge in its stock price year to date, outpacing the broader Zacks Consumer Discretionary sector and numerous peers in the entertainment industry. This stellar performance comes against a backdrop of concerns over a potential slowdown in user growth, a pivotal metric that has captivated investors in recent times.

For the third quarter of 2024, Netflix anticipates lower paid net additions compared to the year-ago period, attributed to the initial full-quarter impact from paid sharing. The company’s ability to sustain its upward trajectory despite these headwinds has raised doubts among market observers regarding the sustainability of this rally.

Netflix’s Remarkable Year-to-Date Performance

Image Source: Zacks Investment Research

Strategic Adaptations by Netflix in Overcoming Growth Challenges in Streaming

Netflix has employed a multifaceted strategy to uphold its market dominance through various strategic measures amidst concerns surrounding slowing user growth. The company’s intensified focus on original content creation, resulting in the production of successful shows and movies that have garnered critical acclaim and viewer loyalty, has been a cornerstone in differentiating Netflix in a saturated market and justifying price hikes to its existing subscriber base.

Furthermore, Netflix’s expansion into advertising-supported tiers has unlocked new revenue streams, attracting cost-conscious consumers. This expansion has not only bolstered subscriber numbers but also diversified the company’s revenue sources, potentially leading to more stable and predictable earnings going forward.

Moreover, Netflix’s aggressive foray into international markets, particularly regions like India, South Korea, and various European countries through heavy investments in local content production, has yielded substantial dividends. International subscribers now constitute the majority of Netflix’s user base, propelling much of its recent growth.

Expanding their horizons, Netflix is gearing up to introduce a slew of new series and films across various geographies. From captivating Danish narratives like The Legend and Mango to thrilling Indonesian content with Abadi Nan Jaya, Netflix’s diverse offerings are set to engage audiences worldwide. The platform’s expansion into gaming and animated series with titles like Exploding Kittens and Terminator Zero promise unique entertainment experiences.

The Zacks Consensus Estimate projects 29.8 million paid total streaming net membership additions in 2024, with total paid subscribers expected to reach 290.4 million by year-end, indicating an 11.6% annual growth rate.

Netflix has been innovating with new revenue streams beyond its core subscription model, venturing into mobile gaming, merchandise licensing, and limited theatrical releases for select films. These initiatives, while nascent, represent potential growth avenues and revenue diversification prospects for the company.

For the year 2024, Netflix foresees robust revenue growth of 14-15% based on FX rates as of the end of the second quarter of 2024, an uptick from the 13-15% previously reported. The revised revenue outlook underscores strong membership growth trends and business momentum. Netflix is also developing an in-house ad tech platform, slated for a comprehensive rollout in 2025.

The Zacks Consensus Estimate places revenues at $38.68 billion, indicating a 14.7% year-over-year growth, with earnings per share projected at $19.08, denoting a 58.6% increase over the same period.

Image Source: Zacks Investment Research

The company has revised its full-year 2024 operating margin forecast to 26% from the prior estimate of 25%, citing improved revenue expectations and ongoing cost discipline.

Challenges on the Horizon for Netflix

Netflix faces stiff competition from formidable rivals like Disney’s Disney+, Warner Bros. Discovery’s HBO Max, Peacock, Paramount+, Apple’s Apple TV+, and Amazon, intensifying pressure on Netflix’s growth and profit margins. Additionally, Netflix contends for consumer attention against traditional TV, YouTube, TikTok, and the gaming industry. Maintaining its leadership position amidst this crowded landscape remains imperative for Netflix’s sustained success.

On the financial front, the recent stock price surge has expanded Netflix’s valuation multiples, potentially capping future upside potential. The company’s forward 12-month sales multiple of 7.04 exceeds its five-year median of 6.2, hinting at a possible premium valuation compared to historical levels. Furthermore, Netflix’s valuation surpasses the Broadcast Radio and Television industry’s forward earnings multiple of 4.72, indicating stretched valuation metrics relative to its peers.

Price-to-Sales (Forward 12 Months)

Image Source: Zacks Investment Research

Reflections on Netflix’s Financial Trajectory

While Netflix’s stock has seen remarkable growth, its ability to sustain this momentum rests on effectively navigating the challenges of moderating user growth through innovative content strategies, global expansion endeavors, and revenue diversification initiatives. Netflix’s strong market position suggests that abandoning ship prematurely may be unwarranted. Prospective investors should tread

Unveiling Netflix’s Growth Trajectory Amid Market Volatility

Stock Analysis and Market Performance

When considering investment opportunities, market volatility often acts as an unpredictable dance partner. Currently, Netflix, Inc. stands strong with a Zacks Rank #3 (Hold). Investors may find solace in the remarkable 40.5% year-to-date surge in Netflix’s stock price.

A Look at the Historical Context

Reflecting on the past unveils intriguing stories. Netflix’s unswerving rise over the years exposes the company’s resilience amidst market shifts. With a trailing 12-month return on equity of 28.2%, Netflix has managed to captivate the attention of many investors.

Assessing Growth Potential

While Netflix’s current Zacks Rank may give investors pause, opportunities abound for those who are patient. As the company navigates through market challenges, prudent investors may choose to wait for a more favorable entry point, keenly observing the company’s response to shifting user growth trends.

A Glimpse into the Future

Peering into the crystal ball of the market, the fervor surrounding Netflix’s growth potential remains palpable. Amidst the cacophony of fluctuating market conditions, adept investors may discern the right moment to embark on this exhilarating journey with Netflix.