Netflix Quarterly Performance Analysis

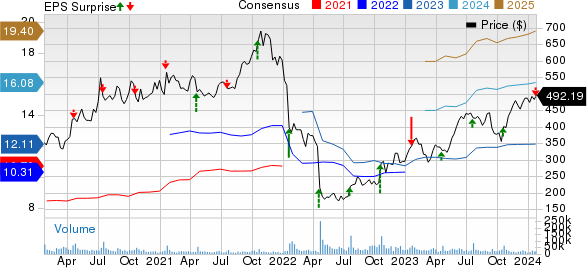

Netflix reported earnings of $2.11 per share for Q4 2023, falling short of the Zacks Consensus Estimate by 4.09%. This marked a substantial increase from 12 cents reported in the year-ago quarter. Meanwhile, revenues for the quarter reached $8.83 billion, demonstrating a 3.4% year-over-year increase and surpassing the consensus mark by 1.33%.

Shares of Netflix soared 8.6% in the after-hours trading session on Jan 23, driven by a significant increase of 13.12 million paid subscribers globally in the fourth quarter, accompanied by a 1% rise in average revenue per subscription, as compared to a gain of 7.66 million paid subscribers in the year-ago quarter. The company attributed its robust revenue growth to various factors, including its paid subscription-sharing offering, recent price changes, and overall business prowess.

Impact of Recent Pricing Changes and Competition

Netflix attested to the influence of its October 2023 premium ad-free plan price increase to $22.99 and a one-stream basic plan price rise to $11.99 on its revenue growth. Moreover, the company witnessed a 70% increase in ad-tier memberships and significant traction for its ad tier, which now constitutes 40% of all Netflix sign-ups in the markets where it was rolled out. The strong performance was also attributed to the company’s content portfolio, which boasted popular titles like “Squid Game: The Challenge” and “Lupin.”

Content Strategy and Corporate Partnerships

Netflix’s content offering also benefited from its partnership with WWE, which marked the streaming service’s entrance into live events and sought to counter competition from rivals like Amazon and Disney. Through this collaboration, the popular show “Raw” will now be exclusively available on Netflix in multiple countries. Additionally, the company’s shares have outperformed competitors such as Amazon, Disney, and Apple, showcasing its strength in the market.

Segmental Revenue and Expansion

Regional performance in terms of revenues and subscriber base showcased a strong positive trend. Regions like United States and Canada (UCAN), Europe, Middle East & Africa (EMEA), Latin America (LATAM), and Asia Pacific (APAC) all demonstrated substantial growth in paid subscribers and revenues. Netflix’s expansion efforts seem to be paying off as it continues to attract and retain a significant subscriber base in international markets.

Operating Expenses and Financial Health

While Netflix’s marketing expenses increased by 64.1% year over year and operating income decreased by 21.9%, the company maintained a healthy balance sheet and free cash flow. With $7.11 billion in cash and cash equivalents, and $14.54 billion in total debt, the streaming giant reported a free cash flow of $1.58 billion for the quarter, along with share repurchases.

Guidance for 2024

Netflix projects a robust start to 2024, with an estimated 16% increase in revenues on a foreign-exchange neutral basis. The company expects to achieve earnings of $4.49 per share, indicating significant growth year over year. Despite lower current expectations from the Zacks Consensus Estimate, Netflix’s guidance implies confidence in its ability to sustain revenue growth and profitability.

Netflix Anticipates Growth Despite Q4 Earnings Miss

Strong Revenue Growth Projections

Netflix’s anticipated 2024 revenues are expected to reach $9.24 billion, indicating an impressive 13.2% year-over-year growth or 12% on a foreign-exchange neutral basis. The consensus forecast for revenues is set at $9.28 billion, surpassing the company’s own expectation.

Improved Operating Margin and ARM Projections

The projected quarterly operating margin stands at 26.2%, compared to the 21% reported in the year-ago quarter. Additionally, Netflix foresees a year-over-year increase in global ARM on a F/X neutral basis for the first quarter.

Optimistic Outlook for 2024

Netflix is optimistic about achieving healthy double-digit revenue growth in 2024 on a F/X neutral basis, driven by a surge in membership and an uptick in F/X neutral ARM.

Revised Operating Margin Forecast

The streaming giant is raising its full-year 2024 operating margin forecast from 22%-23% to 24% (based on F/X rates as of Jan 1, 2024). This upward revision is attributed to the US dollar’s depreciation against other currencies since October, as well as the stronger-than-expected performance in the fourth quarter of 2023.