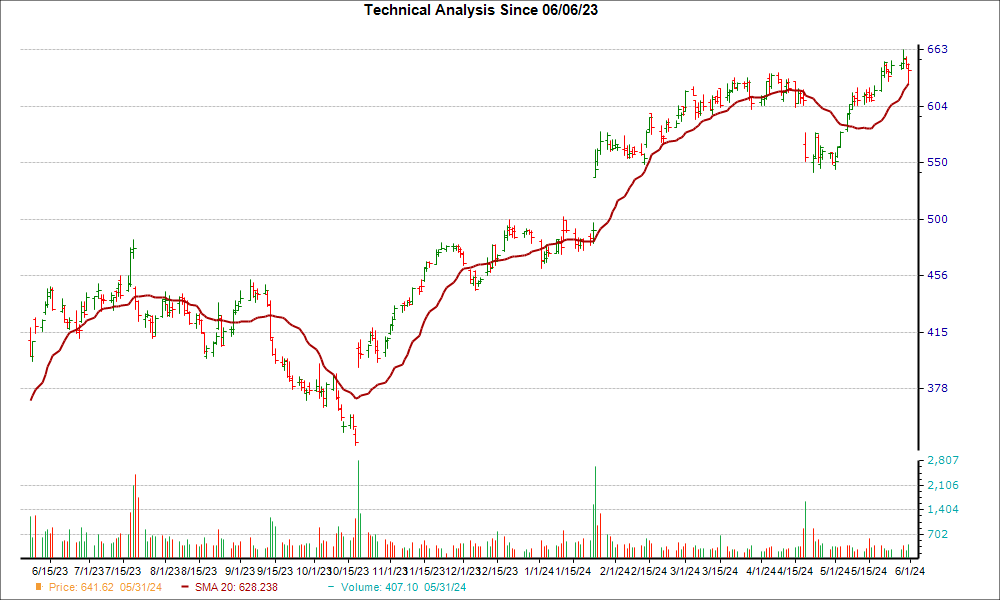

Netflix (NFLX) has recently soared above the 20-day moving average, marking an intriguing turn for potential investors. This breakthrough indicates a momentous upswing, dragging NFLX out of a rut and onto a promising path.

The 20-day simple moving average is akin to a seasoned sailor navigating murky waters. Offering traders a snapshot of a stock’s performance over a concise 20-day period, this tool unravels short-term trends, cutting through market noise to reveal convincing signals of trend reversals.

Witnessing NFLX surf past the resistance at the 20-day moving average nudges the scales in favor of a short-term bullish trajectory. Coupled with a 6.7% surge in the last four weeks, Netflix is currently flaunting a Zacks Rank #1 (Strong Buy), a powerful indicator fueling speculation of an imminent uptick.

Flanked by unflinching positive earnings projections, Netflix’s bull run is further invigorated. Over the last two months, not a single earnings estimate has been trimmed, with a remarkable 12 markers raised for the current fiscal year. As the consensus estimate continues an upward climb, investor optimism finds solid grounding in NFLX’s fundamentals.

Given the company’s pivotal technical juncture and uplifting earnings forecast revisions, it might be prudent for investors to keep a watchful eye on Netflix as it gears up for potential gains in the looming horizon.

Unrivaled Gains Spanning Through the Ages

In the realm of investing, few feats compare to the rip-roaring returns unfurled by Bitcoin. A true standout in the realm of decentralized, boundary-defying financial assets, the cryptocurrency has outshone all rivals, cruising victoriously through highs and lows.

Bitcoin’s formidable pedigree shines through in past presidential election cycles, with stunning returns leaving spectators agog: a jaw-dropping +272.4% in 2012, a whopping +161.1% in 2016, and a staggering +302.8% in the year 2020. With Zacks prophetically murmuring about an impending surge, the chorus of Bitcoin believers grows ever louder.