Stock Performance Analysis

The eyes of investors are riveted onto Netflix, Inc. (NFLX) as it emerges as a player to watch on the stock market. An examination of the past month reveals that the stock achieved a modest return of +1.6%, slightly trailing the Zacks S&P 500 composite’s +2% uptick. This period also saw the Zacks Broadcast Radio and Television industry, to which Netflix belongs, record a 0.4% increase. The burning question now is the future trajectory for this video streaming heavyweight.

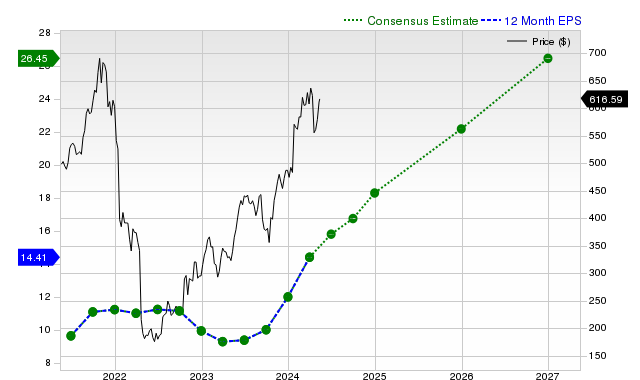

Earnings Estimate and Revisions

Instead of wielding crystal balls, Zacks.com zeroes in on the pivotal factor of interpreting a company’s earnings estimate adjustments. The foundation of our analysis rests on how industry analysts modify their earnings predictions to align with the latest business dynamics. Research underscores a compelling relationship between fluctuations in earnings projections and short-term stock price movements.

In the current quarter, Netflix is foreseen to attain earnings of $4.69 per share, an impressive uptick of +42.6% year-over-year. Similarly, the forecasted consensus earnings estimate for the full fiscal year stands at $18.30, reflecting a +52.1% growth from the previous year. Looking further ahead, the anticipated earnings for the subsequent fiscal year are pegged at $22.18, marking a +21.2% deviation from the prior year.

Revenue Growth Insight

While earnings growth provides a barometer for a company’s financial vitality, revenue expansion remains the bedrock for sustained profitability. Netflix’s anticipated sales for the current quarter, current fiscal year, and next fiscal year indicate positive trajectories of +16.2%, +14.7%, and +12.4%, respectively.

Performance Evaluation and Valuation

A thorough valuation appraisal is indispensable to sound investment decisions. The Zacks Value Style Score assigns Netflix a “F,” suggesting that it stands at a premium compared to its peers. Comparing key valuation multiples with historical values and industry benchmarks provides a holistic view of the stock’s pricing dynamics.

Conclusion: Investment Insights

Netflix’s compelling financial outlook and Zacks Rank #1 (Strong Buy) position it favorably for potential market outperformance. Relying on comprehensive data analytics, investors can glean invaluable insights to navigate the market dynamics surrounding Netflix, Inc.