Marvel at the unfolding drama in the high-stakes world of Tesla as Elon Musk secures another victory. Shareholders have given a resounding nod of approval to Musk’s eye-watering $56 billion pay package with a striking 77% support. But is this truly a triumph for the electric vehicle kingpin, or does the outlook remain murky?

Under the perceptive gaze of Morgan Stanley analyst Adam Jonas, an intriguing narrative unfolds. While the majority of shareholders have embraced Musk’s vision, the path to achieving a vital 25% blocking minority voting power remains veiled in uncertainty.

Jonas postulates that bridging the gap to this crucial threshold demands further strategic maneuvers on Musk’s part. Could his vast assets, exceeding an estimated value of $100 billion, outside of Tesla become pawns in this high-stakes chess game?

Notably, the outcome still hangs in the balance, hinging on impending legal evaluations. A storm of litigation looms on the horizon following attempts to overturn a pivotal court ruling that threatens to upend Tesla’s CEO 2018 compensation framework.

Looking ahead, Jonas prophesizes Musk’s continued stewardship of Tesla with an optimistic outlook on the forthcoming Q2 earnings call, coupled with the highly-anticipated robotaxi event in Austin on August 8th.

As the storyline unfolds, Jonas highlights critical milestones crucial for Tesla’s future trajectory. Immediate imperatives involve a radical reset in cost and capacity benchmarks within the automotive sector, recognizing that shareholder endorsements alone cannot propel EV adoption. Mid-term prospects entail the launch of innovative products across automotive and ancillary realms, leveraging Tesla’s prowess in AI, robotics, computing, and green energy. Jonas emphasizes the imperative of coherence in Tesla’s overarching strategies encompassing Musk’s diverse ventures, signifying the need for succession planning in the long run.

With a blend of caution and optimism, Jonas forecasts a brighter future for Tesla, underscoring the visionary leader’s undivided focus. Despite grappling with leadership uncertainties that have cast a shadow over Tesla’s performance, a promising dawn beckons as Elon Musk renews his ardor for steering Tesla through its most transformative phase to date.

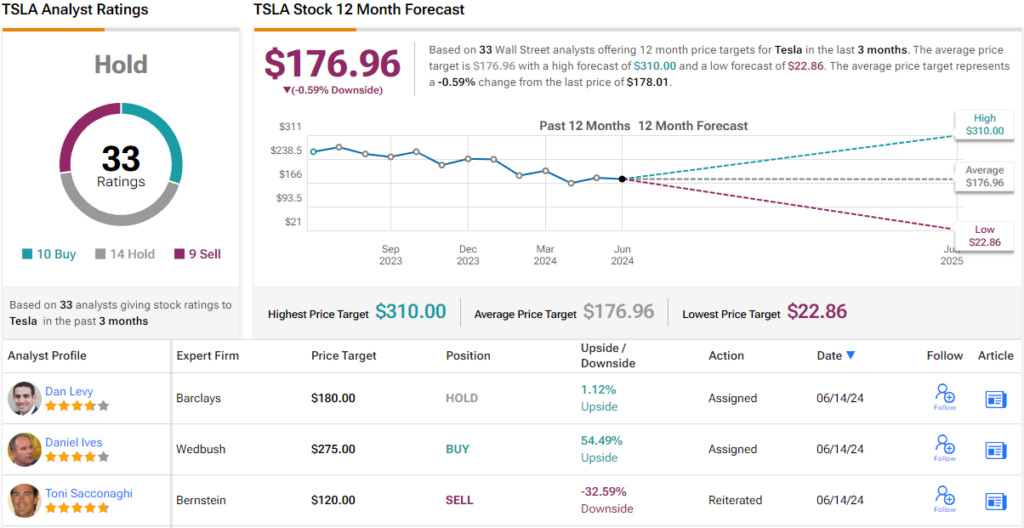

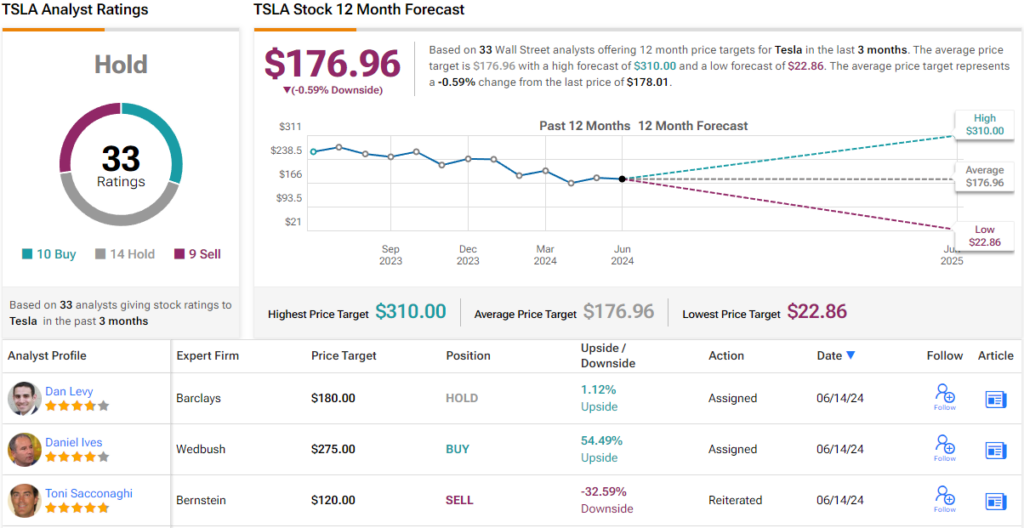

The conclusion remains unequivocal – Jonas retains his bullish stance on Tesla, designating it as an ‘Overweight’ (i.e., Buy) stock with a lofty Street-high price target of $310. Should his projections materialize, investors stand to reap a substantial 74% return from existing levels. While Jonas stands at the forefront of TSLA advocates, a mosaic of 9 additional analysts align with his upbeat sentiment. However, a contingent of 14 Holds and 9 Sells temper the exuberance, culminating in a ‘Hold’ (i.e., Neutral) consensus rating. The prevailing average price target of $176.96 alludes to a stalled momentum in Tesla’s current valuation.

For astute investors seeking value opportunities in the market landscape, TipRanks’ ‘Best Stocks to Buy’ tool houses a treasure trove of equity insights to guide informed decisions.

Disclaimer: The perspectives articulated herein represent the analyst’s personal views. This content aims to provide informational value and should not be construed as financial advice. Conduct thorough due diligence before engaging in investment endeavors.