Mobileye Global Inc. (MBLY) is gearing up to disclose its financial performance for the fourth quarter of 2023 on Jan 25 before the market open. According to the Zacks Investment Research, analysts predict earnings per share of 27 cents and revenues of $636.38 million for the upcoming reporting period.

The consensus estimate for Mobileye’s Q4 earnings per share has been revised upwards by 4 cents in the last 30 days. The company’s bottom line is anticipated to remain unchanged from the same period last year.

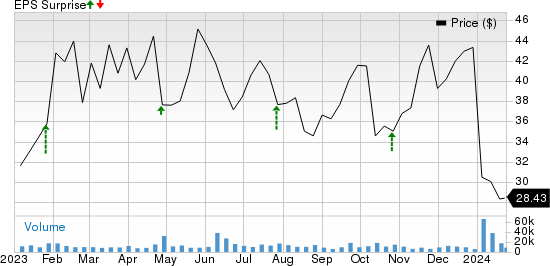

Revenue projections indicate a 12.6% year-over-year surge for Mobileye. Over the previous four quarters, the company has outperformed earnings expectations each time, with the average positive surprise standing at 29.47%.

Recap of Previous Quarter (Q3)

Mobileye exceeded the Zacks Consensus Estimate in its third-quarter 2023 earnings. The adjusted earnings per share stood at 22 cents, surpassing the consensus metric of 17 cents and marking an increase from 15 cents per share reported in the year-ago quarter. However, consolidated revenues of $530 million, representing a 17.7% rise year over year, narrowly missed the Zacks Consensus Estimate of $531 million.

Operating Challenges and Intense Competition

Challenges for Mobileye include a significant increase in operating expenses, which are affecting margins. Operating expenses surged by approximately 18.4% in the first nine months of 2023 due to the company’s ongoing investments in areas such as SuperVision and Chauffeur launch, the sixth and seventh generations of EyeQ, and expansion of facilities worldwide. Moreover, the company is facing aggressive competition from automotive chipmakers like Qualcomm and NVIDIA, which is expected to intensify in the coming period.

Mobileye’s plans to introduce the second generation of the supervision domain controller in the fourth quarter could lead to a decline in the average selling price, which may impact margins initially before potentially improving in the second quarter of 2024. As a result, the company’s near-term margin could be negatively impacted.

Earnings Forecast

According to Zacks Investment Research, their model does not conclusively predict an earnings beat for Mobileye in the upcoming quarter, citing the absence of the right combination of elements for an earnings surprise. Specifically, Mobileye has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell).

Comparative Analysis

However, there are other players in the automotive industry believed to have a favorable combination of elements to potentially outperform in this reporting cycle. Lear Corporation (LEA) and Ford Motor Company (F) are expected to announce their Q4 2023 results on Feb 6, with optimistic forecasts, along with BorgWarner Inc. (BWA) on Feb 8. These companies are anticipated to fare well in comparison to Mobileye.

These developments will undoubtedly influence investor sentiment and provide a comprehensive snapshot of Mobileye’s competitive standing in the automotive industry.