Regulatory challenges are mounting for MSFT’s Azure cloud business as the Competition Commission of South Africa gears up to file a formal complaint. Accusations of exorbitant fees for cloud license migration may lead to fines up to 10% of Microsoft’s revenues in the nation. Two years ago, MSFT implemented global software licensing changes permitting South African customers to transfer licenses to local providers without extra cost.

As global regulators intensify scrutiny on Big Tech, Microsoft is battling allegations of anti-competitive practices and market dominance across multiple jurisdictions. These investigations could reshape the competitive landscape in the tech industry significantly.

In a historical context, South African regulators have taken action against tech giants like Alphabet’s Google, instructing measures to boost visibility for local businesses and aid smaller platforms. Ongoing investigations are exploring whether AI models and digital platforms, including Microsoft’s Bing, are hindering revenue streams for the nation’s media companies.

Challenges Beyond South Africa

Regulatory pressure on Microsoft’s Azure extends globally, with authorities scrutinizing potential anti-competitive behavior. Recent moves to sell Teams separately from Office aim to address concerns after the EU investigated bundling practices. The company has a track record of EU antitrust fines, totaling billions over the last decade.

The EU’s ongoing examination of Microsoft concentrates on the fees and compatibility of rival messaging services with Office Web Applications, with potential antitrust charges looming. Complain from Cloud Infrastructure Services Providers in Europe (CISPE) and concerns over data practices pose further legal challenges.

The Competition and Markets Authority in the UK is also investigating the cloud market, particularly focusing on Microsoft’s Azure terms for any anti-competitive clauses that may restrict competition.

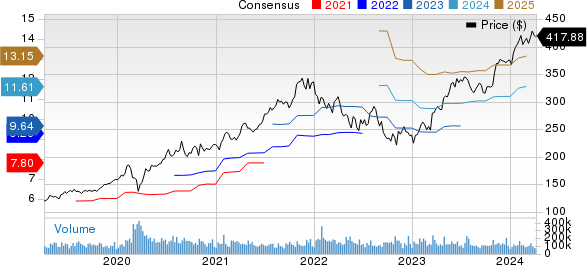

Shares of Microsoft, ranked #3 (Hold), have seen an 11.1% increase year-to-date, slightly trailing the sector’s growth. Looking ahead, the outcome of these regulatory battles could have a significant impact on the industry’s landscape and competition dynamics.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook, names 5 stocks with high growth potential in the AI sector. By 2030, the AI industry could have a massive economic impact. Embracing automation in this era is crucial for tapping into future economic potential.