Amongst the tumultuous sea of stocks, Microsoft has stood out as a beacon of consistent growth, tripling its value over the past half-decade. Nestled a mere 10% away from its pinnacle, the tech giant appears poised to soar even higher heights. The two pillars underpinning this ascent? Microsoft Cloud and the company’s AI endeavors – a dynamic duo propelling the stock towards fresh summits.

Microsoft’s Ascendancy Against AWS

Climbing the ranks in the competitive realm of cloud computing, Microsoft has made noteworthy strides, clawing its way towards the zenith inhabited by the cloud titan, Amazon Web Services (AWS). Now commanding a 25% ownership of the cloud computing market, Microsoft’s ascension poses a bullish bet amidst the landscape of cloud providers. AWS, the reigning sovereign, holds court with a 31% market share, while Alphabet lags far behind with a measly 11% sliver of the pie.

In the latest fiscal quarter of 2024, Microsoft further fortified its standing by notching a 21% year-over-year surge in cloud revenue, outstripping AWS’s 19% uptick in Q2 2024. Should this trend persist, the Redmond-based behemoth stands to continue annexing market share, inching closer to AWS’s mantle.

Moreover, the allure of amassing a greater share of the market is tantalizing, especially within a burgeoning domain. With the burgeoning demand for cloud platforms fueled by artificial intelligence, Microsoft remains at the vanguard. Its cutting-edge AI features, interspersed within its cloud platform, edge it ahead in the race for preeminence.

Embracing the Cloud: Microsoft’s Rising Fortunes

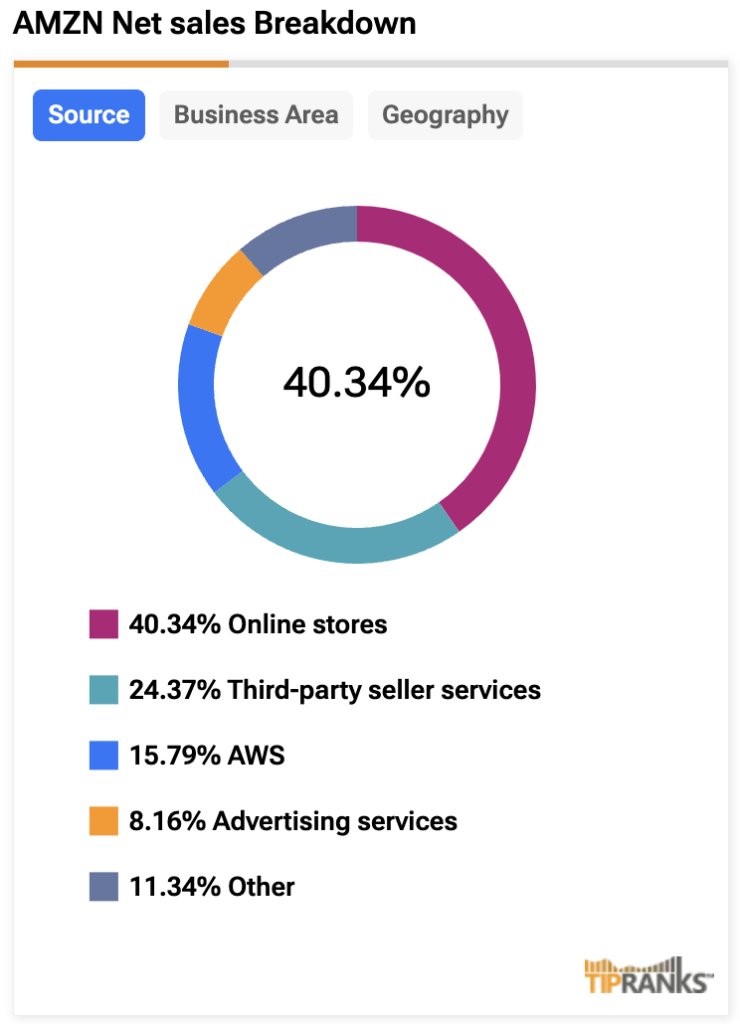

Setting itself apart from its tech counterparts embroiled in the cloud conundrum, Microsoft derives a lion’s share of its revenue from cloud computing – an undeniable boon in an era brimming with potential. Conversely, tech titans like Amazon and Alphabet draw less than 20% of their revenue from cloud pursuits, rendering them comparatively shielded from the full force of this burgeoning industry.

Diving into the numbers, Microsoft’s fiscal report for Q4 FY24 unveils a revenue windfall of $64.7 billion, a 15% year-over-year leap, with the Microsoft Cloud segment spearheading the charge, raking in $36.8 billion – nearly 60% of the total revenue.

Pioneering AI Frontiers: Microsoft’s Strategic Edge

While Microsoft Cloud affords the company an early foray into AI territory, the embers of innovation blaze bright through varied avenues. From fostering ties with OpenAI to unveiling tech marvels like Copilot, Microsoft’s CEO, Satya Nadella, underscores the company’s determination to lead the AI era.

Deploying AI prowess across its gamut of offerings, Microsoft adroitly integrates AI elements, as manifested in autogenerated suggestions on LinkedIn posts and the productivity-boosting Copilot. Not stopping there, the tech juggernaut unveiled Copilot for security, democratizing cybersecurity access for small businesses.

Although competitive pressures may erode Microsoft’s market share to a degree, its first-mover advantage proves pivotal in maintaining its perch. As the AI domain burgeons, Microsoft’s coffers should swell, buoyed by heightened revenue and net income.

Beyond the Clouds: Microsoft’s Multifaceted Revenue Streams

Beyond the allure of AI and cloud computing, Microsoft’s business repertoire spans other thriving sectors. Notably, LinkedIn churned a 10% year-over-year revenue growth in Q4 FY24, emerging as a pivotal hub for career-centric networking.

Augmenting this, Microsoft’s search and news advertising revenues surged by 19% year-over-year, unfazed by acquisition costs. Fortifying its foothold in the gaming sphere, the acquisition of Activision Blizzard catapulted Xbox revenue by 61%, with Activision Blizzard lending a weighty 58 percentage points to the growth trajectory.

Replete with diversified revenue streams, Microsoft’s business landscape stands apart from its peers in the public domain. Bolstered by AI investments, the tech titan stands primed to unearth growth avenues within its enterprise.

To Buy or Not to Buy: Microsoft’s Investment Landscape

The oracle of analysts deems Microsoft a “Strong Buy,” with 30 analysts flagging it as such, encompassing 28 “Buys” and 2 “Holds.” Boding well, the average price target for MSFT hovers at $501.15, hinting at an enticing 16% upside potential.

The Future Fortunes of Microsoft

The Path to Success for Microsoft

In the realm of tech dominance, Microsoft stands tall as the sole Magnificent Seven member that garners over half of its revenue from the vast realm of cloud computing. This distinctive strategy hasn’t just yielded long-standing prosperity, but also charts a course for reaching uncharted market peaks. With profound investments in the realm of AI, Microsoft not only boasts a commendable lead over its contenders but fortifies its product portfolio, setting it apart in the fiercely competitive tech landscape. The tech behemoth demonstrates substantial diversification, presenting itself as a bright prospect for investors that have the resolve to see the fruits of their patience.