The earnings season is heating up, with tech powerhouses like Microsoft, Apple, Amazon, and META Platforms set to reveal their quarterly reports. The tech sector has faced turbulence in recent times, with companies like Tesla, Netflix, and Alphabet witnessing stock price declines post their Q2 earnings.

Notably, Alphabet, despite exceeding earnings expectations, saw its stock falter. The overarching reason? The lofty valuations of tech companies, demanding more than mere headline beats to justify their premiums.

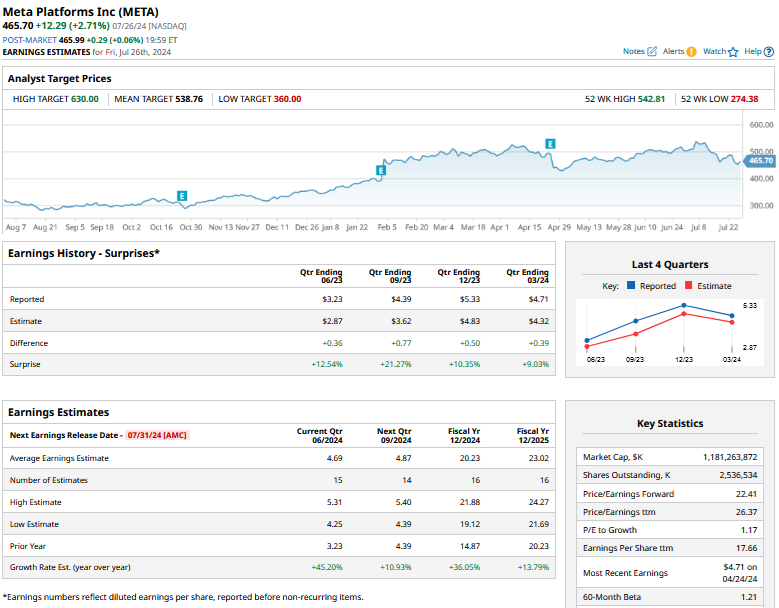

Amidst this tech sector turmoil, META Platforms has experienced a 13% drop from its yearly highs, now residing in correction territory following a 10%+ plunge. After being the sole “Magnificent 7” stock to tumble post its Q1 earnings and shedding a substantial $132 billion in market capitalization in a single day, can META Platforms rebound from its recent setbacks after the Q2 earnings disclosure? Let’s delve into this analysis, commencing with a preview of Wall Street’s expectations for the Facebook parent’s Q2 earnings.

Insight into META Platforms Q2 Earnings

Projections anticipate META to announce revenues of $38.3 billion in Q2, marking a robust 19.6% year-over-year surge. Despite the Q1 guidance of revenue between $36.5 billion and $39 billion – hitting $37.75 billion at the midpoint – falling short of the $38.3 billion analyst estimate, the growth trajectory remains positive.

The consensus eyes a Q2 earnings per share (EPS) of $4.69 for META, suggesting a remarkable 45% yearly upswing. The bottom line of META has experienced rapid expansion in the past year, driven by an unwavering focus on cost efficiencies.

Focusing on Key Metrics in META’s Q2 Earnings

Beyond headline figures, the spotlight will shift to the following aspects during META’s Q2 earnings release after Wednesday’s trading hours:

- Q3 Guidance: META’s subdued guidance last quarter rattled investors. Attention now turns to the Q3 outlook post the current earnings report. Forecasts anticipate a 14.7% revenue increase in Q3, with growth likely tapering to 12.6% in the final quarter of the year.

- Chinese Advertisers: The upsurge in ad expenditure by Chinese firms targeting Western audiences has been a prime revenue driver for META. Against the backdrop of escalating tensions and the impending U.S. elections, insights on changes in spending patterns of Chinese advertisers will be crucial.

- AI Monetization, New Open-Source Model: META’s recent launch of Llama 3.1 405B, termed by Mark Zuckerberg as a groundbreaking open-source AI model, raises intrigue on its revenue implications. META aims to dispel revenue concerns and affirm the model’s safety. The earnings call may shed more light on the model’s future timeline and monetization strategies.

Analysts’ Sentiment and Stock Projections for META

Wall Street analysts exhibit a bullish tilt towards META, endorsing a “Strong Buy” rating. The mean target price stands at $538.76, reflecting a 15.7% improvement from last week’s close. The highest street price of $630 portrays a lofty 35.3% premium.

With analysts heightening optimism ahead of the Q2 release, META’s stock received target price upgrades from Oppenheimer and Bernstein. Morgan Stanley went a step further, advocating for capitalizing on the market dip.

Strategizing Meta Stock Investment Amidst Challenges

Despite facing various risks in 2024, including the potential resurgence of Donald Trump alongside VP nominee JD Vance, META navigates a precarious political landscape. The tech giant’s revenue from Chinese advertisers might also face headwinds under a Trump administration keen on imposing tariffs.

However, META’s AI endeavors present short-term growth prospects, while its metaverse investments hint at long-term transformative potential, notwithstanding present revenue deficits. Trading at a moderate next-12 months price-to-earnings (PE) ratio of 22.3x, META offers an intriguing investment proposition. It seems prudent to capitalize on the stock dip cautiously, given the challenges looming in 2024.