The Spark Behind MasTec’s Spectacular Rally

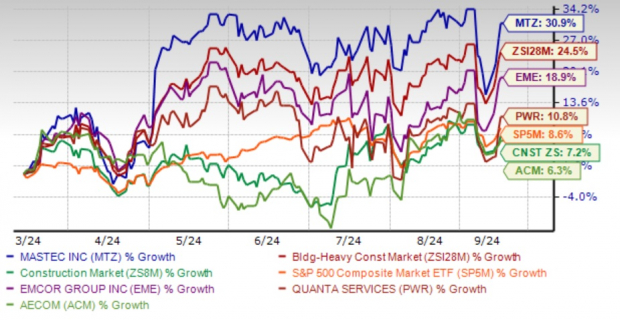

Over the past six months, MasTec, Inc.’s stock (NYSE: MTZ) has surged by an impressive 31%, outshining not only its industry peers but also broader market indices like the S&P 500. The infrastructure construction giant has capitalized on the growing need for enhanced power, data capabilities, and network speed, steering the company towards exceptional growth.

Strategic investments in diversification, coupled with a bullish outlook for future growth, have propelled MasTec to the forefront of the industry, leaving competitors like EMCOR Group, Quanta Services, and AECOM in its wake.

What Sets MasTec Apart?

MasTec’s forecast for 2024 paints a rosy picture, with a robust backlog of $13.3 billion providing a clear roadmap for the company’s trajectory. Elevated revenue projections, improved EBITDA margins, and a strong focus on clean energy and infrastructure projects all point towards a stellar performance in the coming years.

With key segments like Power Delivery and Communications witnessing substantial growth in backlog and revenues, MasTec’s long-term prospects seem bright. The company’s strategic focus on expanding its communications pipeline, coupled with upcoming acquisitions and equity investments, further solidifies its position in the market.

MasTec’s Path to Profitability

Analysts are bullish on MasTec’s future, evident from upward revisions in earnings estimates and a solid track record of beating earnings expectations. The company’s VGM Score of A underscores its growth potential and market outperformance prospects, setting the stage for continued success.

In a landscape teeming with competitors, MasTec’s $8.75 billion market cap and strategic positioning make it a standout choice for investors seeking a blend of stability and growth. The company’s multidimensional growth strategy and diversified portfolio mark it as a prime contender in the construction sector.

Verdict: Is MasTec Worth the Investment?

With an encouraging Zacks Rank #2 (Buy) rating and favorable earnings outlook, MasTec emerges as an attractive investment option in a sector rife with opportunities. The company’s proactive stance towards growth, coupled with solid fundamentals, positions it as a front-runner for investors looking to capitalize on the construction industry’s upward trajectory.