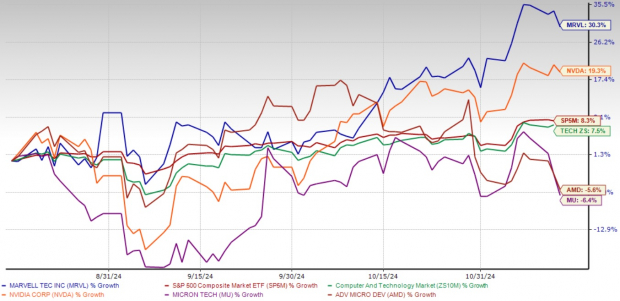

Marvell Technology, Inc. MRVL has been on an impressive run, with its shares surging more than 30% over the past three months. This performance significantly outpaces the broader market, where the S&P 500 and the Zacks Computer and Technology sector have risen by 8.3% and 7.5%, respectively.

MRVL stock has also outperformed other semiconductor heavyweights, including NVIDIA Corporation NVDA, Advanced Micro Devices, Inc. AMD and Micron Technology, Inc. MU. In the past three months, NVIDIA rose 19.3%, while shares of Advanced Micro Devices and Micron Technology have declined 5.6% and 6.4%, respectively.

3-Month Price Return Performance

Image Source: Zacks Investment Research

This stellar performance has led many investors to question whether it’s time to take profits or continue holding on to MRVL. Here’s why a hold strategy might be the best course of action.

Marvell’s Prominent Growth in AI Markets

Marvell’s future is firmly tied to the rapidly expanding artificial intelligence (AI) industry, an area with massive growth potential. According to Gartner, the global AI semiconductor market is projected to witness a 33% revenue increase to $71.25 billion in 2024, followed by a 29% rise in 2025. Marvell’s innovative chips are key players in this sector, helping manage and transport the extensive data sets generated by AI applications.

The company’s high-performance electro-optics solutions, including PAM DSPs and ZR interconnects, are crucial for enabling seamless data transmission across AI-enhanced data centers. These products position Marvell at the center of building next-generation data infrastructure, a critical component as AI adoption accelerates globally. By aligning its product development with the increasing demands of the AI boom, Marvell is strategically positioned to capture significant market share.

Marvell’s Custom Silicon and Data Center Expansion

Marvell’s commitment to custom silicon solutions for cloud service providers gives it a unique competitive edge. The company’s second-quarter fiscal 2025 saw robust growth in its data center segment, driven by the ramp-up of custom AI compute programs. Management forecasts high-teen sequential growth in data center revenues for the third quarter, underscoring strong demand for AI-focused solutions.

Investments in cutting-edge technology, like PCIe Gen 6 retimers and advanced interconnect products, reflect Marvell’s forward-thinking approach to bolstering data center capabilities. These strategic moves are crucial as the industry scales up to meet AI-driven demands, highlighting Marvell’s position as a key player in this long-term growth market.

Marvell’s Operational Resilience Amid Challenges

Despite a challenging macroeconomic environment, Marvell’s second-quarter fiscal 2025 performance showcased its resilience. The company reported non-GAAP earnings per share (EPS) of 30 cents, a marked improvement from 24 cents in the previous quarter. This growth highlights Marvell’s effective cost management and operational efficiency.

Marvell’s ability to navigate supply-chain disruptions and shifting customer demands while maintaining profitability is a testament to its strong execution. The company’s pricing discipline and strategic portfolio management have supported its margins.

Wall Street remains optimistic, with the Zacks Consensus Estimate projecting a 35% year-over-year revenue increase and a 71% jump in earnings for fiscal 2026. Such projections reinforce confidence in Marvell’s ability to sustain growth.

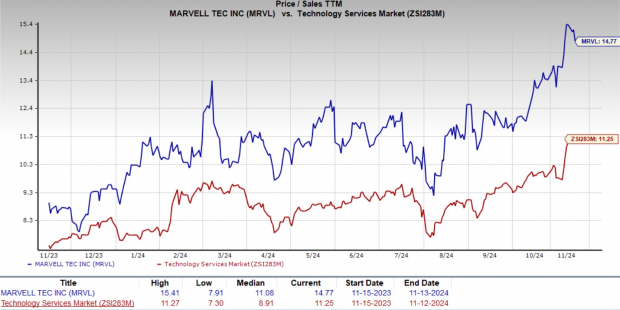

Image Source: Zacks Investment Research

Near-Term Hurdles Exist for Marvell

While the long-term growth prospects are compelling, Marvell faces some near-term risks. One significant challenge is the U.S. government’s tightening restrictions on semiconductor exports to China. This is particularly concerning as China accounted for more than 46% of Marvell’s total revenues in the second quarter of fiscal 2025. Any further escalation in export controls could impact the company’s sales and market position.

Marvell’s valuation remains relatively high. The stock trades at a trailing 12-month price-to-sales (P/S) ratio of 14.77, higher than the Zacks Technology Services industry’s average of 11.25. This premium valuation could expose the stock to potential pullbacks, especially if broader market sentiment turns bearish.

Image Source: Zacks Investment Research

Conclusion: Hold MRVL Stock for Now

While Marvell’s strong growth in AI markets, custom silicon solutions and operational resilience paint a promising long-term picture, near-term risks like U.S.-China trade tensions and high valuations warrant caution. For now, holding MRVL stock seems the most prudent choice.

Maintaining this position allows investors to benefit from Marvell’s strong fundamentals and strategic positioning as the company navigates opportunities and challenges in the evolving semiconductor landscape. Marvell currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report