Market Movement and Investor Sentiment

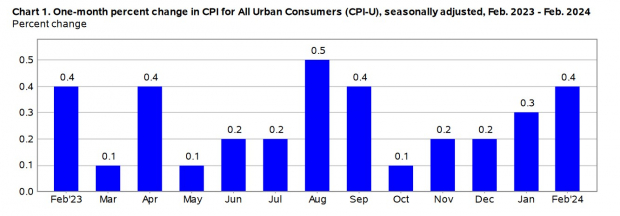

This morning witnessed a dip in broader markets following a 0.6% increase in the Producer Price Index (PPI) for domestic producers, surpassing expectations of a 0.3% uptick. The uptrend in the Consumer Price Index (CPI) over recent months indicates ongoing inflationary pressures.

Opportunities Amid Volatility

Despite looming inflation concerns, low-beta stocks are shining as beacons of stability. Zacks Rank #1 stocks boasting dividend yields of over 5% appear particularly attractive amidst market volatility.

Organon & Co: A Medical Gem

Organon & CO OGN: With a beta of 0.81, Organon & Co, a healthcare company specializing in women’s services, is currently undervalued. Despite a 27% year-to-date surge, the stock trades at $18, offering a modest 4.3X forward earnings multiple.

Oversea-Chinese Banking: Banking on Stability

OverseaChinese Banking OVCHY: Based in Singapore, Oversea-Chinese Banking boasts a beta of 0.71 and a stable 52-week trading range of $17.46-$20.49 per share. With a consistent 5.42% annual dividend yield, it presents a compelling investment case.

Southside Bancshares: A Dip Worth Buying

Southside Bancshares SBSI:Southside Bancshares demonstrates a low beta of 0.53 and offers a standout 5.1% annual dividend yield, outperforming industry averages. With significant upward revisions in earnings estimates for FY24 and FY25, it emerges as a compelling buy-the-dip candidate.

Seizing the Opportunity

Earnings estimate revisions for Organon & Co and Oversea-Chinese Banking remain favorable, making it an opportune moment for investors to consider these low-risk, high-income stocks amid market fluctuations driven by inflationary data.

Wise Investments in Volatile Times

In the realm of uncertainty, these stocks shine as beacons of stability, offering investors a chance to weather market storms while reaping high dividends. Despite market flux, a strategic investment in these gems may provide a hedge against turbulent times.