The Volatility Venture

After a tumultuous week of market mayhem, where stocks seemed to ricochet from their lows, we now brace for the impending Fed rates decision that might reignite market volatility. Is it time to cast our gaze upon stocks exhibiting a subdued implied volatility percentile?

Decoding the IV Percentile

Several stocks are flaunting a low implied volatility percentile, Pfizer (PFE) stands out with its implied volatility pegged at 21%, a whisper above its low of 18% and a murmur beneath its high of 34% over the past year.

Implied volatility percentile, a staple metric in options trading, offers perspective on how current implied volatility compares to historical ranges within the same stock. For example, Palantir’s IV percentile scrutinizes current implied volatility against its historical backdrop, yielding a percentage scale from 0-100%.

An IV percentile of zero signifies the stock’s current implied volatility near or at its historical low, while a lofty 100% indicates the stock swims in historically high volatility waters.

For investors seeking stocks with a serene implied volatility percentile, the Stock Screener unveils a treasure trove of calm.

Navigate the Calm Waters

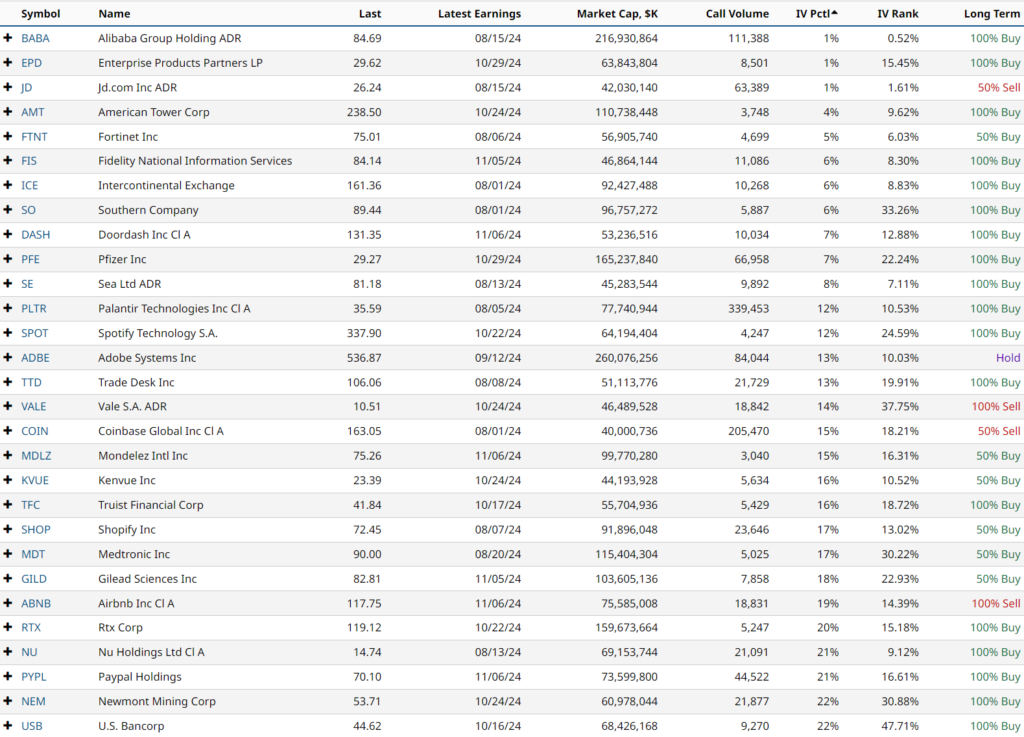

By filtering through the Stock Screener, potential investors can sift through stocks with low implied volatility. Setting filters like Total Options Volume above 2,000, Market Cap surpassing 40 billion, and IV Percentile below 25% unveils stocks such as Alibaba (BABA), Enterprise Products Partners (EPD), and JD.com (JD) in the tranquil volatility seas.

The art of utilizing IV percentile lies in aligning long volatility trades like debit spreads, long straddles, and long strangles when this metric ebbs. Also, scrutinizing a stock’s IV Percentile against the broader market landscape could unveil unique opportunities.

Moreover, being mindful of impending earnings can avert sailing into stormy earnings-related waves post announcements.

Harvesting Knowledge

While exploring the depths of low IV percentile, investors should remain cautious of the risks options pose and be vigilant of potential losses. Remember, education remains paramount, and consulting a financial advisor before embarking on any investment journey is sage advice. The market beckons, navigate wisely.