The Current Landscape of Low Implied Volatility

Today’s market presents a curious sight – the tides of volatility have receded to levels unseen in half a year. Many stocks now wear the cloak of a low implied volatility percentile.

Take Palantir, for instance. Its implied volatility languishes at 37%, a far cry from the twelve-month high of 61%.

Understanding Implied Volatility Percentile

Implied volatility percentile, a cornerstone metric in options trading, holds up a mirror to current implied volatility against historical shadows.

Imagine it as a yardstick that measures a stock’s current volatility against its past gyrations, condensed into a percentage between 0 and 100.

A paltry 0% denotes the calmest seas a stock has sailed in the lookout. Meanwhile, a searing 100% marks a stock riding the peak of volatility waves.

Utilizing the Stock Screener for Low Volatility Finds

For a closer scrutiny into stocks basking in the glow of low implied volatility, tools like the venerable Stock Screener come into play.

Using the Stock Screener to Find Low Volatility Stocks

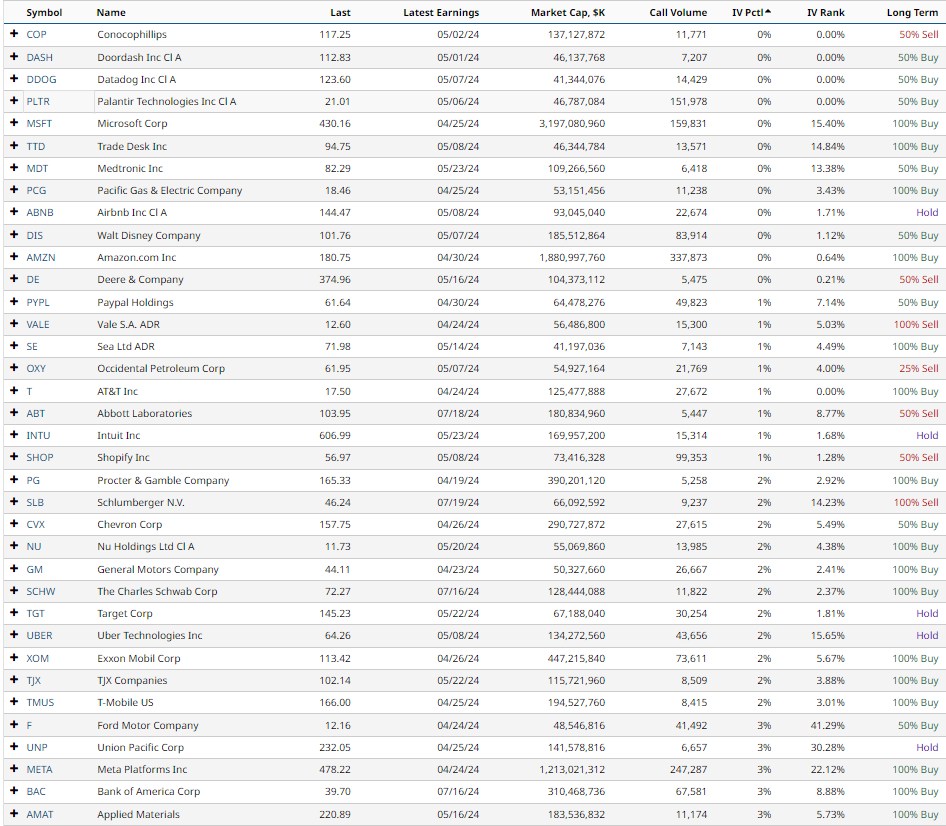

A stringent set of filters unveil a trove of tranquility:

- Total Options Volume greater than 2,000

- Market Cap greater than 40 billion

- IV Percentile less than 15%

Behold the serene ranks, from the serene to the subdued:

Conocophillips

Doordash

Datadog

Palantir Technologies

Microsoft

Trade Desk

Medtronic

Airbnb

Disney

Amazon

Peruse the comprehensive list below:

Unlocking the Potential of IV Percentile

In times of low implied volatility, the sagest move is to tilt towards long volatility trades, like debit spreads, long straddles, and long strangles.

Amp up your savvy by contrasting a stock’s IV Percentile against the broader market canvas. If the tide brings low IV Percentiles across all stocks, the tide might lack momentum. Conversely, if market-wide implied volatility swells, the time is ripe to snap up bargains from our aforementioned list.

Bonus tip – do keep tabs on those impending earnings dates. Companies often reveal in surprises post-earnings that can jolt share prices awake.

Options, however, tread in perilous waters where investors can plunge 100% deep. This exposé seeks to enlighten, not to hoodwink. Should you wade in these waters, a friendly reminder – due diligence always precedes financial steps.