Crypto exchange Kraken recently made a bold move, filing a motion to dismiss the lawsuit brought against it by the U.S. Securities and Exchange Commission.

Uncovering the Story

In its motion, Kraken vehemently contended that the SEC failed to establish any actual fraud or harm to its users.

Significance of the Case

This lawsuit, part of a series challenging regulatory oversight, involves prominent players like Coinbase and Binance.US. All these litigations underscore a critical debate – the scope of the SEC’s supervision over the booming crypto sector and the appropriateness of its interventions.

Analyzing the Details

Kraken’s plea to dismiss echoes familiar refrains: the SEC’s shaky delineation of certain assets as securities, a broad interpretation of “investment contracts,” and accusations of regulatory overreach.

While some arguments mirrored those of Coinbase and Binance.US, Kraken added unique elements, such as addressing the SEC’s claim about its asset marketing practices and the absence of direct consumer harm allegations.

These legal maneuvers foreshadow a prolonged legal battle, with potential involvement from the highest judicial authority, the U.S. Supreme Court.

The Coinbase case unfolds in the Southern District of New York, Binance.US in the District of Washington, and Kraken in the Northern District of California. Another contender, Legit.Exchange, has entered the fray in the Northern District of Texas. With multiple districts in play, achieving a consensus poses a significant challenge. Anticipating a series of appeals, multiple courts are poised to weigh in.

While predicting the outcome remains premature, the litigious nature of these cases signals a protracted legal struggle ahead. The likelihood of relentless appeals, driven by the vast resources at play, suggests prolonged judicial scrutiny.

To the legal minds among our readers, the road ahead beckons with questions. What path lies ahead in this legal saga? What timeframe can we expect, and what twists and turns might precede a potential SCOTUS intervention?

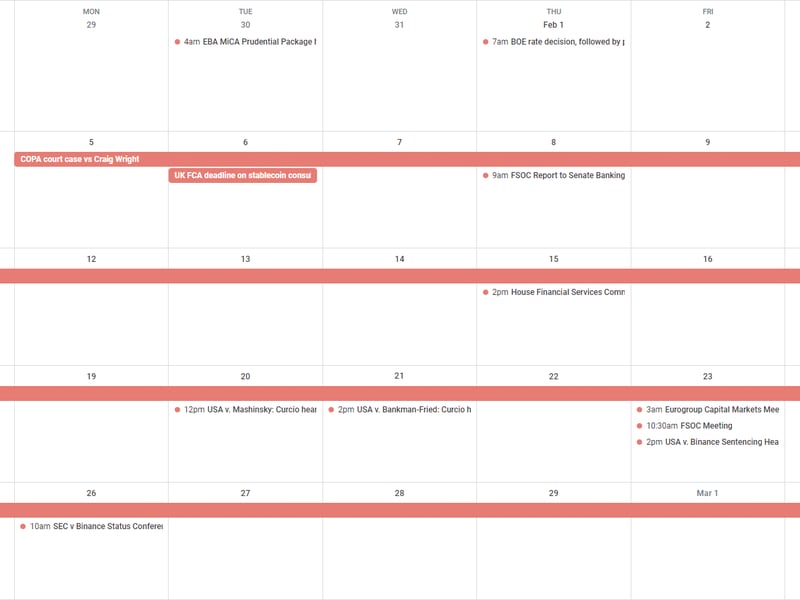

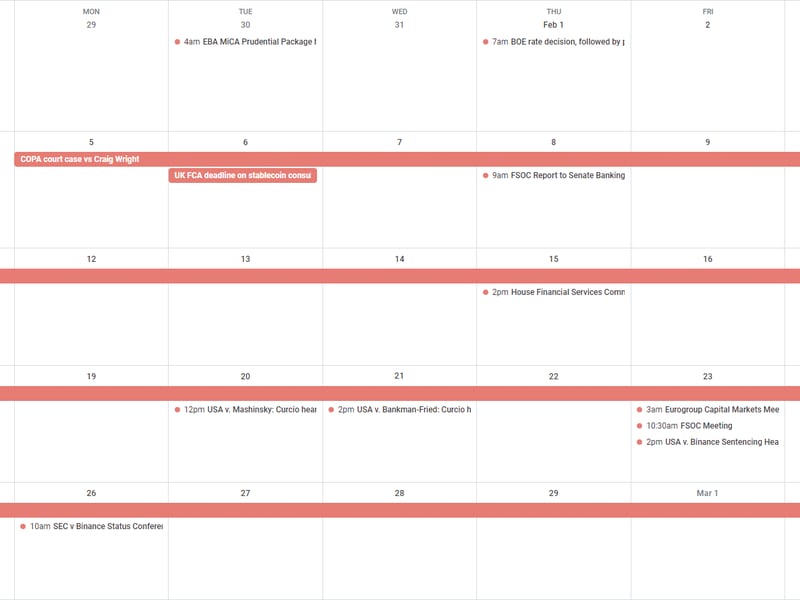

Tuesday

- 17:00 UTC (12:00 p.m. ET) The judge handling the case involving Alex Mashinsky hosted a hearing to endorse his attorneys’ dual representation, including representing Sam Bankman-Fried.

Wednesday

- 19:00 UTC (2:00 p.m. ET) The judge overseeing the proceedings concerning Sam Bankman-Fried conducted a similar hearing to validate the same. Bankman-Fried confirmed that his trial lawyers would no longer act on his behalf.

Friday

- 14:30 UTC (10:30 a.m ET) The Financial Stability Oversight Council convened in a closed-door session.

- 19:00 UTC (11:00 a.m. PT) The judge presiding over the Binance case approved the proposed settlement. However, the sentencing hearing for former Binance CEO Changpeng Zhao was rescheduled for April.

- (Ars Technica) A Canadian court ruled that Air Canada must adhere to a refund policy devised by its “AI” chatbot. Subsequently, Air Canada discontinued the chatbot.

- (Reddit) With in-flight Wi-Fi becoming ubiquitous, passengers now have the liberty to capture and inquire about aircraft anomalies, as evidenced on United flight 354. This 29-year-old Boeing 757 navigated a safe diversion to Denver following an incident.

- (Bloomberg) In a new lawsuit, Alameda Research is accused of securing a “billions of dollars” line of credit from Deltec Bank to bolster the growth of tether (USDT).

If you have any thoughts, suggestions for future topics, or feedback, drop me an email at nik@coindesk.com or connect with me on Twitter @nikhileshde.

Also, join the discussion on Telegram.

Until next week, take care!