A long call butterfly strategy is like walking a tightrope in the market – a delicate balance of precision and timing. This intricate play is for traders who foresee a stock dancing on a narrow path – not soaring to the sky or plummeting underground – from trade inception to expiration. Crafting this strategy with calls involves buying an in-the-money call, selling two at-the-money calls, and adding an out-of-the-money call, all in a meticulous choreography. The entrance fee, a net debit, is also the potential loss limit, setting the stage for a careful dance of risk and reward.

When executed with finesse, the maximum profit emerges as the gap between the short and long calls, less the premium forked out for the ensemble.

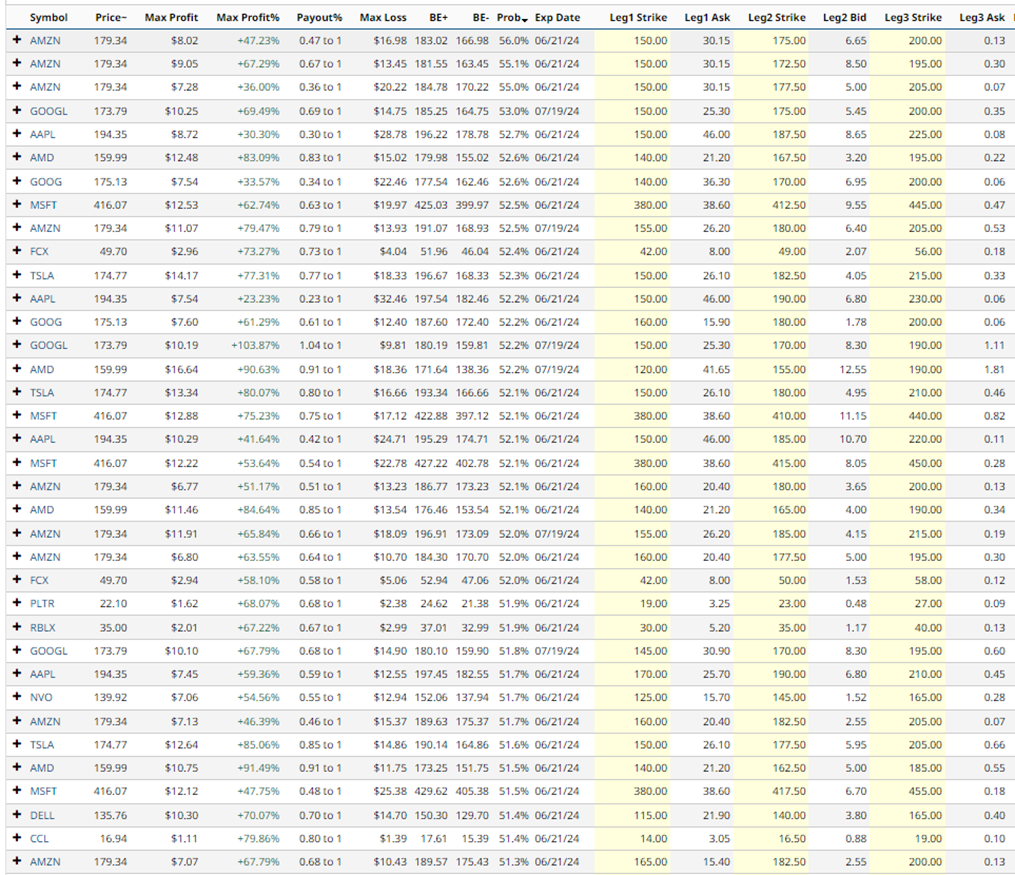

Let’s dive into Barchart’s Long Call Calendar Screener for June 5th:

The screener heralds tantalizing long call butterfly trades on star-studded stocks like Amazon, Alphabet, Apple, AMD, Microsoft, FCX, and Tesla.

Zoom in on the first entry – a Long Call Butterfly on Amazon.

For the June 21 deadline, the performance includes picking up the $150 strike call, tossing in two of the $175 strike calls, and plucking a $200 strike call. This exotic dance demands $1,698 for a ticket, the total stake in this risky tango. The crescendo? A potential windfall of $802, with the lower breakeven point at $166.98 and the upper at $183.02. An alluring 47.23% maximum profit awaits, tantalizing with a 56.0% likelihood of success.

The Barchart Technical Opinion chimes in with a resounding 56% Buy, signaling a wobbly short-term forecast but solid long-term backing.

GOOGL Long Call Butterfly – A Strategic Ballet

Another performance unfolds, this time featuring Alphabet.

In the spotlight for July 19, this spectacle stars the $150 strike call, flanked by two $175 strike calls and backed by a $200 strike call. The show demands a $1,475 offering, the cost of admission to this high-wire act. The dazzling finale? A potential bonanza of $1,025, with the lower and upper breakeven thresholds set at $164.75 and $185.25, respectively. A captivating 69.49% peak profit beckons, with a 53.0% probability of success.

The Barchart Technical Opinion leads with a confident 100% Buy, holding a firm grip on the short-term trajectory and reinforcing a steadfast long-term pattern.

Apple’s Long Call Butterfly Tango

The finale spotlights a long call butterfly on Apple.

For the June 19 act, the performance calls for the $150 strike call, flanked by two $187.50 strike calls, and supported by a $225 strike call. This grand production requires a $2,878 investment, the risk ceiling for this dramatic waltz. The grand finale unveils a potential jackpot of $872, with the lower and upper breakeven levels set at $178.78 and $196.22. A modest 30.3% maximum return gleams on the horizon, with a 52.7% chance of success.

The Barchart Technical Opinion whispers a modest 40% Buy, hinting at a strengthening short-term forecast alongside an impending risk of overextension.

Investors, heed the warning – we may be tiptoeing near overbought terrain. Stay vigilant for a potential course correction.

Managing Risk Amidst the Butterfly Ballet

The beauty of Long Call Butterfly Spreads lies in their innate risk containment mechanisms. Prudent traders may opt to exit if the breakeven bounds are breached, shielding themselves from excessive exposure.

Practicing judicious position sizing is key, ensuring that any potential 100% loss does not breach a 1-2% threshold of the total portfolio value.

Beware the specter of early assignment risk lurking within these intricate performances, especially as the short calls flirt with in-the-money territory as the curtain draws close on expiration.

Remember, the options arena is a wild ballroom where fortunes can swing fiercely. Approach with caution.

This guide serves as an educational compass, not a beacon for trades. Always don your due diligence hat and seek counsel from your financial navigator before setting sail on any investment voyage.