The Potential of Certepetide Unveiled

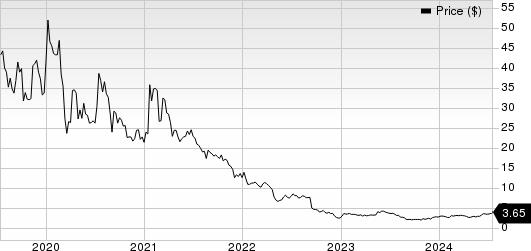

Lisata Therapeutics, Inc.’s stock, symbolized as LSTA on the NASDAQ, has witnessed a remarkable surge of 33.7% year to date (YTD). This resurgence comes amidst a backdrop of a general industry retraction of 2.7%.

A Silver Lining for Cancer Treatment

The driving force behind this stock momentum is the promising pipeline candidate of Lisata – certepetide. This investigational drug, once known as LSTA1, focuses on battling various solid tumors.

New Heights in Cancer Research

Recent data released by Lisata displayed striking results from preclinical trials of certepetide against intrahepatic cholangiocarcinoma, a deadly form of cancer. Mice treated with certepetide alongside standard-of-care therapies showcased enhanced survival rates, instilling hope for prospective human treatments.

Shaping the Landscape of Cancer Therapy

Certepetide functions by facilitating the penetration of anti-cancer drugs into solid tumors, thus optimizing the tumor microenvironment for immunotherapy. Ongoing phase IIa trials of certepetide including the BOLSTER study for cholangiocarcinoma have bolstered Lisata’s position in the cancer treatment arena.

Embracing the Future

Looking ahead, Lisata intends to broaden its research horizon by adding another branch to the BOLSTER study, investigating certepetide in conjunction with chemoimmunotherapy for intrahepatic cholangiocarcinoma. This strategic move aims to further solidify the company’s progressive stance in combating cancer.

Expanding Horizons: Stocks on the Rise

Certepetide’s potential has not gone unnoticed by the FDA, with Orphan Drug designations granted for rare cancers like osteosarcoma. Furthermore, numerous early-to-mid-stage studies continue to assess the efficacy of certepetide in tackling a myriad of cancer types, further propelling Lisata’s growth trajectory.

A Lens into the Future: Compassionate Stock Ratings

Though Lisata currently holds a Zacks Rank #3 (Hold), the company’s stock performance positions it favorably in the biotech arena. Investors seeking better prospects may turn their gaze towards Zacks Rank #2 (Buy) stocks such as ANI Pharmaceuticals, Inc., Adaptive Biotechnologies Corporation, and RAPT Therapeutics, Inc.

On the Rise: Promising Stock Performances

The past performance of ANIP, ADPT, and RAPT stocks offers a mixed bag of results, indicating the dynamic nature of the biotech sector. While ANIP showcases impressive earnings growth, ADPT conducts pioneering research in spite of some setbacks, and RAPT continues to maneuver through challenges with resilience.

The ongoing studies on certepetide, along with forthcoming clinical data readouts, hold the key to unlocking Lisata’s full potential through the remainder of 2024. As Lisata navigates the seas of cancer research, investors eagerly anticipate the bounty these efforts may yield in reshaping the landscape of cancer therapy.