Bitcoin BTC/USD surpassed the $67,000 mark on Monday, reaching heights not seen since 2021, marking a dramatic upswing over the last half-year. Renowned stock picker Jim Cramer shared his insights into what may be propelling the remarkable ascent of the world’s most extensive digital currency.

The Core of the Matter: Bitcoin has been making strides recently, inching closer to its peak achieved in November 2021. While many credit the surge to the approval of new spot Bitcoin exchange-traded funds (ETFs) and the anticipation of the upcoming April halving event, Cramer believes there is an underlying force that is fueling the uptrend.

“Initially, I thought the spike in Bitcoin was prompted by the ETFs,” Cramer revealed during a segment on CNBC’s “Squawk On The Street.”

“I reckon individuals are simply expressing their lack of faith in traditional fiat currencies.”

Cramer elaborated that he sees Bitcoin serving as a diversification safeguard against the U.S. dollar and other fiat currencies, which he views as inherently weak due to their lack of tangible backing like gold. The U.S. formally departed from the gold standard in 1971, causing the dollar to lose approximately 98% of its purchasing power over the ensuing five decades.

Last week, Bank of America analyst Michael Harnett tied Bitcoin’s recent surge to the nation’s mounting debt. Harnett highlighted that the U.S. national debt is escalating by about $1 trillion every 100 days and is forecasted to surpass $35 trillion by April.

With Bitcoin’s total supply capped at 21 million, many view it as a shield against persistent devaluation of the U.S. dollar and other fiat currencies.

“The younger generation believes that the only way to get out of this economic quagmire is to inflate the dollar, making payments with less valuable currency,” remarked Cramer.

Cramer’s stance on Bitcoin and the broader crypto sector has fluctuated in recent years. He entered the Bitcoin market early in 2021, but exited near its peak just before the industry grappled with various challenges, including the upheaval of the FTX cryptocurrency exchange.

Although Cramer has maintained a level of caution regarding cryptocurrencies since then, his recent statements suggest a potential shift in perspective. Last week, he implied that Ethereum ETH/USD could only ascend from current levels. On Monday, he hinted that the anticipated approval of Ethereum ETFs could trigger another surge in the cryptocurrency space.

“Initially, I attributed a large part of this growth to ETFs, I admit … An Ethereum ETF is on the horizon, and you better be prepared,” remarked Cramer.

Further Reading: Is Jim Cramer Feeling Positive about Crypto? Ethereum to Soar Higher, Cryptocurrency Market Poised for Growth

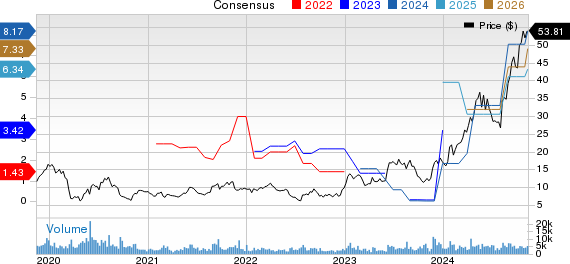

$BTC Price Movement: Bitcoin showed a 6.02% increase over a 24-hour period, reaching $66,644 at the time of publication, as per Benzinga Pro.

Photo Credit: Eivind Pedersen from Pixabay.