The Timeless Wisdom of “Old Turkey”

Embedded within the realms of financial lore lies the wisdom of “Old Turkey” – a sage figure whose counsel to famed speculator Jessie Livermore echoes through the ages: “It’s a bull market you know!” Livermore, once tangled in the frenetic web of active trading, found solace in these words, realizing a fundamental truth – the prevailing bull markets don’t yield to whims; they persist, often outlasting the speculators themselves.

The Resilient Bull Market Phenomenon

History illuminates the enduring nature of bull markets, defying investors’ expectations. The US Stock market, more often than not, dances to the tune of a seemingly eternal bull phase, surging higher amidst a chorus of skepticism. Livermore’s trajectory shifted as he embraced the essence of “Old Turkey’s” wisdom – opting for steadfast staying power over fleeting gains.

Despite Livermore’s tumultuous journey marked by peaks and valleys, the excessive leverage, akin to his Achilles’ heel, masked his proficiency in reaping substantial profits from the prolonged bullish upswings and sporadic bearish downturns.

The Current Market Landscape

Navigating the intricate tapestry of today’s market reveals a myriad of bullish harbinger propelling the stocks skyward. This newfound bullish momentum appears to be an overture rather than the culmination, driven by:

– AI revolution: The resounding echoes of the AI revolution, likened to the transformative impact of the internet era, portend substantial productivity gains on the horizon.

– Strong economic growth: The robust US economy, defying prognosticators’ expectations, showcases a resilient growth trajectory that promises unforeseen prosperity.

– Interest rate cuts: The imminent reduction in interest rates by the Federal Reserve heralds the dawn of another expansionary cycle, setting the stage for enduring market exuberance.

The Pioneering Stocks

Amidst the clamor of naysayers preaching that a stock has soared beyond reason, the exemplars of leading stocks defy gravity and soar higher. Take NvidiaNVDA, for instance; skeptics have persistently aired their doubts month after month, yet the stock unfalteringly scales new heights.

Leading stocks ascend for a reason – driven by escalating sales and earnings, grounded in substance rather than fleeting hype. The age-old adage of holding winners rings true in the prevailing market zeitgeist.

Venturing into the realm of the top-tier stocks identified by the Zacks Rank unveils a trove of gems poised to ride the wave of current economic trends. Meta Platforms and Nvidia, stalwarts atop the list, bear witness to upward-tilting earnings revisions, forecasting a remarkable annual growth trajectory of 30% and 20%, respectively.

The Stealthy Contender: Cadence Design Systems

Lurking within the shadows, yet making colossal strides in the labyrinth of semiconductor and AI industry, is Cadence Design SystemsCDNS. This unsung hero crafts software for chip design, spearheading the sector with unmatched prowess.

A standout feature of Cadence Design lies in its strategic position within the semiconductor terrain – where software reigns supreme. While semiconductor production entails exorbitant capital expenditure, the software domain basks in high-margin efficiency, exemplified by Cadence Design’s staggering gross and net margins of 90% and 26%, respectively.

Bullish Trends in Tech Stocks and Earnings Growth

Emerging Bullish Patterns in CDNS Stock

Amidst promising earnings revisions, CDNS presents a compelling technical trade setup. The stock’s price action has been shaping a bullish consolidation, poised for a breakout that could propel the stock to new heights.

Image Source: TradingView

Amazon’s Dominance in Tech

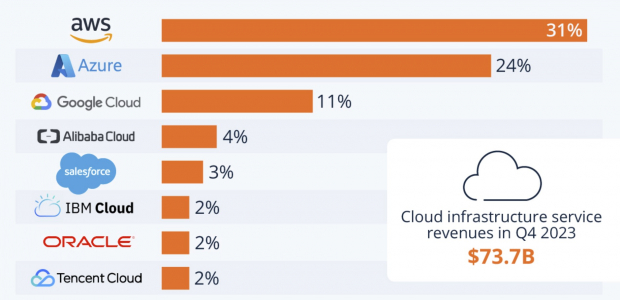

Amazon (AMZN) stands out as a leader set to continue its dominance. Both its ecommerce and cloud services segments benefit from substantial tailwinds in the expansion of online retail and digital transformation. Notably, Amazon Web Services commands a hefty 31% market share in cloud computing.

Image Source: Statista

Steady Growth Predicted for Amazon

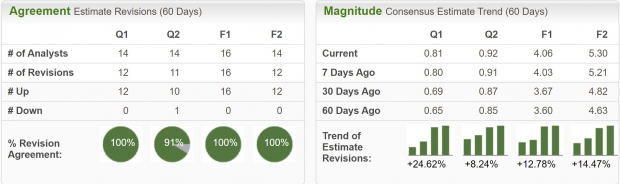

Amazon boasts a Zacks Rank #1 (Strong Buy) rating, reflecting optimistic earnings revisions. Projections indicate a rapid growth trajectory, with earnings expected to soar over the next 3-5 years at an impressive rate of 28% annually.

Image Source: Zacks Investment Research

Market Outlook and Investor Sentiment

While minor corrections of 5% and 10% may occur as the market ascends, investors are advised not to succumb to bearish forecasts and give in to fear. It’s crucial to recognize the prevailing bullish trend in the market and maintain a long-term perspective on investment decisions.

Remember, it’s a bull market out there!

Key Consideration for Investors

Investors should consider the promising indicators in tech stocks like CDNS and Amazon, which are backed by positive earnings revisions and strong market positions. Embracing the bullish trends and staying focused on long-term growth prospects can lead to rewarding investment outcomes.