Over the past decade, the semiconductor market has seen significant consolidation, with a particular focus on field programmable gate arrays (FPGAs). These chips, crucial in semiconductor design, AI systems, and various electronic applications, have sparked noteworthy acquisitions. In 2015, Intel acquired Altera for $17 billion, and in 2022, AMD purchased Xilinx for nearly $50 billion, altering its business landscape.

The Last Standing FPGA Company

Following those mega-mergers, Lattice Semiconductor emerged as the sole FPGA pure-play company. Despite facing challenges, Lattice’s stock has outperformed Intel and even AMD in recent years, making it an intriguing investment option in the market.

Lattice’s Current Challenges

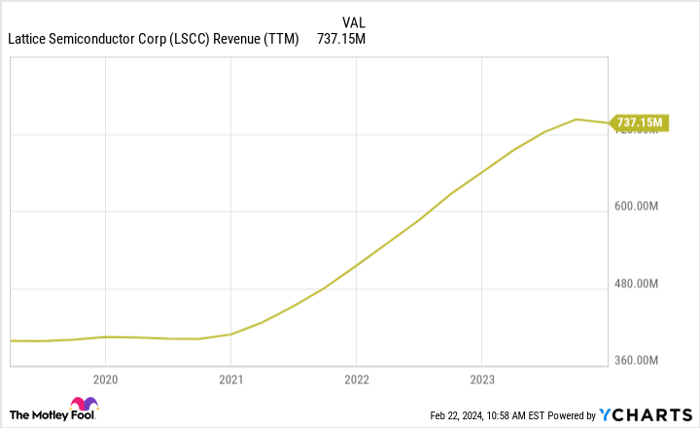

Lattice experienced robust growth under CEO James Anderson, with a focus on product innovation and market expansion. However, a cyclical downturn has hit the company due to slowing industrial demand and chip oversupply post a period of shortages. Consequently, Lattice is currently facing a revenue decline, a rare occurrence after a sustained period of growth.

Unique Strength in Tough Times

While Lattice anticipates challenging times ahead, the company holds a crucial advantage compared to industry giants like AMD and Intel: strong profitability. Despite the downturn, Lattice foresees maintaining high profitability levels, showcasing resilience in tumultuous times. This contrasts sharply with the profitability struggles of AMD and Intel during their downturns.

A Glimpse into the Future

While Lattice’s financials may worsen before recovery, its enduring profitability sets it apart in weathering market volatility. Trading at a premium, if Lattice can sustain its outperformance and return to profitable growth, it could cement its position alongside top semiconductor industry players. Investors may find Lattice Semiconductor an intriguing prospect amidst industry turbulence.