Rivian Automotive (RIVN) has stirred the financial waters with a sizable billion-dollar cash infusion from a strategic dance partner, Volkswagen AG (VWAGY). This monetary embrace has not only plumped Rivian’s coffers but has also shone a light on the electric vehicle (EV) maker’s web of partnerships and strategic assets in the industry. With Rivian affirming its annual production paces and forecasting a cheery gross profit in the distant fourth quarter of 2024, followed by a positive EBITDA outlook come 2027, the market has its curious eyeballs glued on the company’s trajectory.

Significantly, Guggenheim recently christened Rivian with a fresh “Buy” badge, adding more zest to the stock’s appeal. This piece will dissect the repercussions of the Volkswagen fiscal embrace, scrutinize Rivian’s financial compass, valuation, growth plausibilities, options market whispers, and check the temperature to ascertain if Rivian’s stock is a savory dish at current prices.

The Riveting Rivian Narrative

Established in the sunny lands of California back in 2009, Rivian Automotive (RIVN) and its kin specialize in conjuring up electric vans, trucks, and urban utility vehicles, along with doling out software wizardry, IT enchantments, and the good ol’ repair and upkeep services. The company currently sports a market cap robe worth $14.58 billion.

Rivian’s shares have sashayed up by a jolly 27.5% in the past month, yet linger sad and forlorn, down 37.8% since the dawn of the year.

A Glimpse Into Rivian’s Recent Initiatives

On July 2, Rivian unveiled its handcrafted figures for the second quarter, revealing the birth of 9,612 vehicles at its Illinois plant and the joyful delivery of 13,790 offsprings in that same timeframe, in line with expectations. The company also resumed its bard-like chants of producing 57,000 wheels by year’s end.

Come June 27, Rivian Automotive celebrated its 2024 Investor Day gala, articulating the birth of its Gen 2 model, prophesying material cost crusades, and predicting the genesis of a positive gross profit in Q4 and an EBITDA to pet and pat by 2027. Among its long-term wishes is a 25% GAAP gross margin and a 10% free cash flow margin.

On June 25, Guggenheim’s oracle, Ronald Jewsikow, anointed Rivian with the coveted “Buy” scepter and twinkling eyes set on an $18 bounty. He unfurled a map to Rivian’s break-even promised land in Q4, a spot where Gross Profit Mountain looms large. Jewsikow prophesied that this summit, coupled with future opulence upticks, would strike a chord with the market’s ears.

Guggenheim earmarks the R2/R3 platform as the crown jewel in its Rivian treasure chest, branding it with a high-teens gross margin in a world full of benchmark dreams. Investing in Rivian is, in their eyes, about scribbling love sonnets to the R2/R3, a tale that investors should tingle over.

Rivian Spreads Its Wings on the Volkswagen Breeze

On a bright June day, Rivian’s wings caught a breeze that propelled the stock up by over 23%, all thanks to Volkswagen’s divine bestowal of a cool $1 billion. Volkswagen, the behemoth of automotive coffers, and the budding automaker are now tangoing in a 50:50 dance, crafting next-gen electrical symphonies and software odes for EV enthusiasts.

In this tango, Volkswagen has pledged an extra $4 billion into Rivian’s treasure chest and the joint circus they’ve devised. Expectantly, Volkswagen will grab $2 billion of Rivian shares, swirling them in two $1 billion servings over a two-year dance, with prices pirouetting based on 30-day twilight wanders. Furthermore, Volkswagen will sprinkle $1 billion into their joint heirloom and loan an additional $1 billion, all in the name of progress.

Rivian’s shareholders fluff their feathers, awaiting the growth gala this gala brings, marking the spot where losses dip, sails catch wind, and Rivian marches closer to profitability, standing tall against EV juggernaut Tesla. Market revelers, including Hargreaves Lansdown’s prodigy, Susannah Streeter, view this dalliance as a surefire vote of confidence in Rivian’s future.

As of July 2, Rivian shares waltzed up by about 7% following whispers of Volkswagen and Rivian expanding their spring fling, toying with notions of a grander partnership in hardware and production.

Peeking Into Rivian’s Q1 Performance

Rivian Automotive unveiled its financial tapestry for the first quarter of fiscal 2024 on May 7, surpassing its own jigs and reels and laying a sturdy path for the future. With the company busy fine-tuning demand sirens, tightening operational corsets, nurturing the R2 sapling, and chasing the golden fleece of profitability, Rivian sits pretty as the fifth favorite EV kahuna in the realm of the States in that quarter, clutching a tasty 5.1% nibble of the whole pie.

Rivian’s Q1 revenue aria climbed by an 81.5% year-over-year, singing a $1.2 billion melody, serenaded by grander deliveries hugging a vehicle leasing tango, elevated selling price courts, and non-Rivian vehicle romances, cufflinking the Wall Street forecast by a cheerful $30 million.

Rivian’s Financial Outlook: A Bumpy Ride Towards Profitability

Rising Operating Expenses and Adjusted Losses

In the recently reported quarter, Rivian witnessed a surge in operating expenses, climbing from $898 million to $957 million compared to the previous year. This increase can predominantly be attributed to the uptick in selling, general, and administrative expenses. The first-quarter adjusted loss of $1.24 per share fell short of analysts’ estimates by $0.08.

Gross Profit Struggles and Recovery Prospects

The gross profit per vehicle delivered painted a grim picture, landing at -$38,784, with a significant negative impact of $9,346 per vehicle delivered. This was primarily linked to various supplier costs and other expenses incurred ahead of the technological shifts and parts integration into the R1 platform as part of its cost-saving initiatives. However, post the retooling enhancements, the company anticipates a notable improvement in material and conversion costs, aiming to achieve a modest gross profit by the fourth quarter of this year.

Financial Strategies and Liquidity Concerns

Rivian’s management is focused on reducing gross inventory by more than 25% within the next 1.5 years, banking on lower variable costs to drive gross profit improvements through fiscal 2024. Despite reporting a negative adjusted EBITDA of $798 million for the quarter, a year-over-year improvement was noted from the negative $1.02 billion recorded previously.

Balance Sheet Analysis and Future Projections

The company closed the first quarter with a cash balance of $5.97 billion and total liquidity amounting to $9.05 billion, inclusive of its asset-based revolving credit facility. Despite a high cash burn of $1.5 billion, management foresees a reversal in negative working capital trends in the upcoming periods. Looking forward, the 2024 adjusted EBITDA guidance remains at a negative $2.7 billion, with revised capital expenditures now standing at $1.2 billion.

Market Expectations and Sentiments

Analysts foresee Rivian’s net loss narrowing to $4.87 per share in fiscal 2024, alongside an anticipated revenue increase of 9.11% year-over-year to $4.84 billion for the same period. Despite optimistic long-term projections, the first positive EPS is predicted to surface only in fiscal 2029.

Comparative Valuation Analysis

In terms of valuation, Rivian’s stock trades at 3.06 times forward sales, surpassing the sector median of 0.86x. However, the company lags behind its peer Lucid Group (LCID), trading at a lower multiple of 8.66x, struggling with delivery and profitability challenges.

Options Market Sentiment on Rivian Stock

Based on the options market analysis for September 20, 2024, a potential 27% anticipated movement in either direction from the $15.00 strike price has been projected, indicating a trading range of $10.69 to $18.60 by the expiration date. Moreover, a bullish sentiment prevails with more open calls than puts at the $15.00 strike price.

Analysts’ Ratings and Target Price Projections

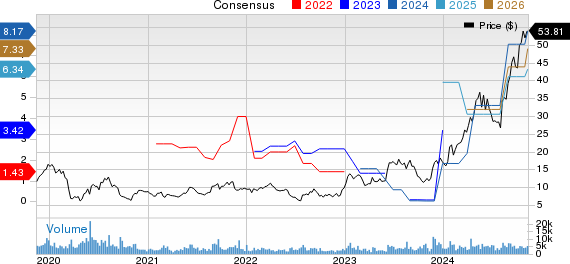

Rivian stock holds a consensus “Moderate Buy” rating on Wall Street, with varying recommendations from different analysts. The mean target price suggests an upside potential of 17.9% from the current price, standing at $17.27.

The Bottom Line on RIVN Stock

Investors might view Rivian as an attractive investment opportunity at its current levels. The strategic equity investment from Volkswagen has bolstered the company’s prospects, indicating improved liquidity and a higher chance of achieving its development goals. Furthermore, the options market sentiment signals further growth potential for the stock.