A Dual Dance in Two Booming Markets

Nvidia, often hailed as the tech marvel of the century, has been a rollercoaster of a stock. Its ascent to the pinnacle of the tech industry can be attributed to the soaring sales of artificial intelligence (AI) systems. The recent addition of Nvidia to the elite group known as the “Magnificent Seven” could leave even the most seasoned investors scratching their heads. With a sky-high market cap nearing $2.3 trillion and revenue projected to spike by over 80% to $110 billion, analysts are atwitter with excitement. The forward price-to-earnings ratio of 36 only adds fuel to the fire.

Investors are betting big on Nvidia’s perpetually high-growth trajectory. But how realistic is this expectation given the semiconductor giant’s cyclical past? Perhaps the optimism is well-founded, as CEO Jensen Huang unveils Nvidia’s prominent positions in two colossal AI markets:

- The existing data center market, estimated at a staggering $1 trillion, is in dire need of accelerated computing upgrades to keep up with the demands of new AI software.

- The emergent generative AI market, carving its path to significance by allowing entities to fashion bespoke AI systems using proprietary data.

The data center market typically undergoes a refresh every four to five years, necessitating the substitution of outdated hardware with superior equipment. Nvidia, with its GPU prowess, is primed to lead the charge in the AI upgrade cycle.

But what about these burgeoning generative AI data centers, likened by Huang to “AI factories”? AMD’s CEO Lisa Su forecasts accelerated computing chip sales to hit $400 billion in 2027, inclusive of both generative AI hubs and upgrades to existing data centers. The rise of generative AI as a multi-billion-dollar industry looms on the horizon, with Nvidia’s data center products poised to soar beyond the $20 billion mark in quarterly revenue. Once installed, chip systems tend to stick, a scenario amply illustrated by Intel’s longstanding dominance in the data center domain.

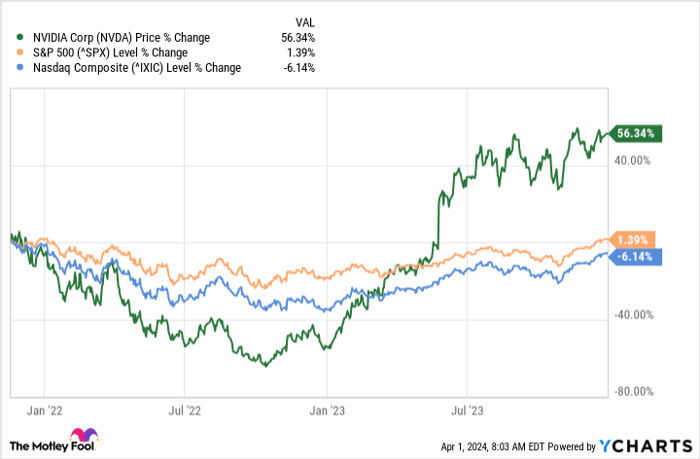

Navigating the Ebb and Flow of Nvidia Stock

As tantalizing as Nvidia’s saga may be, investors should prepare for an inevitable deceleration in accelerated computing growth or even a temporary downturn. However, pinpointing the timing of this cyclical slowdown proves to be an enigma. All indicators hint at another stellar year on the horizon for Nvidia in 2024. Huang and key suppliers allude to auspicious signs for 2025, yet it remains too premature to make definitive claims.

For existing Nvidia shareholders or prospective investors eyeing a slice of the pie, historical wisdom advocates patience. Younger investors, with ample time ahead to let their portfolios flourish, are encouraged to adopt a dollar-cost averaging approach rather than placing hefty bets on Nvidia. Embracing a systematic purchase plan promises stability, especially during tumultuous stock downturns.

Conversely, investors heavily laden with Nvidia shares and nearing a pivotal financial milestone, such as retirement, might find solace in a reverse dollar-cost averaging strategy. By periodically shedding small portions of their holdings, these investors can safeguard a portion of their profits.

As we step into the blossoming spring, Nvidia continues to command attention with its impressive performance. The fervor among investors is set to intensify, underscoring the dynamic nature of this tech behemoth. Wherever the tides may take Nvidia, one thing is certain: the journey promises to be nothing short of electrifying.

Unleashing the Potential: A Look at Investing in Nvidia

Considerations Before Investing

As you contemplate allocating $1,000 towards Nvidia stock, it’s imperative to weigh your options judiciously.

Expert Insights

The esteemed analysts at the Motley Fool Stock Advisor recently unearthed the top 10 stocks they believe offer exponential growth potential. Interestingly, Nvidia did not make the coveted list.

Stock Advisor Service

Stock Advisor extends a guiding hand to investors, providing them with a clear roadmap to triumph. With steady guidance on portfolio construction and two fresh stock recommendations monthly, this service has outperformed the S&P 500 by a significant margin since 2002.

Historical Perspective

Reflecting on the past, Stock Advisor’s track record showcases its knack for identifying lucrative opportunities and maximizing returns for investors.

Final Thoughts

In conclusion, while Nvidia might not have secured a spot in the top 10 stocks highlighted by Stock Advisor, its potential merits further exploration. Remember, prudent investing requires a blend of research, caution, and resilience.