The anticipation surrounding Netflix’s Q3 earnings report scheduled for October 17th has been a rollercoaster ride for investors. Amid concerns over subscriber growth impacting Wall Street’s sentiment, Netflix stands its ground, forecasting double-digit revenue growth and improved margins through advertising initiatives. While Q3 may witness heightened volatility, my conviction in Netflix as a strategic investment choice, especially for long-term viability, remains unwavering, given its comparatively derisked valuation metrics.

Reflection on Netflix’s Q2 Triumphs

Netflix’s exceptional performance in Q2 validated my optimistic outlook on the streaming giant. Achieving a remarkable 17% year-over-year revenue surge, reaching $9.55 billion, Netflix outpaced market expectations. Bolstered by successful shows like Baby Reindeer and Bridgerton, alongside a substantial 16% spike in paid memberships, totaling 277.65 million, Netflix welcomed around 8 million new subscribers, surpassing analyst projections.

Despite an initially subdued market response post-Q2 results due to heightened anticipation, Netflix consistently overachieved in critical metrics like operating margins and subscriber expansion. With an impressive 27.2% operating margin in the latest quarter, up from the prior year’s 22.3%, Netflix also generated $3.35 billion in free cash flow for the first half of 2024, signaling a sturdy cash position amidst hefty content investments.

Moreover, Netflix raised its 2024 revenue growth outlook to 15% and predicted an annual operating profit margin of 26%, up from the earlier forecast of 25%, reflecting the company’s solid growth trajectory.

Anticipating Netflix’s Q3 Performance

Heading into Q3, my optimism in Netflix remains resolute as the company eyes a 14% revenue growth and an expected operating profit margin of 28.1%, a considerable leap from the 22.4% margin in Q3 2023. The bolstered margin stems from escalating subscriber figures and burgeoning revenues, both conducive to enhanced profitability.

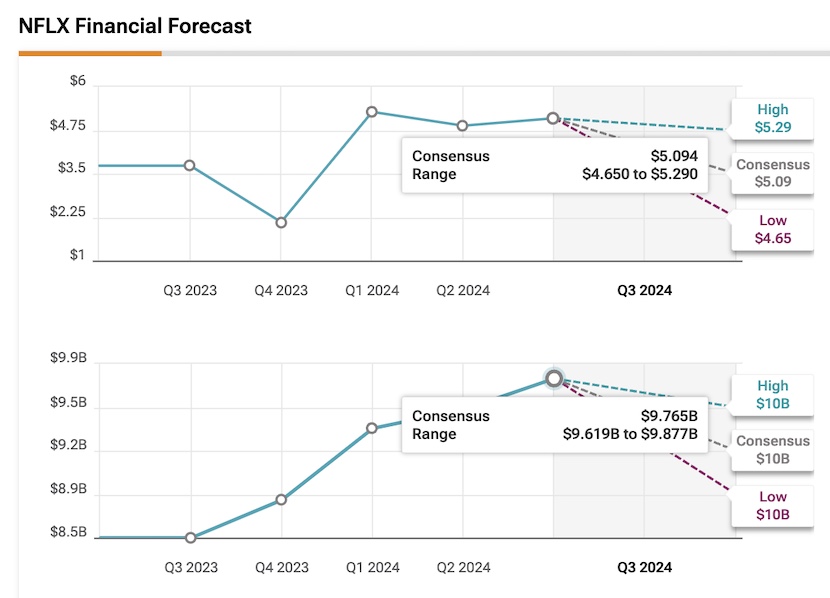

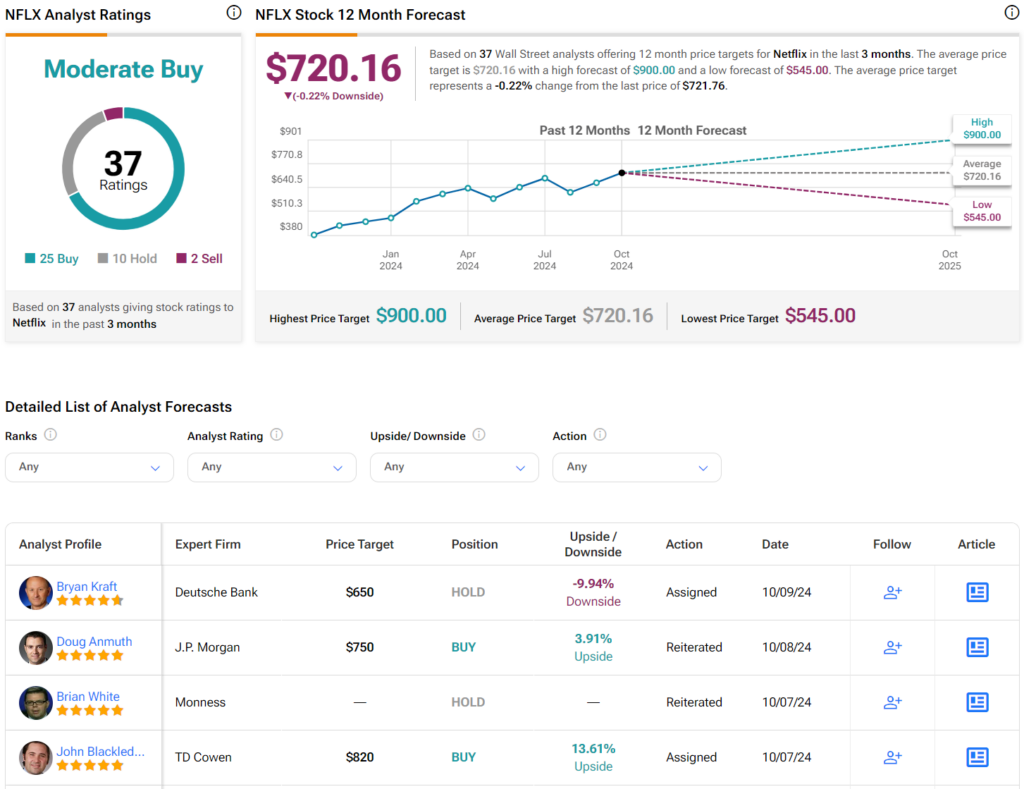

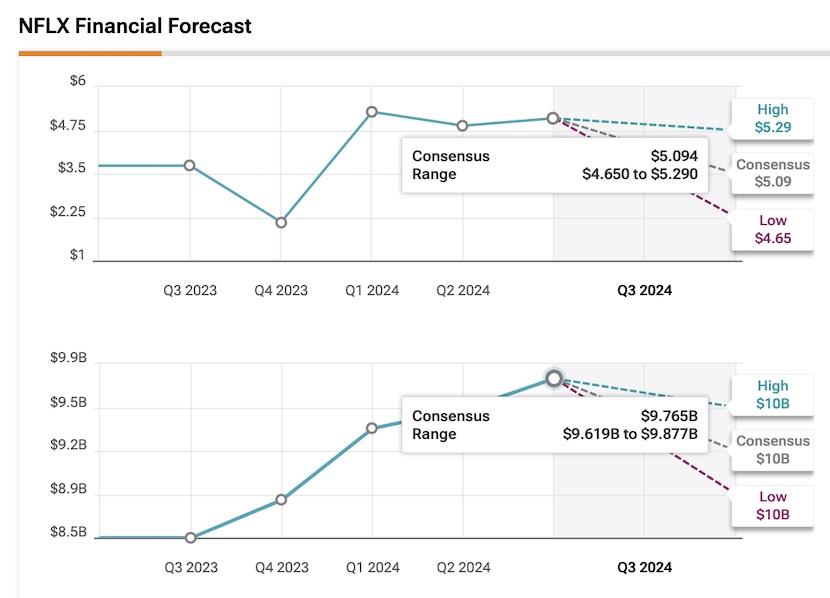

To outshine market predictions, Netflix must report earnings per share (EPS) surpassing $5.09, denoting a 36.5% year-over-year surge, and revenues exceeding $9.765 billion, translating to a 14.3% uptick. Analyst sentiments on Q3 remain mixed, with 29 out of 31 analysts revising EPS targets higher in the past three months, while only 11 out of 32 analysts lifted their revenue forecasts for the quarter.

Netflix’s Transition to a Distinct Growth Trajectory

Netflix’s resurgence, plummeting below $170 per share in mid-2022 post its first-ever subscriber growth setback, signifies a paradigm shift. The market now perceives Netflix as a growth entity once again, albeit in a refined manner. As the streaming magnate matures, it shifts from a growth-oriented metric to a monetization-centric approach, with advertising playing a pivotal role.

By phasing out its basic plan in favor of an ad-tier model, Netflix strategically nudges users towards enhanced ad-generated revenue streams. Ergo, Netflix’s strides in advertising may eclipse subscriber metrics’ significance in Q3.

Embracing Post-Earnings Volatility

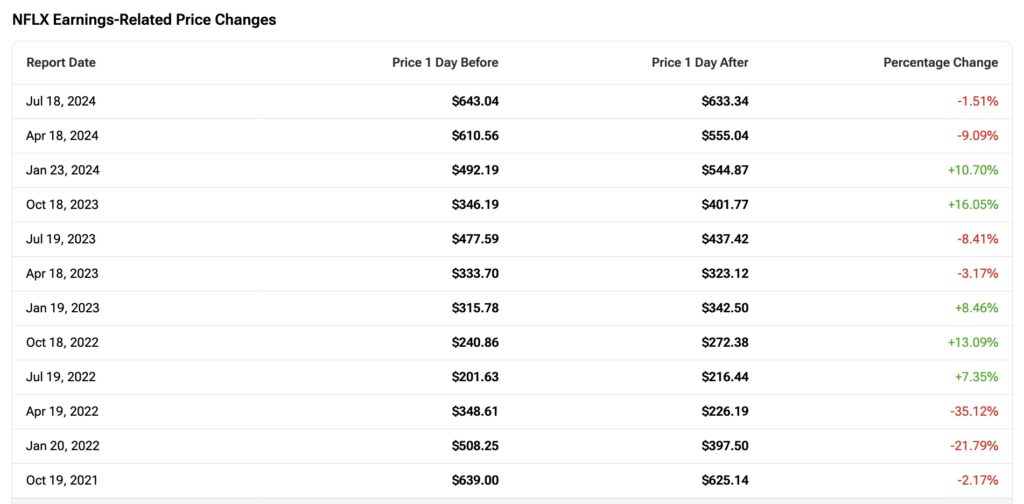

Post the earnings revelation, Netflix’s shares historically witness considerable volatility, underpinned by contrasting perceptions of its value and growth essence. The market’s oscillation between viewing Netflix as a value or growth asset accentuates price swings in the aftermath of earnings reports. Despite potential volatility in the near term, a bullish stance for long-term investors seems prudent, as minor Q3 fluctuations are unlikely to sway overarching investment prospects.

Valuation emerges as a pivotal factor driving potential Q3 volatility. Currently, Netflix trades at a forward price-to-earnings (P/E) ratio of 37.7x, its highest since 2022. Despite signaling an escalating valuation, Netflix’s current P/E ratio remains relatively modest compared to its five-year average of 46.8x.

With projected EPS growth of 59% in 2024 and an additional 20% in 2025, Netflix could metamorphose into a forward P/E of 30.4x by then. While not a bargain, this envisages a mitigated growth opportunity, appeasing risk-conscious investors.