Investors often turn to the musings of Wall Street pundits to inform their financial choices, pondering whether to hold, buy, or sell particular stocks. Yet, the sway of these brokerage-firm-backed analysts remains in question.

Before delving into the veracity of brokerage recommendations and their utility, let’s probe the sentiments emanating from the corridors of Wall Street regarding Workday (WDAY).

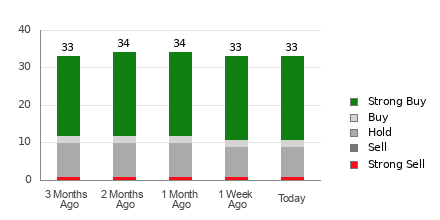

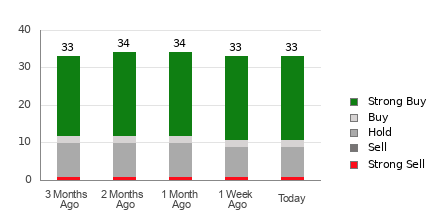

Standing tall in the limelight is Workday, donning a commendable Average Brokerage Recommendation (ABR) of 1.67 on a scale extending from 1 to 5. This numerical stance, derived from explicit referrals – Buy, Hold, Sell, among others – by 33 brokerage entities, tacitly suggests a position between Strong Buy and Buy.

Among the 33 acclaimed recommendations shaping this resolute ABR for Workday, 22 stand tall as Strong Buy, with an additional two in the Buy category. These emboldened stances respectively embody 66.7% and 6.1% of the overall endorsements.

Patterns in Brokerage Recommendations for Workday

While the ABR beckons towards procuring shares in Workday, prudence whispers warnings against anchoring investment decisions solely on this metric. Research underlines the limited triumph of brokerage exhortations in steering investors towards stocks with potent price appreciation vibes.

But why, you wonder? Blame it on the patchwork medley of vested interests that underlie brokerage affirmations. Analysts adorned in the finery of brokerage camaraderie often paint an overly rosy picture of the stocks they cover. For every “Strong Sell”, brokers lavish five “Strong Buy” accolades. This bias underscores the misalignment between institutional interest and the retail investor’s lexicon, casting scant illumination on a stock’s trajectory.

Thus, it is prudent to wield this information as a validation tool for personal analysis or in consort with a reliable forecast mechanism that adeptly forecasts stock gyrations.

Peering into the annals of proven reliability is our proprietary luminary – the Zacks Rank. This veritable tool, making waves with an externally audited pedigree, categorizes equities into a spectrum of five archetypes, spanning from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This robust indicator serves as a litmus test for a stock’s immediate price fortunes. Symbiotically aligning the Zacks Rank with the ABR might prove to be a golden thread in the labyrinth of investment choices.

Zacks Rank: A Nourishing Contrast to ABR

In stark variance with ABR, the Zacks Rank swathes itself in a different mantle altogether. While both metrics parade digits between 1 and 5, they jet off on divergent trajectories.

The ABR is an ode to broker affirmations and often parades in decimal garb (such as 1.28). Conversely, the Zacks Rank dances to the tunes of a quantitative ballet orchestrated around earnings estimate metamorphoses. In its realm, numbers speak in whole tones, from 1 to 5.

Brokerage analysts, donned in vested interests, have serenaded a tune overly saccharine in their endorsements – a shade sweeter than their research would attest. This razzmatazz veneer often befuddles investors more than it enlightens, an ignoble masquerade indeed.

On the flip side, the Zacks Rank shines with the radiance of earnings estimate revisions. Charting a course dictated by empirical veracity, the symbiosis between short-term price undulations and earnings estimate trends comes to light.

Enlightening the ethos with another stroke of contrast, the Zacks Rank gallantly distributes its grades among all stocks weighing under brokerage estimates for the current fiscal year. In this perpetual waltz, equilibrium is the North Star.

Another facet piercing through the veils of the ABR-Zacks confluence is the veil of timeliness. While the ABR languishes in the shadows of obsolescence, the Zacks Rank struts with alacrity. As brokerage analysts revise their fiscal scripts to mirror the evolving tides of businesses, the Zacks Rank holds its looking glass to the fire, exhibiting a timely semblance of future price pirouettes.

Is Workday a Treasure Trove of Investment Returns?

Gazing into the annals of Workday’s earnings estimate evolution, the Zacks Consensus Estimate for the ongoing fiscal year witnessed a 7.1% surge over the bygone month, hitting $6.93.

Analysts, swaddled in prognostic optimism over the company’s earnings odyssey, manifested a sterling consensus as they collectively nudged EPS projections skyward. This wave of alacrity tiptoed Workday to a Zacks Rank #2 (Buy), basking in the spotlight of burgeoning potential.

Thus, the Workday’s Buy-coated ABR emanates as a beckoning North Star for discerning investors.

Discover Stocks Poised to Double

Each gem has been handpicked by a Zacks luminary as the top contender to double up, offering a +100% gush in the labyrinth of 2024. While not every gem might clinch laurels, echoes reverberate of past treasures that soared +143.0%, +175.9%, +498.3%, and +673.0%.

Most stars adorning this firmament stay shrouded from Wall Street’s prying eyes, offering canny investors a chance to catch the inaugural lift-off.

Unveil These 5 Potential Home Runs Today >>

Dig deeper into Workday, Inc. (WDAY) with our Free Stock Analysis Report.