Brokerage recommendations are like a compass for investors navigating the tumultuous seas of the stock market. An intricately woven web of ratings, these insights often sway the direction of stock prices. But should investors stake their fortunes on these fickle recommendations?

Before delving into the reliability of brokerage opinions, let’s decipher the chatter echoing from Wall Street analysts regarding Devon Energy (DVN) and explore how investors can leverage these forecasts to their advantage.

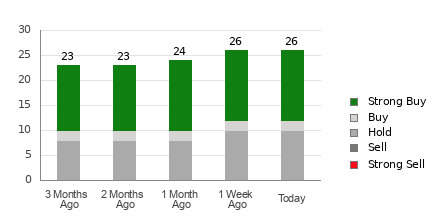

With an average brokerage recommendation (ABR) of 1.85, Devon Energy finds itself in a coveted sweet spot between Strong Buy and Buy. This consensus arises from the musings of 26 brokerage firms, with 14 advocating for a Strong Buy and two for a Buy recommendation. Strong Buy and Buy jointly account for over 60% of all recommendations.

Flow of Brokerage Recommendations for DVN

A swoon-worthy ABR might beckon investors, but solely banking on this metric could steer you into perilous waters. Studies reveal that brokerage recommendations often miss the mark when it comes to predicting profitable stock picks. Why? Analysts, shackled by their firms’ interests, tend to adorn stocks with rosier projections than merited. For every “Strong Sell,” there are five sparkling “Strong Buys,” reflecting a clear disparity in the analysts’ advisory.

So, what’s a prudent investor to do? Cast your gaze towards the Zacks Rank – a battle-tested tool renowned for its prowess in discerning a stock’s trajectory. By coupling the Zacks Rank with the ABR, investors can pave a path towards savvy investment decisions.

Deciphering ABR vs. Zacks Rank

Diverging as two ships in the night, the ABR and Zacks Rank might seem akin but harbor stark disparities. While the ABR hinges solely on brokerage opinions, manifested in decimal form, the Zacks Rank dances to the tune of earnings estimate revisions, clad in integers from 1 to 5.

While brokerage ratings often sparkle with unwarranted optimism, the Zacks Rank shines through pragmatic analysis. Anchored in earnings estimate revisions, this ranking unveils a shipshape correlation between forecasts and stock price shifts.

Unlike the ABR, which might lag in timeliness, the Zacks Rank thrives on current data, steering investors towards clearer horizons. With brokerage analysts ruffling their sails to align with evolving business trends, the Zacks Rank shines as a beacon of updated wisdom in forecasting stock prices.

Evaluating DVN as a Lucrative Venture

Amidst the tumult of shifting tides, Devon Energy emerges as a sturdy vessel, witnessing a 1.4% uptick in the Zacks Consensus Estimate for the current year, soaring to $5.41.

Analysts’ resurging confidence in the company’s hefty earnings potential, mirrored in harmonious EPS revisions, set the stage for a potential uptick in stock prices.

The winds of change, coupled with other earnings-related factors, have garnered Devon Energy a respectable Zacks Rank #2 (Buy). This accolade positions Devon Energy as a promising candidate among top-tier stocks.

Hence, Devon Energy’s Buy-equivalent ABR emerges as a guiding North Star for investors, signaling potential fortunes on the horizon.

Zacks’ Top 3 Hydrogen Stocks

Venturing into the realm of clean energy, the demand for hydrogen power lays claim to a promising future, with projections of exponential growth. Zacks spotlights three stalwarts poised to lead the charge in the hydrogen revolution.

With one stalwart boasting a meteoric rise of over +2,400% in the past quarter-century and another securing commitments of $15 billion for low carbon hydrogen ventures, the stage is set for a monumental shift in energy dynamics.

The third contender ascends to the zenith, hitting 52-week highs in Q4 2023, crowned by a decade-long tradition of escalating dividends.

Discover Top Hydrogen Stocks Now >>

Ensure you’re primed with the latest insights from Zacks Investment Research to navigate the choppy waters of stock investments. Download the 7 Best Stocks for the Next 30 Days for a strategic advantage in your investment voyage.

Unveil the potential hidden within Devon Energy Corporation (DVN) with a comprehensive Stock Analysis Report.

To stay on top of the latest market trends, catch up on Zacks Investment Research.