Before deciding on a stock investment, it’s common practice for investors to seek guidance from Wall Street analysts. The question lingers: are these analyst recommendations truly reliable indicators? Let’s delve into the realm of Allstate (ALL) and explore the current sentiments of Wall Street analysts alongside the real worth of their advice.

Understanding Brokerage Recommendations for ALL

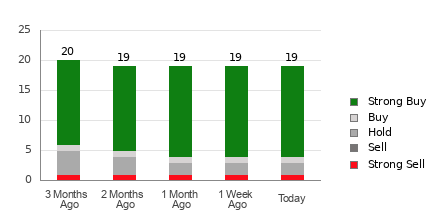

Currently, Allstate carries an average brokerage recommendation (ABR) of 1.47, hovering between Strong Buy and Buy on the 1 to 5 scale. This ABR calculation takes into account diverse recommendations from 19 brokerage firms, with 15 suggesting a Strong Buy and one indicating a Buy. These recommendations signify optimism, with Strong Buy and Buy collectively representing over 84%.

The Dubious Nature of Brokerage Recommendations

Despite the bullish ABR for Allstate, it’s imprudent to base investment decisions solely on this data. Studies have repeatedly shown the limited reliability of brokerage recommendations in predicting stock price movements. Why the skepticism? The inherent bias of brokerage firms towards the stocks they cover often skews analyst ratings positively, veering far from an accurate projection of a stock’s trajectory.

The Power of Zacks Rank in Investment Decisions

Contrasting the ABR, the Zacks Rank emerges as a robust tool for gauging a stock’s near-term performance. This proprietary ranking system categorizes stocks from Strong Buy to Strong Sell based on earnings estimate revisions. Unlike ABR, which solely relies on brokerage recommendations, Zacks Rank offers a more quantitative approach deeply intertwined with forecasted earnings trends.

Deciphering the Zacks Rank vs. ABR Difference

While ABR may seem inviting with its decimal nuances, the Zacks Rank presents a clear-cut 1 to 5 scale, founded on actual earnings estimate revisions rather than subjective analyst views. The alignment of Zacks Rank with earnings estimate trends reveals a strong predictive correlation with stock price movements, setting it apart from the potentially misleading ABR assessments.

Is Allstate a Promising Investment Opportunity?

Delving into Allstate’s earnings estimate revisions unveils a positive outlook, with the Zacks Consensus Estimate for the current year surging by 11.8% to $14.99 in the past month. This favorable sentiment among analysts, reflected in the increased EPS estimates, led to a striking Zacks Rank #1 (Strong Buy) for Allstate. The recent consensus estimate surge coupled with identified earnings factors paints a promising future for the stock.