The Allure of Wall Street Recommendations

Often regarded as gospel, the pronouncements of Wall Street analysts wield significant influence over investors, dictating buy, sell, or hold decisions. Yet, do these Wall Street sages truly hold the key to successful investments?

Deciphering Alibaba’s Standing

Before delving into the reliability of brokerage endorsements and strategies for leveraging them, a peek into Wall Street’s views on Alibaba (BABA) is warranted.

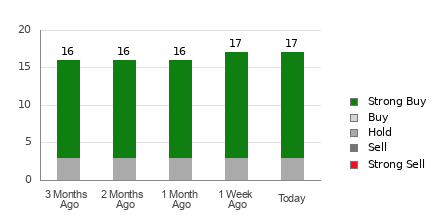

Alibaba presently garners an average brokerage recommendation (ABR) of 1.35, signifying a stance teetering between Strong Buy and Buy, an amalgamation of inputs from 17 brokerage behemoths.

The lion’s share of these recommendations, 82.4% to be precise, lean heavily towards Strong Buy, painting a picture of optimism.

Unraveling Brokerage Trends for BABA

Prior to contemplating a plunge into Alibaba based on ABR whispers, it’s imperative to pause. Extensive studies indicate that brokerage opinions seldom shepherd investors towards stocks poised for significant price upswings.

Why the skepticism, you ask? It often boils down to the vested interests at play—a tendency among analysts affiliated with brokerage firms to amplify positivity, hence skewing ratings towards the bullish end of the spectrum.

Perhaps a judicious approach lies in using brokerage insights as a validation tool, supplementing them with corroborative indicators such as the esteemed Zacks Rank, a battle-tested compass in the stock market labyrinth.

Discerning Zacks Rank from Brokerage Ratings

Albeit sharing a numeric scale, ABR and Zacks Rank are not cut from the same cloth.

Whereas ABR emanates solely from brokerage assessments, adorned in decimal configurations, Zacks Rank props on a quantitative model, harnessing earnings estimate revisions, and flaunts a more wholesome numerical spectrum.

The perennial bias of brokerage analysts towards buoyant appraisals contrasts sharply with the foundation of Zacks Rank—the bedrock of earnings estimate revisions, a linchpin in deciphering short-term stock price oscillations.

Harnessing Insight for Investment Decisions

As the Zacks Consensus Estimate for Alibaba’s current year earnings weathers a 0.4% decline over the past month, a storm cloud looms over the company’s profit horizon.

An acclaimed Zacks Rank #4 (Sell) bestowed upon Alibaba, paralleled by a downward trajectory in EPS forecasts, steers investors towards a cautious stance amidst an impending earnings tempest.

Contemplating an investment in Alibaba? Considering the recent consensus estimate tremors and a constellation of factors leading to the Zacks Rank #4 designation, prudence demands a seasoned scrutiny beyond the Buy-sirenic ABR allure.