The Rise and Fall of Rivian

Once basking in the glow of a record-breaking IPO in 2021, Rivian Automotive (RIVN) has since weathered a turbulent storm. From its dizzying high of $172.01 per share shortly after going public, the company is now trading at around $10 per share, reflecting a stark decline in value. With a market cap of about $10 billion, Rivian’s journey has been nothing short of a rollercoaster ride, captivating the attention of investors and analysts alike.

Unpacking the Downward Spiral

The narrative of Rivian’s decline is a cautionary tale in the world of electric vehicle startups. Fueled by exuberance and lofty expectations, the company suffered from an inflated valuation that was unsustainable in the long run. Supply chain disruptions, missed production targets, and escalating manufacturing costs have all contributed to Rivian’s current predicament. As the broader EV market grapples with tepid demand and heightened competition, Rivian finds itself at a crossroads, grappling with significant operational and financial challenges.

Assessing the Road Ahead for RIVN

With mounting losses per vehicle and ongoing manufacturing inefficiencies, Rivian faces an uphill battle to right the ship. A planned shutdown for operational enhancements underscores the company’s commitment to improving efficiency but raises questions about short-term financial implications. As Rivian looks to capitalize on its potential in the commercial vehicle segment, market uptake and profitability remain critical areas of focus. Moreover, the discrepancy between production capacity and output highlights the subdued demand landscape for high-priced EVs, posing a conundrum for the company’s growth trajectory.

Charting a Course for Recovery

Despite its current tribulations, Rivian is not without hope. The company’s forthcoming lineup of new vehicle models, including the R2, R3, and R3X, offers a glimpse into its future innovation and market expansion strategies. As Rivian aims to navigate its path towards profitability, a strategic blend of cost optimization, technological integration, and operational efficiency will be pivotal in shaping its recovery. While challenges loom large on the horizon, Rivian’s resilience and adaptability may prove to be its saving grace in the evolving landscape of the EV industry.

The Conundrum of Rivian’s Valuation: A Closer Look at the Numbers

RIVN’s Value Metrics Under the Lens

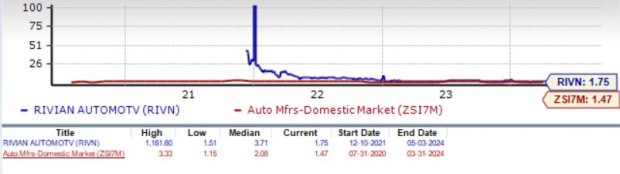

Trading with a forward sales multiple of 1.75, Rivian stands far below its median of 3.71 over the past five years. This descent is akin to a steep drop from lofty heights, leaving investors questioning the company’s potential for resurgence. Despite the stock’s retreat from historically inflated valuations, the fundamentals that underpin Rivian currently lack the requisite strength. Consequently, the stock proudly sports a Value Score of F, suggesting caution in viewing it as a safe haven for investors.

Insights from Zacks’ Projections and Analytical Model

Projected estimations by Zacks present a somber picture for Rivian in the first quarter of 2024. The consensus anticipates a loss of $1.13 per share, a deterioration from the $1.06 loss projected 90 days earlier. During the same time last year, the company faced a loss of $1.25 per share. Revenues for the quarter are estimated to reach $1.15 billion, indicating a substantial 73% rise from the corresponding period in the previous year.

The outlook for the full year 2024 is equally grim. Consensus figures suggest a loss per share of $3.97, a one-cent widening in predictions in the past week. This compares to a loss of $4.88 per share in 2023. The revenue estimates for the entire year hint at modest growth of 7.6%.

Interpreting Rivian’s Position

Delving into the quantitative model, the amalgamation of a favorable Earnings ESP and a Zacks Rank #3 or higher generally heightens the likelihood of a positive earnings surprise. Unfortunately, Rivian finds itself in a less-than-ideal scenario with a Zacks Rank of #3 and an Earnings ESP of -0.52%, dimming the prospects of an earnings beat.

As investors mull over the decision to dive into Rivian’s stockpond, attention must veer towards management’s communication regarding the company’s cost-cutting initiatives and operational advancements. Clarity on Rivian’s maintenance of positive GPU per vehicle projections and strides in creating more affordable models will be crucial. Additionally, insights into the company’s anticipated growth in deliveries for the upcoming year will play a pivotal role in determining its trajectory.

Despite the allure of a discounted valuation, Rivian remains ensnared by challenges such as feeble EV demand, operational inefficiencies, and a voracious appetite for cash. It would be prudent for investors to exercise patience and await clearer signals post the first-quarter earnings announcement before considering a position in the stock.

Disclaimer: This article is intended for informational purposes and should not be construed as financial advice. Investing in stocks carries inherent risks, and individuals are advised to conduct thorough research or consult with a financial advisor before making any investment decisions.