The artificial intelligence (AI) revolution is being supercharged by the “Magnificent Seven” stocks of Microsoft, Amazon, Alphabet, Apple, Meta Platforms, and Nvidia (NASDAQ: NVDA).

With the exception of Apple and Tesla, each of these AI stocks has outperformed the S&P 500 over the last year. Nvidia, however, stands in a league of its own.

The stock has surged almost 260% in the last year, adding a trillion dollars of market cap in less than 12 months. With such a meteoric rise, investors may feel they missed the boat.

But let’s dive into Nvidia’s current state of affairs and explore potential catalysts for future growth. The time might just be ripe to consider a position in this AI powerhouse.

The Elevator Doesn’t Have To Go Down

Nvidia manufactures graphics processing units (GPUs) used in various generative AI applications, including accelerated computing and machine learning. The demand for its A100 and H100 chips is overwhelming and shows no signs of slowing down.

In its recent financial results for Q4 and fiscal 2024, Nvidia reported a revenue of $60.9 billion for the full year, marking a 126% year-over-year increase. Notably, the company’s gross margin surged to 72.7%, up almost 16 percentage points from the prior year. Additionally, its free cash flow skyrocketed sixfold to $27 billion.

With such stellar financial performance, one might wonder if the music will ever stop playing. But don’t bet on that just yet.

Image source: Getty Images.

Nvidia Unleashed: Beyond the Horizon

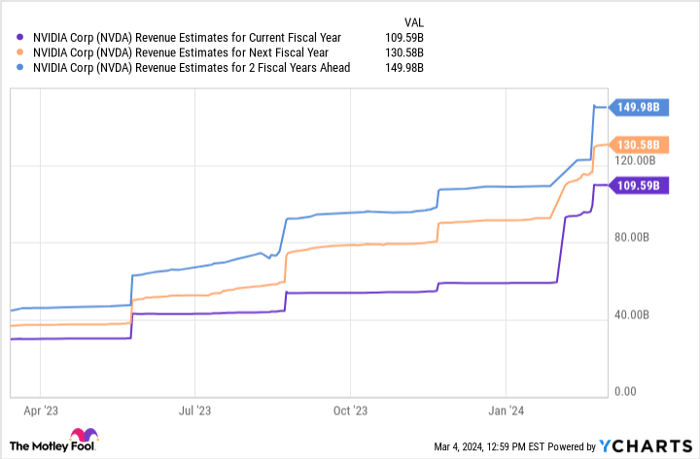

Despite Nvidia’s record growth last year, Wall Street analysts believe the ride may just be starting.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts.

Nvidia is projected to boost its revenue by about 78% this year, followed by steady growth in the coming years. Forecasting beyond one year can be more art than science. As an investor, I’m cautious about estimates post-fiscal 2025.

New catalysts like Nvidia’s investment in voice-recognition software company SoundHound AI and its foray into enterprise software business are emerging. These developments signal a potential for further growth as Nvidia diversifies beyond semiconductor chips.

Software typically offers higher margins than hardware development, which could be advantageous amid rising semiconductor competition. Nvidia seems prepared to leverage its data center operation with a software component to navigate this landscape.

The Nvidia Conundrum: To Invest or Not to Invest

During the recent earnings call, Nvidia CEO Jensen Huang proclaimed that “accelerated computing and generative AI have hit the tipping point.” While this statement could be misinterpreted as the end of Nvidia’s growth trajectory, Huang highlighted that the installed base for data center infrastructure could double within the next five years.

With Nvidia’s strong market position and the outlined catalysts, investors have solid reasons to believe in significant upside potential for Nvidia stock.

Unveiling Nvidia’s Growth Trajectory Amid Rising AI Trends

Underlying Potential of Nvidia Stock

With an ambitious $1,400 price target set by Hans Mosesmann of Rosenblatt Securities, Nvidia stock eyes a potential 60% surge from its current trading levels. While this target may be aspirational, it sheds light on the broader canvas.

Resilient AI Trends

Despite market fluctuations, the enduring momentum behind artificial intelligence (AI) expenditure is forecasted to not just endure but thrive in the upcoming years. Nvidia stands uniquely positioned at the intersection of hardware and software, poised to leverage an expanding array of applications and use cases.

Embracing Investment Strategies

Given the backdrop of this propitious landscape, the present moment presents an opportune time to contemplate utilizing dollar-cost averaging to establish or augment a position in Nvidia stock.

Surpassing Conventional Wisdom

Looking beyond conventional wisdom, the Motley Fool Stock Advisor team champions a different set of ten stocks believed to hold potential for substantial returns in the times ahead. Notably, Nvidia does not feature among these ten selections. Yet, realistic gains are anticipated from the chosen elite.

Marrying easy-to-follow directives with timely insights, the Stock Advisor service has outperformed the S&P 500 by a significant margin since its inception in 2002*. This testament to its efficacy beckons investors keen on maximizing financial returns.

See the elite 10 stocks-

*Stock Advisor returns as of March 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.