Disney (NYSE: DIS) evokes sentimental warmth and nostalgic memories, rooted in its heartwarming movies and enchanting theme parks. However, beneath its facade lies a formidable media behemoth, encompassing a vast array of businesses ranging from television networks and streaming services to production studios, theme parks, cruises, and retail operations. The recent undercurrents of discontent, marked by activist investor Trian Partners’ failed boardroom ambitions, reflect a divergence in investor sentiments regarding Disney’s strategic direction and financial performance.

Following the shareholder nod to retain the incumbent board, Disney now stands at a juncture where it can refocus its energies on fortifying its operations to deliver enhanced shareholder value. Despite the stock’s modest 11% uptick since the year’s commencement, slightly trailing the broader S&P 500 index’s 14% surge, the critical question that looms is whether Disney shares carry the potential to outperform the market in the long run, or if the current market optimism has inflated the share price beyond justifiable levels.

Image source: Getty Images.

Progress Amidst Challenges

Upon assuming the reins in late 2022, CEO Bob Iger swiftly unfurled an ambitious roadmap aimed at bolstering Disney’s bottom line. This strategic blueprint entails stringent cost-cutting measures, including a leaner content production slate, achieving profitability in the streaming sphere, and reinstating dividends to augment investor rewards. With tangible strides in this direction, Disney’s streaming business, spearheaded by ESPN, narrowed its quarterly loss to $18 million, a stark improvement from the $659 million hemorrhage a year earlier.

However, beneath the veneer of progress, cracks in the edifice emerge. While witnessing modest subscriber upticks across its diverse services, Disney grapples with dwindling average monthly revenue per paid subscriber within the domestic Disney+ arena despite heightened subscription fees. This juxtaposition underscores the arduous road ahead for Disney to carve a sustainable niche in the cutthroat streaming domain dominated by titans like Netflix, warranting a deft strategic touch.

Although Disney’s holistic business witnessed a tepid 1.4% revenue increment, buoyed by a more than 30% surge in adjusted earnings per share to $1.21, powered by diligent cost-cutting endeavors.

Navigating Succession Quandaries

Disney’s revival narrative gained traction with Iger’s return post his 2020 sabbatical, catalyzed by waning confidence in his erstwhile heir, Bob Chapek, amid a tumultuous 30% decline in shares during Chapek’s tenure. However, the saga assumes a renewed narrative as Iger’s contract lapses in 2026, rekindling the question of seamless succession planning. Bearing witness to the repercussions of botched succession endeavors, investors remain vigilant about Disney’s succession trajectory, cognizant of the pivotal stake it holds in preserving shareholder value.

Weighing Investment Prospects

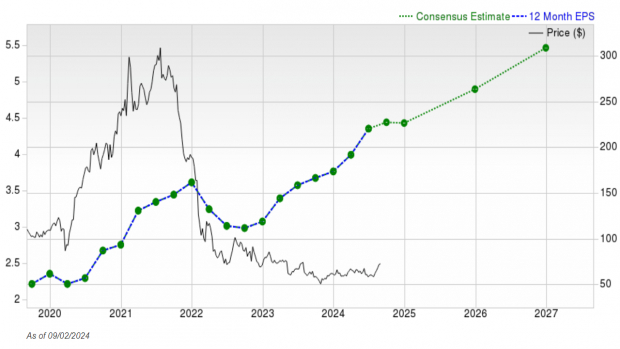

Amidst the ebb and flow of Disney’s strategic evolution, the reinstated dividend, slated to increase to $0.45 in July, though a commendable stride, somewhat underwhelms income-oriented investors with a lackluster 0.9% dividend yield. Mirroring a broader market sentiment, Disney’s current share pricing dynamics, underscored by a price-to-sales ratio of 2.1, exceeding the S&P 500’s 1.7 valuation metric, pose intricate conundrums for prospective investors.