A Beacon of Hope Amidst Turbulence

For shareholders of Apple Inc. (NASDAQ: AAPL), the past year has been a rollercoaster ride. As the S&P 500 surged ahead, Apple’s stock saw a mere 5% increase since May of the prior year. Challenges from inflation spikes in 2023 led to a string of revenue drops over four consecutive quarters for the tech giant. But the tide seems to be turning in 2024.

Exceeding Expectations with Bold Moves

Despite a 4% year-over-year revenue dip to $91 billion in the second quarter of 2024, Apple managed to surpass analysts’ forecasts by $190 million. Struggles in the iPhone business persisted, with a 10% sales drop, partly due to COVID-related supply disruptions. However, a bright spot emerged in the form of a 14% revenue increase in the services segment, enhancing the company’s financial landscape.

Embracing AI: Apple’s Future Frontier

At a recent product unveiling, Apple showcased its commitment to artificial intelligence (AI) with the introduction of the M4 chip in its latest iPad Pro. While competitors like Microsoft and Amazon have led the charge in AI, Apple’s substantial brand loyalty and market presence position it as a potent force in the AI domain. With acquisitions like Datakalab and reported plans to refresh its Mac lineup with a focus on AI, Apple is set to leverage its brand power in the evolving AI market.

Strategic Investments and Potential Growth

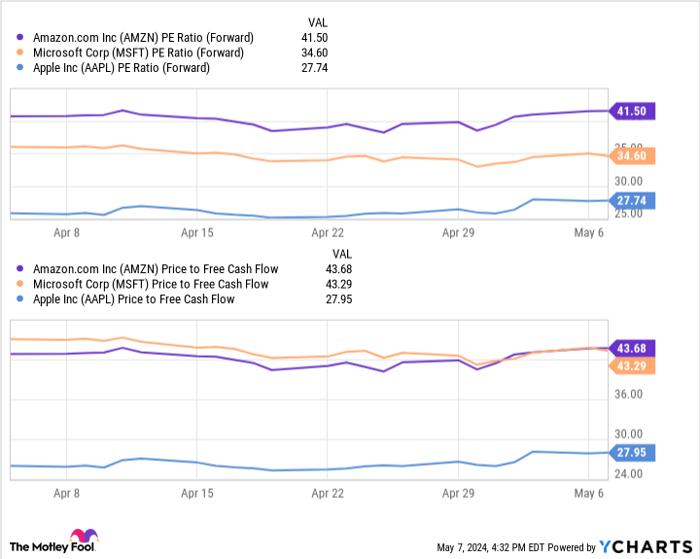

The recent announcement of a historic $110 billion stock buyback, along with robust free cash flow figures, signals Apple’s confidence in its trajectory. The company’s lower forward price-to-earnings ratio compared to industry giants like Microsoft and Amazon presents an enticing investment opportunity. With a firm foothold in consumer tech and a promising AI strategy, Apple’s stock outlook appears bright for long-term investors.

Weighing the Prospects: Is Apple Still a Good Buy?

Before diving into Apple stock, investors should consider the broader market landscape. While not part of the current top 10 stock picks, Apple’s history of innovation and market dominance presents a compelling case for investment. As the tech landscape evolves, Apple’s strategic positioning and foray into AI could pave the way for significant earnings growth in the future.