Alphabet’s Ascendancy in Digital Terrain

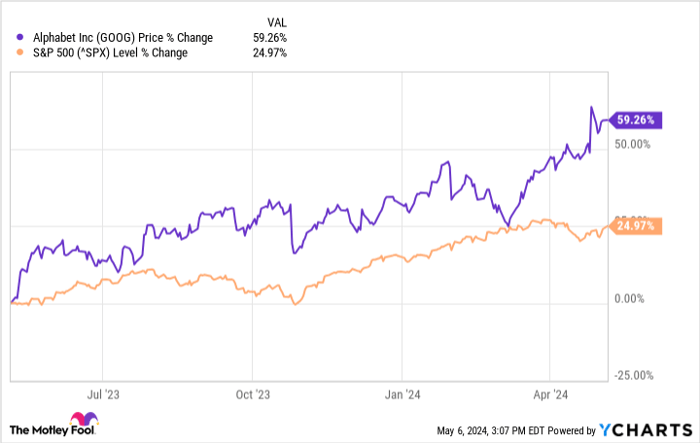

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has been a phoenix in the stock market, rising from the digital ashes to captivate investors with a 60% surge in the past year. Stealing the limelight from the S&P 500, Alphabet’s first quarter of 2024 unveiled a promising trajectory driven by a robust comeback in digital advertising and an expanding realm of artificial intelligence (AI).

Riding High on AI Innovation

Alphabet’s latest quarterly results have been a beacon of hope for investors eyeing the tech giant. The company’s revenue soared by 15% YoY to $81 billion, with Google Services sales witnessing a notable 14% uptick. The winds of macroeconomic challenges that once impeded Alphabet’s advertising juggernaut seem to have mellowed, signaling a promising chapter ahead.

Embracing AI Cloud with Strategic Precision

While approximately 80% of Alphabet’s revenue is derived from advertising, the AI-focused cloud business with Google Cloud stands as a pillar of future growth. Reportedly, revenue in this segment surged by 28% YoY, with operating income catapulting by a staggering 371% to $900 million. Alphabet’s investment in AI innovation, exemplified by the launch of the potent Gemini AI model, is beginning to yield fruit and solidify its foothold in the ever-evolving tech landscape.

Unveiling Undervalued Potential in the AI Arena

Despite facing initial hurdles in the AI market, Alphabet’s cloud business is gaining momentum, with a nearly 30% revenue spike and soaring profits. The company’s enhanced AI capabilities through Gemini are poised to revolutionize various sectors, from advertising efficiency to revolutionary updates for Android. With a robust free cash flow of $69 billion, Alphabet’s extensive reach in tech and strategic investments exhibit a company poised for sustained growth in the AI domain.

Strategic Financial Fortitude in the AI Race

In a thrilling comparison of valuation metrics, Alphabet emerges as a concealed gem in the AI stock universe. While possessing the third-largest cloud computing market share, Alphabet’s forward price-to-earnings (P/E) and price-to-free cash flow metrics outshine industry giants like Amazon and Microsoft. Boasting similar free cash flow as Microsoft and significantly higher than Amazon, Alphabet’s financial prowess, coupled with its vast user base, harbors immense potential for further AI expansion.

Investment Outlook: Riding the Alphabet Wave

Alphabet’s stock, thriving with a 536% surge over the past decade, unveils a mesmerizing narrative backed by robust financial resources, an extensive user base, and promising quarterly results. The enticing prospect of investing in Alphabet and reaping the benefits of its dynamic growth trajectory seems far from fleeting, offering a compelling investment prospect for astute investors.