The healthcare landscape has historically thrived on innovation, boasting a direct correlation to enhanced patient care. The stock of Intuitive Surgical (NASDAQ: ISRG) has soared, reaping the benefits of this fundamental principle. With an impressive appreciation of over 22,000%, the company has stunned the market through its robotic surgical solutions.

Transitioning from a burgeoning star to an industry titan, Intuitive Surgical now commands a market capitalization of $161 billion. Such colossal size prompts a critical evaluation of the company’s future growth potential, warranting an exploration into whether its stock presents a viable investment opportunity.

Elevating Global Healthcare Standards

Surgery, spanning centuries, naturally beckons technological advancement. Intuitive Surgical specializes in robotic systems that aid surgeons in minimally invasive procedures, augmenting the skills of human practitioners. By facilitating error reduction, enhancing maneuverability, and enabling intricate operations via minor incisions, these systems align with the goal of improving surgical outcomes and expediting patient recovery.

Established in the mid-1990s, Intuitive Surgical reports that over 60,000 surgeons have been trained to use its flagship da Vinci system. As of the second quarter of 2024, the company boasts an installed base exceeding 9,800 systems. Witnessing a 14% year-over-year growth in installations, the firm maintains robust momentum, with most installations representing fresh expansions rather than mere replacements.

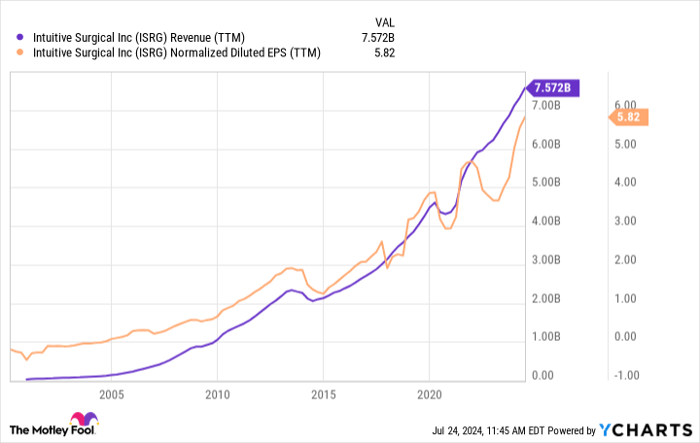

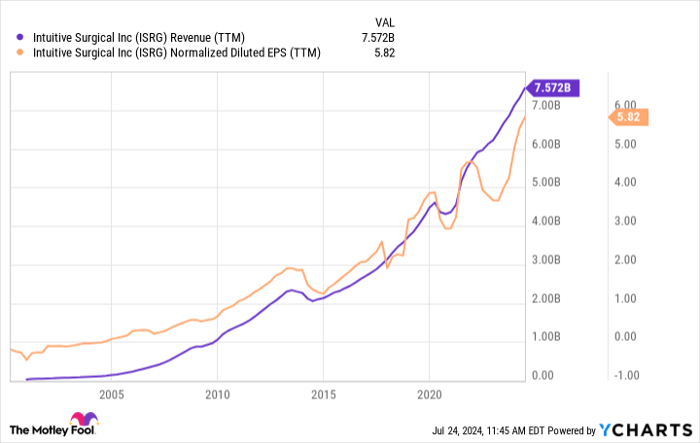

ISRG Revenue (TTM) data by YCharts.

The company’s revenue stream exhibits a compelling aspect for investors. A notable portion of sales stems from maintenance services, escalating from 71% in 2016 to 83% in the preceding year. This trend enhances revenue predictability, bolstered by new system sales fueling incremental growth and broadening the install base, thereby amplifying recurring revenue. Once hospitals invest in a system, sustained maintenance spending appears inevitable.

Furthermore, substantial growth prospects loom beyond U.S. borders. A vast global network of approximately 165,000 hospitals, primarily situated outside the United States, presents an expansive market. With merely 3,818 international systems currently in place, signifying a fraction of the potential market, a slew of hospitals in emerging economies could gradually embrace robotics as their economies burgeon in the ensuing years.

Assessing Growth Implications on Valuation

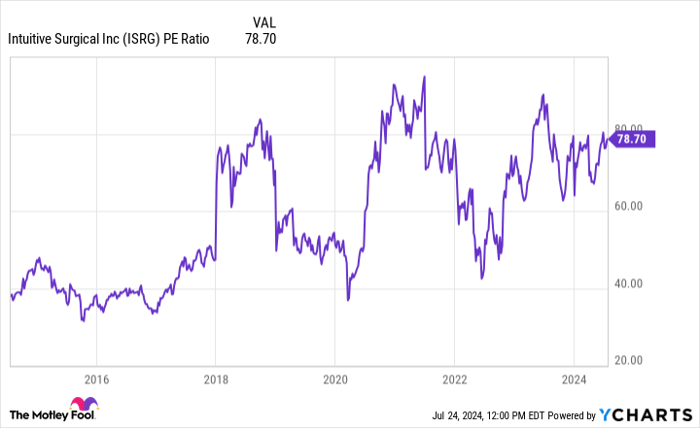

Blue-chip growth stocks like Intuitive Surgical often grapple with a common dilemma – their exalted status tends to inflate shares, compelling investors to pay a premium for ownership. The trajectory of Intuitive Surgical’s stock, soaring by nearly 800% over the past decade, outshines broader market indices. However, a closer look reveals an overheated valuation trend.

ISRG PE Ratio data by YCharts.

Consequently, the stock’s meteoric rise surpasses its business growth. Such valuation dissonance is often unsustainable, as elevated market expectations burgeon alongside soaring stock prices. Any failure to meet these heightened expectations can precipitate a painful correction, potentially leading to a stock price slump.

Evaluating Investment Viability

Analysts project Intuitive Surgical’s earnings to surge at a 17% average annual rate over the forthcoming three to five years. However, this growth estimate seems insufficient to justify the stock’s forward price-to-earnings (P/E) ratio of 69. Typically favoring stocks with a price/earnings-to-growth (PEG) ratio under 1.5, Intuitive Surgical’s PEG ratio nearing 4 indicates an overpriced stock relative to its anticipated growth.

While the company’s long-term growth trajectory appears promising, savvy investors may opt to monitor Intuitive Surgical for a potential dip in share price that significantly undercuts current levels. Nonetheless, the prevailing exorbitance renders the stock unattractive for investors seeking to capitalize on the company’s sterling quality through robust investment returns.

Considering an Investment in Intuitive Surgical

Before plunging into Intuitive Surgical stocks, contemplate the following:

The Motley Fool Stock Advisor team recently unveiled their selection of the 10 best stocks for investors to acquire, excluding Intuitive Surgical from this elite cohort. The identified stocks harbor immense potential for colossal returns in the impending years.

Reflect on the scenario when Nvidia secured a spot on this list back in April 15, 2005… investing $1,000 at the recommendation junction would have burgeoned into $692,784!*

Stock Advisor furnishes investors with a clear-cut blueprint for prosperity, offering tailored counsel on portfolio curation, regular analyst updates, and two fresh stock selections monthly. Since 2002, the Stock Advisor service has quintupled the returns of the S&P 500.*

*Stock Advisor returns as of July 22, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool holds positions in and endorses Intuitive Surgical. The Motley Fool adheres to a disclosure policy.