Wall Street analysts evidently play a significant role in the investment decisions of many individuals, guiding them towards potential buys, sells, or holds. But can these recommendations truly be the North Star for investors? Let’s delve into the landscape surrounding Energy Fuels (UUUU) and decipher the nuances of brokerage analyses to unlock their value.

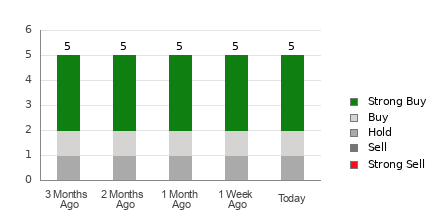

The current state of affairs positions Energy Fuels with an Average Brokerage Recommendation (ABR) of 1.60, a figure derived from the input of five brokerage firms. This ranking, falling between Strong Buy and Buy, comprises three Strong Buy and one Buy recommendations, forming a compelling narrative for optimistic investors.

Unveiling the Trend in Brokerage Recommendations for UUUU

While the ABR may nudge towards a positive sentiment for Energy Fuels, a word of caution looms. Research indicates that these recommendations, colored by brokerage interests, may not always pave the way for profitable investment decisions. Analysts showcasing an overwhelming bias towards “Strong Buys” often sway away from a balanced perspective, leaving investors teetering on shaky ground.

In contrast, the Zacks Rank, a battle-tested tool boasting a meticulous evaluation process, provides a more focused outlook on a stock’s potential. Relying on tangible metrics such as earnings estimate revisions, this model harmonizes with market trends, offering a reliable compass for investors navigating the tumultuous seas of stock investments.

Deciphering the Zacks Rank beyond ABR

The dichotomy between the ABR and Zacks Rank reveals their disparate foundations. While the ABR gravitates towards brokerage opinions laden with optimism, the Zacks Rank roots itself in the pragmatic realm of earnings estimate revisions, a crucial determinant in predicting stock dynamics. This qualitative difference underscores the divergent paths that investors can traverse while wielding these financial compasses.

Intertwined with timeliness, the Zacks Rank emerges as a beacon of real-time insights, perpetually syncing with fluctuating business trends. Unlike the static nature of ABR, the Zacks Rank proactively aligns with evolving market dynamics, offering steadfast guidance through the choppy waters of stock valuation.

Navigating the Investability of UUUU

The Zacks Consensus Estimate for Energy Fuels signals stability, holding steady at -$0.11 for the incoming year—an indication that the stock may tango in tandem with broader market movements in the near term. Despite securing a Zacks Rank #3 (Hold) due to recent minor fluctuations, investors should tread cautiously around the Buy-tinged ABR, underscoring the need for a discerning eye in the mercurial realm of stock investment.

Amidst the swirling seas of stock recommendations, the silver lining lies in insightful tools like the Zacks Rank, unfurling a roadmap that transcends the biases of brokerage analysts. So, as investors navigate through the labyrinth of investment decisions, a judicious mix of analytical acumen and strategic prudence may pave the way for a sustainable voyage towards financial success.