Berkshire Hathaway, the titan of investing led by the legendary Warren Buffett, appears to be sailing through choppy waters amid the rising tide of artificial intelligence (AI) innovations. The company’s recent move to reduce its exposure to tech giant Apple, a significant player in the AI realm, casts shadows on its readiness to ride the AI wave.

Berkshire Hathaway Trims Apple Holdings

Recent reports unveiled Berkshire Hathaway’s strategic trimming of its Apple holdings, signaling a cautious stance amidst market uncertainties. This reduction, translating to almost a 50% slash from 790 million shares to 400 million shares, reflects a departure from Apple’s dominance in Berkshire’s portfolio.

Previously constituting around half of Berkshire’s equity portfolio, Apple held sway over the conglomerate’s investment landscape. However, with the recent divestment, concerns over tax implications, valuation, and liquidity surfaced as factors steering Berkshire away from its once primary tech bet.

Berkshire Hathaway’s AI Investments

While Apple boasts burgeoning AI initiatives like Apple Intelligence software collaboration with OpenAI, other potential AI-driven assets within Berkshire’s fold, including BYD, Amazon, and Snowflake, constitute a modest portion of its overall investments. Noteworthy but not predominant, these holdings underscore Berkshire’s cautious foray into the AI arena.

Berkshire’s Exit Is Potentially Premature

As Berkshire pares down its Apple stake, questions arise regarding its AI investment strategy in the face of rapidly evolving technological trends. Contrasted with bold moves by other funds like Norway’s Government Pension Fund Global, which steadfastly navigate the AI landscape despite market frothiness, Berkshire’s conservative realignment marks a departure from growth-centric AI enthusiasm.

Does Berkshire Hathaway Stock Present Good Value?

Assessing Berkshire’s intrinsic value against industry metrics reveals a nuanced picture. While Berkshire trades at a modest discount compared to the broader market indices in terms of forward earnings and EV-to-EBITDA ratios, its unique conglomerate structure makes traditional benchmarks a somewhat incomplete compass in evaluating its worth.

Is Berkshire Hathaway Stock a Buy, According to Analysts?

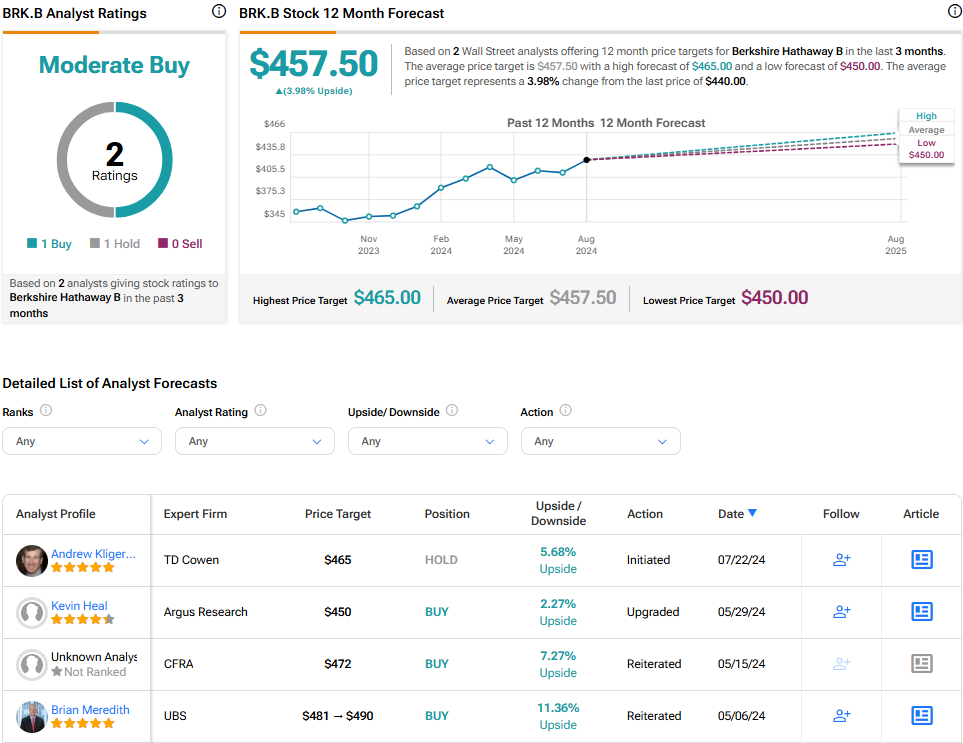

Analyst sentiment, as gauged by TipRanks, leans towards a Moderate Buy for Berkshire Hathaway stock. With a target price reflecting a 4% potential upside, Berkshire’s current valuation beckons a closer examination amidst its recalibration away from tech stalwart Apple.

Explore more Berkshire Hathaway analyst ratings here.

The Bottom Line on Berkshire Hathaway

Amidst the winds of change blowing through the investment landscape, Berkshire Hathaway presents a compelling case study on adaptation and evolution. Its measured response to AI tailwinds, exemplified by the Apple divestment, underscores a cautious approach that may, inadvertently, limit its exposure to the transformative powers of AI in the coming years.