By Unknown Author

Compared to last year, Bitcoin’s price has surged by a remarkable 120%.

Enthusiasts in the crypto space are buzzing with anticipation, believing that the ongoing bitcoin bull market could stretch out gloriously until 2025.

But why such unwavering confidence in bitcoin’s upward trajectory?

The answer lies in the historical significance of Bitcoin halvings, events that cut the block reward for Bitcoin miners in half every four years — with the next halving scheduled for April 20, 2024, at block height 840,000.

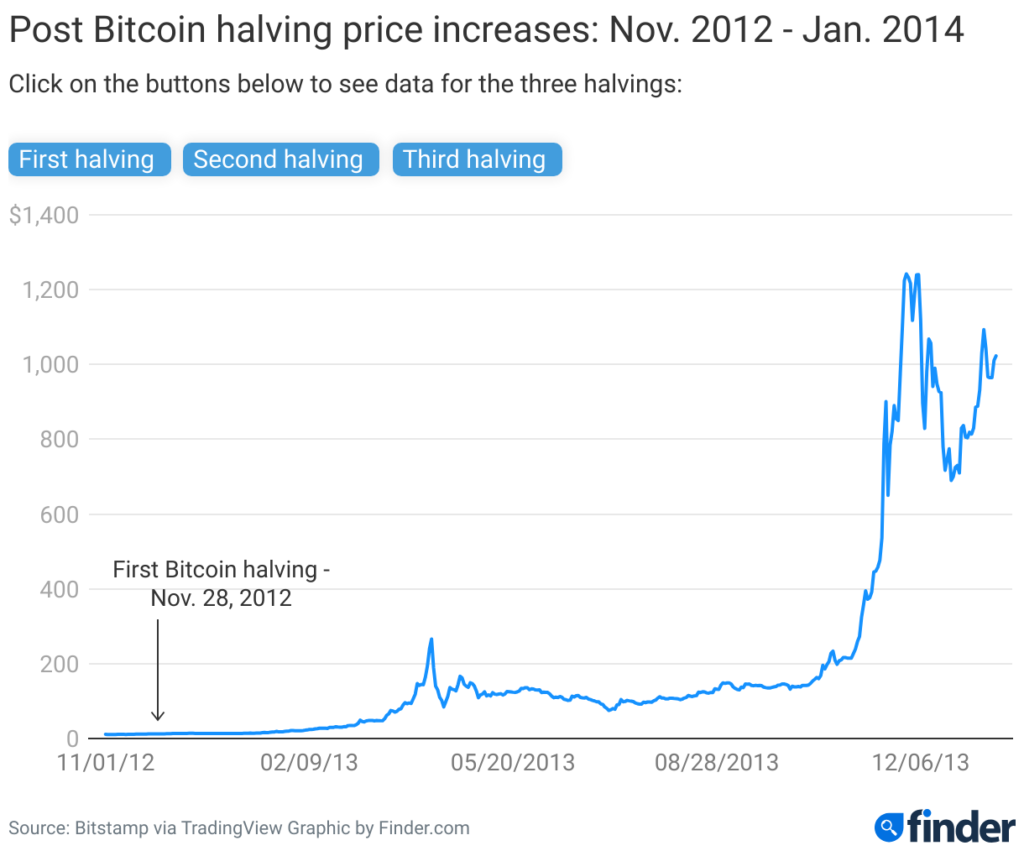

This reduction in bitcoin supply entering the market historically acts as a catalyst for a bullish market surge.

Looking at past post-halving patterns, the correlation between these events and bitcoin’s price rise is striking.

Furthermore, nearly 60% of analysts surveyed by Finder foresee not just a bitcoin bull run but a broader crypto price rally triggered by the upcoming halving.

Despite this optimism, is it all smooth sailing ahead for bitcoin?

Considering Bitcoin’s Future Trajectory

While bitcoin may aim to surpass its all-time high of around $69,000 before 2024, turbulence could be lurking along its path.

In any bitcoin bull market, corrections of 20-30% are par for the course.

Yet, should we find ourselves in a “melt-up” phase, where market prices spike before a potential crash, a substantial correction might be looming on the horizon.

If a significant chunk of the massive $6 trillion stashed in money market mutual funds reenters the market amid the looming regional banking crisis, a chilling market correction could unfold soon.

In an election year, it’s plausible that the U.S. Federal Reserve and government might resort to injecting money to stabilize the market, but predicting bitcoin’s year-end price remains a daunting task.

Investment Strategies in the Bitcoin Bull Market Scenario

Given the historical correlation between Bitcoin halvings and price surges and the prevailing macroeconomic uncertainties, how should one approach investment decisions?

The reality is that nobody possesses a crystal ball to divine the future. A enduringly favored investment approach across asset classes is dollar-cost averaging.

Through consistent, periodic investments, this strategy allows investors to mitigate risks associated with market volatility and capitalize on the potential gains that may accompany a bitcoin bull market.

The Art of Strategic Bitcoin Investment

Investing in bitcoin can be akin to dancing in a volatile market ballroom. Amidst the unforgiving highs and lows, adopting a strategic approach is akin to having a chameleon’s resilience.

Embrace Dollar-Cost Averaging

Picture investing fixed amounts in an asset like casting seeds in a garden—consistency breeds growth. Allocate say, $200 monthly into bitcoin, a move likened to watering a plant regardless of the weather.

This deliberate strategy becomes a shield in the stormy seas of bitcoin volatility. Through this method, you acquire bitcoin at varying price points, curating a diversified portfolio.

Whether the market is on a sugar high or a sobering decline, dollar-cost averaging ensures you grasp the silver lining by purchasing at discounts amid downturns—an investment tango of sorts.

Be Grateful, Not Gluttonous

In the upcoming months, should you ride the bitcoin wave and witness a historical price surge, remember: fortune favors the grateful. Reflect on the cyclical nature of markets, where euphoria ultimately succumbs to reality.

History echoes warnings of bitcoin plummeting up to 93% post-bull runs, an essential reminder to count blessings amidst surging wealth. Instead of greedily yearning for more, prudence suggests savoring profits or meriting diversified allocation.

A bitcoin bull run is akin to catching a shooting star in your hands—gleaming, yet transient. Mastering this market dance entails a composed and calculated demeanor, eschewing erratic impulses for strategic maneuvers.