The Thriving Journey of Netflix, Inc. (NFLX)

Amidst the ebbs and flows of the stock market, Netflix (NFLX) shines as one of the most sought-after stocks on Zacks.com, beckoning investors to delve into the nuances shaping its performance. In the past month, the internet video service’s shares surged +5.4%, outperforming the Zacks S&P 500 composite’s ascent of +3.6%. Nestled within the Zacks Broadcast Radio and Television industry, Netflix boasts a commendable 6% growth during this period. The overarching question lingers – what lies ahead in the horizon for this stock?

Earnings Estimate Revisions: A Telltale Sign

Delving beyond surface-level news and rumors, the fundamental bedrock that underpins an investor’s long-term commitment to a stock fundamentally hinges on earnings estimates. Recognizing the quintessential value of assessing a company’s revised earnings projection, Zacks homes in on this vital metric. A surge in earnings estimates signals an escalating interest among investors, propelling the stock price upwards. Rooted in empirical evidence, the correlation between earnings estimate trends and short-term stock price movements remains robust.

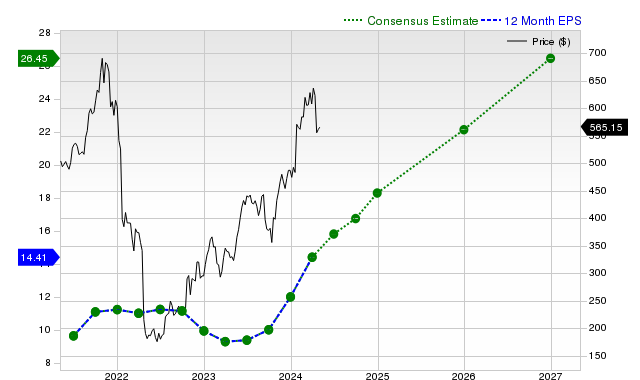

The current quarter witnesses Netflix poised to unveil earnings of $4.70 per share, marking a spirited +42.9% leap from the prior-year quarter. Projections for the current fiscal year stand firm at $18.31, translating into a formidable +52.2% surge vis-a-vis last year. The upcoming fiscal year paints an optimistic picture, with estimated earnings of $22.12, reflecting a promising +20.8% escalation from the preceding year.

Projected Revenue Growth: Fueling the Engine

Diving into the heart of a company’s financial vigor, revenue growth emerges as the cardinal engine propelling earnings. Netflix’s consensus sales estimate for the current quarter pegs at $9.53 billion, signifying a robust +16.4% swing year-over-year. Forecasts of $38.7 billion and $43.36 billion for the current and subsequent fiscal years suggest a healthy uptick of +14.8% and +12%, respectively.

Last Reported Results and Surprise History

Shedding light on Netflix’s performance trajectory, the last reported quarter showcased revenues of $9.37 billion with a commendable +14.8% climb from the prior year. The EPS of $5.28 surpassed the $2.88 mark from the previous year. Impressively, Netflix exceeded consensus EPS estimates thrice in the last four quarters, establishing a resilient narrative of surpassing market expectations.

Valuation: The Litmus Test

No investment mosaic is complete without scrutinizing a stock’s valuation. Peering through the prism of price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) multiples, assessing whether a stock’s current price encapsulates its intrinsic value and growth prospects is indispensable. Garnering a tepid D in the Zacks Value Style Score, Netflix stands perched at a premium relative to its industry peers, hinting at a valuation that could give investors pause.

In Conclusion

Armed with these insights and a plethora of data from Zacks.com, investors are better poised to decipher the market buzz surrounding Netflix. Despite the intrigue, the Zacks Rank #3 cautiously foretells of Netflix’s potential alignment with the broader market dynamics in the near term, urging investors to tread with tempered expectations and vigilant scrutiny.