Nvidia’s Financial Strength

Despite market conditions, Nvidia’s remarkable stock performance can be attributed to its robust financial standing.

Over the years, Nvidia witnessed a substantial surge in revenue, escalating from $26.91 billion to an impressive $60.92 billion between FY 2023 and FY 2024. Notably, the profit margins soared from a meager 16% to nearly 50%!

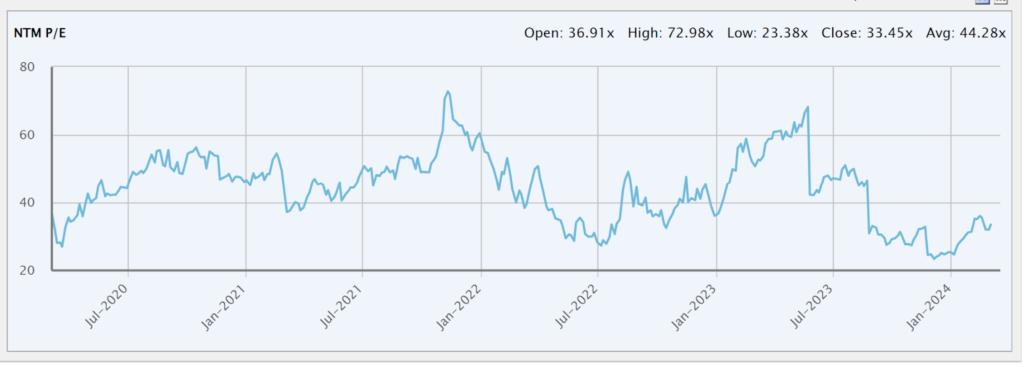

Consequently, with the forward P/E ratio standing at just 33x due to the substantial earnings boost, proponents argue that Nvidia is currently undervalued based on its enhanced profitability.

S&P Capital IQ

Therefore, the bullish argument maintains that investors are obtaining Nvidia at a bargain due to the increased earnings justifying the current stock price.

Nvidia’s Strong Foothold in the AI Market

Positioning itself as a frontrunner in the AI landscape, Nvidia’s dominance is evident with a reported ownership of almost 90% of the AI chip market.

Having capitalized on a first-mover advantage through its expertise in parallel processors from the gaming sector, Nvidia outperforms competitors not only in speed but also in network power and software capabilities.

Furthermore, strategic acquisitions like Mellanox enhance Nvidia’s ability to maximize performance by linking multiple GPUs in data centers. Emphasizing software investments bolsters Nvidia’s competitive edge, surpassing AMD in performance despite comparable chip hardware.

Challenges and Risks Ahead for Nvidia

Nvidia is encountering short-term obstacles that might lead to revenue setbacks, potentially jeopardizing its valuation heavily reliant on anticipated profits.

From geopolitical tensions impacting operations in China to concentration risks tied to semiconductor supply dependency from Taiwan Semiconductors, Nvidia faces vulnerabilities that could dampen its financial outlook.

Moreover, the shift of major customers like Microsoft, Meta, Amazon, and Alphabet toward developing in-house AI chips flags a competitive threat, testing Nvidia’s market share in the long run.

The Volatility Conundrum

Characterized by significant volatility, Nvidia’s stock entails a turbulent history with frequent fluctuations.

With a high beta of 1.73 indicating elevated market sensitivity, Nvidia experienced over 14 instances of more than 50% stock drops post-IPO. The heavy reliance on a single major AI chip buyer underscores the susceptibility of Nvidia’s stock to abrupt downturns in sales.

Relying extensively on future performance for valuation accentuates the precarious nature of Nvidia’s stock, demanding a long-term investment horizon for risk-averse investors.

While dabbling in Nvidia may offer some allure, exploring alternative AI stocks with less hype and heightened stability could present more enticing investment prospects, especially for those seeking sustainable returns.

On the date of publication, Michael Que did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

The researchers contributing to this article did not hold (either directly or indirectly) any positions in the securities mentioned in this article.

Michael Que is a financial writer with extensive experience in the technology industry, with his work featured on Seeking Alpha, Benzinga, and MSN Money. He is the owner of Que Capital, a research firm that combines fundamental analysis with ESG factors to select the best sustainable long-term investments.

More From InvestorPlace

The post Investing in Nvidia Stock: Strategic Genius or High-Stakes Gamble? appeared first on InvestorPlace.