Intel Contemplates Bold Strategic Moves

Intel, the esteemed technology giant, is currently undergoing a moment of profound introspection, contemplating strategic avenues that might redefine its trajectory. Among the deliberations are inklings of a radical move – a potential schism between its product design arm and its manufacturing division.

Advisors at the Forefront of Intel’s Strategic Evolution

The illustrious Intel has summoned the expertise of Morgan Stanley and Goldman Sachs to navigate this turbulent terrain, seeking counsel on the impending strategic crossroads. Their guidance is instrumental in charting a course for Intel as the company readies itself for a pivotal board meeting in the upcoming month of September.

Potential Wheels in Motion

As per reputable sources, scenarios involving the divestiture or separation of Intel’s foundry segment seem improbable, particularly in light of its current predicament – lacking the necessary external clientele to rival titans such as the Taiwan Semiconductor Manufacturing Co.

Postponed Expansion Plans and Political Flare-Ups

Signal flares of delay shimmer over Intel’s expansion blueprints, hinting at a calculated pause in the pursuit of grander horizons. Concurrently, the political arena rumbles with discontent, exemplified by Republican Senator Rick Scott’s pointed critique of Intel’s downsizing maneuvers, especially juxtaposed with its bid for a substantial $20 billion chip subsidy from the U.S.

Financial Quandaries and Market Turbulence

In the wake of a lackluster second-quarter performance, Intel released a stringent $10 billion cost-cutting scheme that also encompasses a sizable workforce reduction exceeding 15%. The tumultuous waters of the market have not spared the venerable Intel, with its stock weathering a 42% plunge over the past year as the PC and data center realms grappled with the disruptive tides of artificial intelligence.

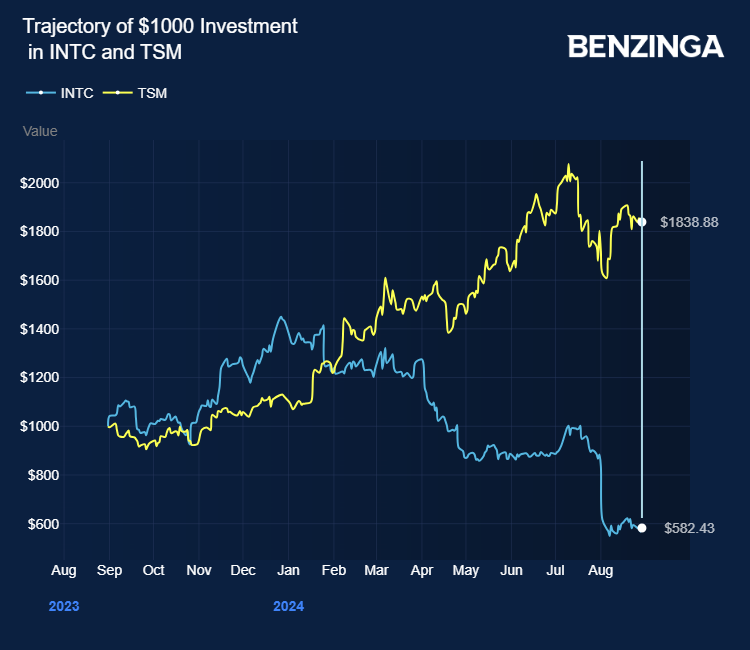

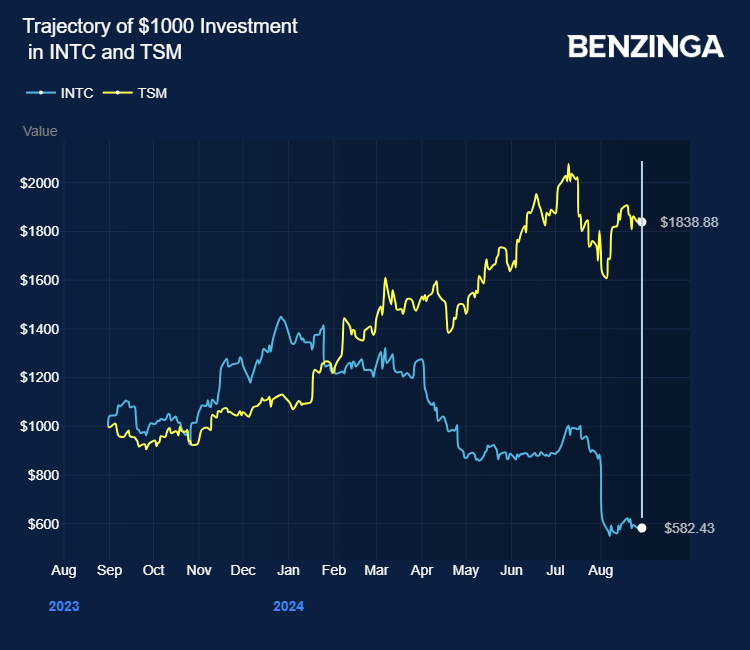

A Hall of Contrasts in Market Performance

Within the tempest-tossed markets, a landscape emerges where fortunes diverge. Intel’s struggles stand in stark contrast to the soaring trajectories of competitors such as Taiwan Semiconductor, which has seen a commendable 78% uptick, and Nvidia Corp, reveling in a staggering 139% surge, capitalizing on the fervor surrounding artificial intelligence innovations.

Forward March of Stock Prices

Despite the storm clouds that hover, there emerges a glimmer of optimism as Intel’s stock showcases a 2.88% surge, dancing to $20.71 in the premarket hours on a Friday, a tangible testament to the enduring allure of this tech behemoth.