The Unfolding Cost-Cutting Masterplan

Intel faced a tumultuous time as its stock plummeted 20% in after-hours trading, followed by an additional 22% decline. The cascading downfall was triggered by the unveiling of an extensive restructuring blueprint, which involves shedding 15% of its workforce and halting dividend disbursements.

These seismic changes were disclosed during Intel’s fiscal Q2 earnings call. This development was magnified by a lackluster fiscal second-quarter performance, with revenues and adjusted earnings per share dwindling by 1% and a staggering 85%, respectively, compared to the prior year. Furthermore, INTC’s Q3 projections failed to meet market expectations, casting a deeper shadow over its future.

The Odyssey of Turnaround Endeavors

Amidst its woes, Intel is engrossed in a Herculean effort to reclaim market shares conceded to competitors like AMD and Nvidia. In conjunction with its cost-trimming initiative, Intel is fortifying its chip production capabilities by launching new facilities nationwide. The U.S. government bolstered this crusade by granting Intel up to $8.5 billion in subsidies and $11 billion in credit to invigorate domestic chip manufacturing under the CHIPS and Science Act.

Forecasting Intel’s Stock Valuation

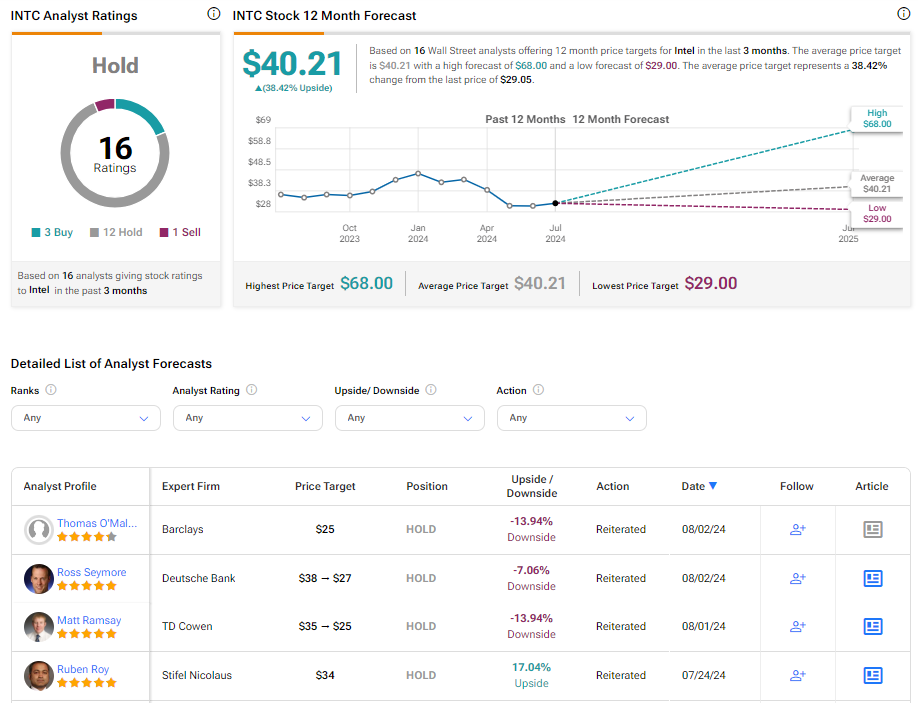

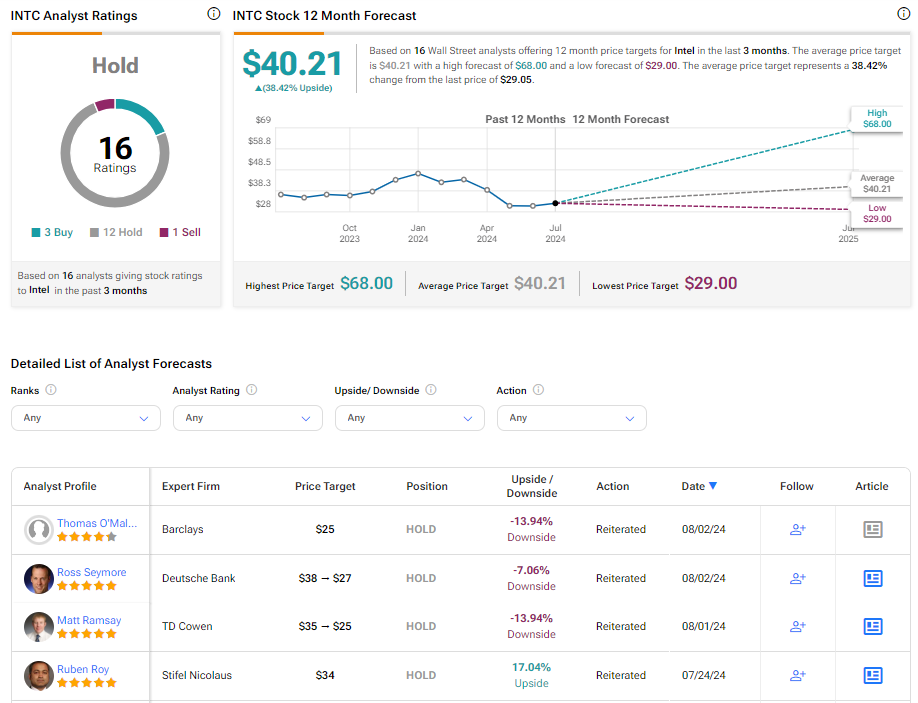

Market analysts have tentatively assigned a Hold consensus rating to Intel, predicated on three Buy recommendations, 12 Holds, and one Sell in the last three months. Following a disheartening year-to-date plummet of approximately 40%, the analysts’ mean price target for Intel stock stands at $40.21. This projection suggests a promising potential upside of 38.42% for investors willing to weather the storm.