The Insider Perspective

Insider trading, a pivotal aspect of market activity, offers a unique glimpse into the minds of those deeply intertwined with a company’s operations. These ‘insiders’, comprising officers, directors, and significant shareholders, possess a wealth of information influencing their investment decisions.

Recent Transactions in the Spotlight

Delving into recent market activities, notable companies such as Dominion Energy, Carvana, Keurig Dr Pepper, American Homes 4 Rent, and Enphase Energy have attracted attention due to insider transactions. These moves, while attracting investor interest, also shed light on the executives’ confidence in their respective companies.

Insight into Enphase Energy

Enphase Energy, a key player in the global energy technology sector focusing on solar solutions, saw its CEO making headlines by acquiring 4000 shares amidst a bearish analyst stance. Despite its stock seeing a 40% drop over the past year, the CEO’s bold move signals a bet on the company’s turnaround potential.

Affirming Confidence in American Homes 4 Rent

American Homes 4 Rent, an internally managed real estate investment trust, witnessed a Director’s purchase of 1,000 shares worth $23.7k. With a promising 2.4% annual yield and a robust 50% five-year dividend growth rate, this move reflects optimism in the company’s financial performance.

Keurig Dr Pepper: Brewing Success

CEOs show belief in their company’s fortunes through actions, as evidenced by Keurig Dr Pepper’s CEO acquiring 171k shares at a total cost of $5 million. Its 2.9% annual dividend yield and a 10% five-year annualized dividend growth rate underscore the potential rewards for investors.

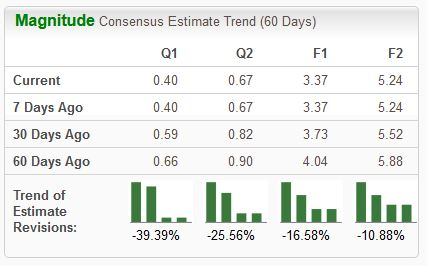

Amid Uncertainty: Dominion Energy’s Position

In a contrasting scenario, Dominion Energy’s CEO displayed belief by purchasing 21.7k shares worth just under $1 million during a time when analysts have adopted a bearish outlook. With an uncertain near-term outlook, investors are advised to await positive earnings forecast revisions.

Carvana: Driving towards Growth

Carvana, an e-commerce platform for used cars, witnessed a Director purchasing 1.3k shares valued at $100k. Despite a remarkable 800% surge in its stock value over the last year, this move hints at the Director’s confidence in the company’s continued success.

Final Thoughts: Deciphering Insider Behavior

Insights gleaned from insider trading activities provide investors with a nuanced understanding of a company’s trajectory. The recent transactions in Dominion Energy, Carvana, Keurig Dr Pepper, American Homes 4 Rent, and Enphase Energy offer valuable hints to those seeking to align their investments with insider sentiment.