Insider trading often carries an air of mystique, with investors peering in to discern the actions of corporate executives. But who actually qualifies as an ‘insider’?

An insider could be a company officer, director, significant shareholder, or anyone privy to internal information due to their intimate association with the firm. Notably, insiders typically hold on to their shares for an extended period, navigating through a maze of stringent regulations.

The Tale of Intel Shares

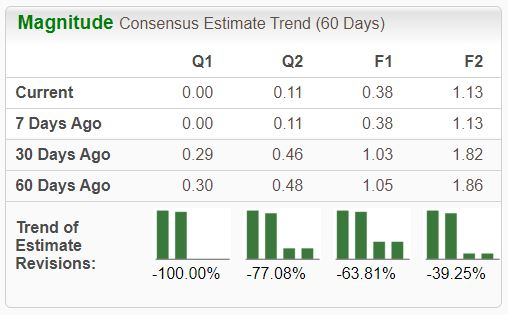

Intel, a behemoth in the semiconductor realm, has struggled to find its rhythm in 2024, lagging behind industry peers and witnessing a steep 60% decline in its stock value. Labelled as a Zacks Rank #4 (Sell), the company’s financial performance in the latest quarter prompted a bearish shift in earnings expectations.

Image Source: Zacks Investment Research

Despite the gloomy outlook, CEO Pat Gelsinger injected optimism into the market by acquiring 12.5k shares, totaling approximately $250k. Gelsinger’s confidence in the company’s future, anchored on upcoming product launches and strategic overhauls, offers a glimmer of hope amidst the prevailing despondency.

Soaring Yum China Shares

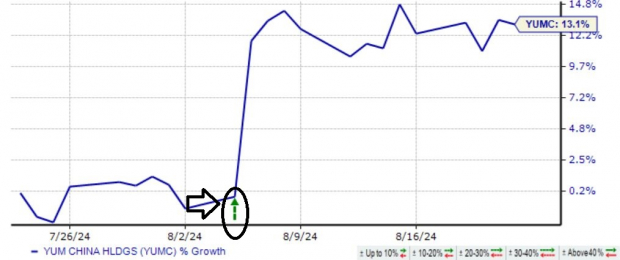

Yum China, unyoked from Yum! Brands in a 2016 spin-off, has been a radiant star lately. Their CEO, Joey Wat, recently snapped up 3.8k shares worth $130k, augmenting her ownership to around 270k shares. Riding on a 13% stock surge post their latest quarterly update, the company witnessed an 18% jump in adjusted EPS and a 1% uptick in sales.

Image Source: Zacks Investment Research

Buoyed by record Q2 figures and an upbeat quarterly report, Yum China presents a compelling narrative for investors despite holding a Zacks Rank #3 (Hold).

Energy Transfer CEO’s Leap

Energy Transfer, a notable player in the U.S. energy landscape, attracted the attention of Co-CEO Thomas Long. Long’s acquisition of 20k shares worth $313k reflects his faith in the company’s trajectory.

With a robust 23% stock surge in 2024 post-earnings, Energy Transfer maintains a Zacks Rank #3 (Hold). However, caution looms due to downward earnings revisions, which could transform the outlook dramatically upon receiving a positive revision.

Image Source: Zacks Investment Research

The Insider Trading Verdict

Immersing in the realm of insider trading offers a peek into the long-term horizon of a company. After all, if insiders lack faith in the company’s trajectory, would they stake their personal wealth?

This trio of stocks – Intel, Yum China, and Energy Transfer – has witnessed notable insider activity, with each company’s CEO taking a plunge into the market, signaling a vote of confidence.